By Javier Blas

The conventional wisdom says liquified natural gas is the future of energy — bridging the gap between the world abandoning fossil fuels and renewable supplies coming online. But that rosy outlook faces a reckoning. LNG is threatened by a pincer movement involving, ironically, the two old and new sources it’s supposed to bridge: coal and solar.

The cracks in the bridge could not have appeared at a worst time. The LNG market is about to witness its third big wave of increased supply in 20 years. If demand growth is weaker than expected, the only way the market would rebalance is via much lower prices.

The beauty of LNG is that once it’s been super-cooled to about minus 160 Celsius, it transforms it into a liquid that can be loaded into tankers and shipped around the world, very much like oil. Thus, LNG can reach any customer, breaking the historical limitation of gas pipelines.

Sources: IMF and Federal Reserve Bank of St. Louis

Since the turn of the millennium, the global LNG market has absorbed every supply wave fairly quickly, taking two to three years. China swallowed a good chunk of the 2009-2011 wave, when supply jumped by about 40% after the completion of several projects in Qatar. Europe absorbed the 2016-2019 wave, which came after a huge buildup in US export capacity increased global production by 45%.

Now, a third wave, which is likely to extend from 2026 to 2030, looms. It’s by far the largest, potentially adding a further 60% to the world’s supply. Thus, demand is key.

Enter the bridge theory. On paper, it makes a lot of sense. LNG is cleaner than coal, so a world worried about the climate crisis would gravitate toward it. On top, LNG offers flexibility, with gas-fired electricity generators powering up and down to offset the intermittency of solar and wind. But what looks good in theory doesn’t always work in the real world — particularly in Asia, now the engine of energy consumption. There, economic development takes priority over the fight against climate change.

Perhaps lower LNG prices would entice some coal-to-gas switching; I’m skeptical. Developing countries in Asia aren’t burning coal for electricity just because the commodity is dead cheap, but because it’s a mined locally, or at least, regionally. Against imported LNG, coal beefs up domestic energy security, provides millions of local jobs in often deprived regions and protects the balance of payments. Look at electricity generation in places such as the Philippines and Vietnam, where coal is on the rise. And above all, look at China, where coal-fired electricity generation hit an all-time high in August.

With coal proving stickier than expected, the first part of the bridge doesn’t make much sense. And the other side of the equation is also performing better than expected, and more quickly: that would be the combination of solar and batteries, which producing far more electricity than many had anticipated a few years ago. A flood of cheap Chinese-made photovoltaic panels — subsidized by cheap coal-fired electricity — is transforming power generation from Pakistan to Vietnam. Batteries are providing the flexibility that many thought would come from LNG. And when that’s not enough, Asian nations still prefer to resort to old-fashioned brownouts and rolling blackouts rather than pay for gas. The shores that LNG was meant to bridge — coal and renewables — are a lot closer than anyone thought; a viaduct may still be needed, but it’s much shorter than expected.

The boundless nature of gas supply that’s been its main advantage is becoming a key contributor to its downfall — because it’s become the go-to fuel each time a supply disruption hits a consuming nation, particularly a wealthy one, inflating its price. Japan grabbed as many LNG cargoes as it needed after the 2011 Fukushima disaster shut down its nuclear industry, forcing it to burn more gas to generate electricity. And Germany and other European nations did the same after Russia invaded Ukraine in 2022. on both occasions, rich countries priced out emerging nations. They’ve learned the lesson. “We have to readjust our strategy,” Ali Pervaiz Malik, Pakistan’s top energy official, told Bloomberg News this month. In private, other nations have made similar comments.

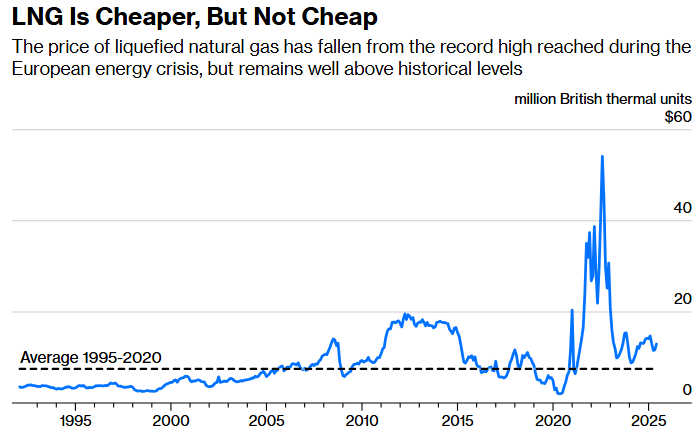

Even today, after the European energy crunch has eased, LNG prices remain extortionate. At about $13 per million British thermal units, it’s about double the 2000-2010 average price.

Even LNG producers seem resigned to the fact that the fuel would be an unlikely source for electricity generation in most of Asia, barring richer nations like Japan, Taiwan, South Korea and Singapore. It doesn’t mean that LNG doesn’t have a future in the region. Its outlook is still bright in industry as a feedstock to crack its molecules into petrochemicals and plastics. Transportation is another hotspot, with thousands of trucks in China running on LNG; India is also witnessing a surge. Outside of Asia, the gas has a future in Europe too, at least while Russian supplies remain remain out of the question.

The biggest hope LNG producers have is low prices — some of the projects penciled in for the later part of the current wave, close to 2030, would never see the light of the day, canceled as prices fall below the necessary level to justify the investment. Read between the lines of the corporate statements, and there’s an emphasis on securing outlets for production and guaranteeing long-term prices — not the kind of language you’d expect if executives anticipated building a bridge to a new world of riches.

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS