As countries around the world scramble to secure fuel to run their power plants, natural gas has attracted energy producers to Canada’s westernmost province.

By Robert Tuttle and Thomas Seal

Stretching from the ice-capped Canadian Rockies to the island-studded coastline, British Columbia has been long renowned as an outdoorsman’s paradise. Canada’s westernmost province is home to vast temperate rainforests, popular ski resorts and cold Pacific waters teeming with salmon. In the town of Dawson Creek, near the Alberta border, intrepid travelers stop for photos beneath a sign marking “Mile 0” of the Alaska Highway, a 2,232-kilometer (1,390-mile) passage through one of North America’s most rugged, stunning and grizzly-dotted landscapes.

These days, the tourists driving deep into northeastern British Columbia are often sharing the road with another seemingly out-of-place group: gas drillers on their way to work.

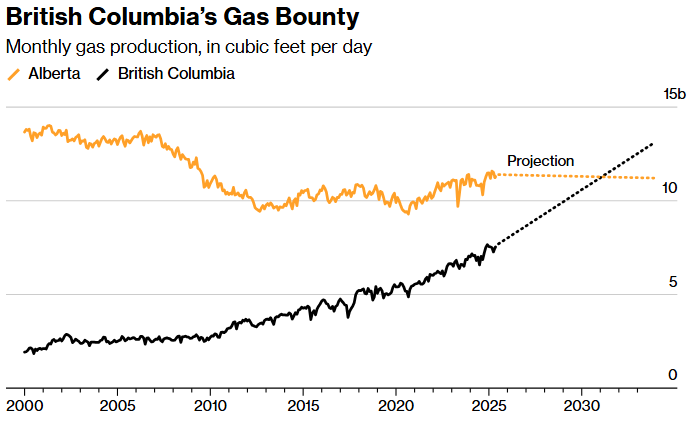

The forested province is quickly transforming into a hydrocarbon powerhouse, thanks to the world’s almost insatiable demand for natural gas. Long a minor player in the global energy trade, British Columbia is expected to hit 10.6 billion cubic feet a day of gas production by 2030, according to an estimate from Martin King, RBN Energy’s managing director of North America energy market analysis. That’s a 41% increase from current levels and would put the province ahead of energy giants such as Algeria, Turkmenistan and the United Arab Emirates. By 2031, King says, British Columbia’s gas output will match (then ultimately surpass in a few years) that of neighboring Alberta, long Canada’s leading energy producer.

In total, 651 gas wells were approved by the BC provincial regulator in the first half of this year, the most for a half-year period since 2008, government data show. Two hundred more have been given the go-ahead in the months since. “We have more rigs in BC now than we’ve had in a long, long, long time,” says Kevin Neveu, who this week retired as chief executive officer of Precision Drilling Corp., a contractor operating in Canada, the US and the Middle East.

Sources: Canada Energy Regulator, RBN Energy

Demand for natural gas, the world’s fastest-growing fossil fuel, and the recent buildout of the coastal infrastructure required to ship it overseas in a liquid form are underpinning the drilling boom. Canada’s first export terminal for liquefied natural gas, Shell Plc-led LNG Canada, started operations in June on the British Columbia coast with the capacity to send almost 2 billion cubic feet of gas a day to markets in Asia. More export facilities are on their way.

For decades, British Columbia’s strong policy guardrails and environmental standards—both on emissions and on consulting the region’s many Indigenous groups—kept drilling in check. But the world wants more of the fuel, and the province could use the revenue. British Columbia’s economy has been hit by credit downgrades, a widening deficit and a stagnant job market. Premier David Eby, who said when he came to power three years ago that the province couldn’t hit its climate goals if it built any more fossil fuel infrastructure, is now celebrating the opening of LNG terminals on the coast. (A similar dynamic is playing out in California, where left-leaning politicians have recently become more welcoming of fossil fuels.)

Natural gas is often touted as a cleaner choice than other fossil fuels, but drilling and burning it both have environmental implications. Its primary ingredient, methane, is a super-potent greenhouse gas; when it’s released without burning, like when it escapes during the extraction or transport process, it traps by some estimates more than 80 times more heat than carbon dioxide during its first two decades in the atmosphere.

Canadian politicians argue that BC’s high environmental standards and the clean hydroelectricity used to power the supercooling process make it the lowest-carbon gas on the market. “In terms of where we should be heading on climate, it’s not ideal—but it’s also a moment that calls for some real pragmatism,” says Eby, part of the left-wing New Democratic Party. “Many of the opportunities that we saw coming as a result of a global realignment are further off than we hoped.”

As recently as last year, researchers, including the International Energy Agency, were predicting that demand for gas would peak before the decade’s end. But that scenario is looking increasingly unlikely. In late 2023, climate talks in Dubai called for countries to quickly shift energy systems away from fossil fuels like oil and coal but left the door open for the continued use of natural gas, which pro-gas advocates call a “bridge fuel” in the energy transition that will help keep the lights on while renewables are figured out. US President Donald Trump’s return to the White House has also galvanized the world’s gas industry. On Day 1, he reversed his predecessor’s pause on LNG export approvals, and his administration is speeding up energy infrastructure permits in an attempt to unleash the US’s vast gas reserves—or what Vice President JD Vance has called “the Saudi Arabia of natural gas.”

Additionally, the advent of hydraulic fracturing more than 20 years ago, along with newer drilling techniques, have made hard-to-reach North American gas deposits accessible in large volumes for the first time. British Columbia’s gas is mostly trapped in the tight siltstone that makes up the Montney Formation, which covers about 130,000 square kilometers (50,000 square miles) along the border with Alberta. Alberta’s side holds the vast majority of the formation’s oil, but British Columbia is where more of the natural gas is contained.

Environmental advocates are, not surprisingly, livid about the development. “LNG is a dangerous and deadly distraction in a province that is already reeling from climate-fueled wildfires and extreme weather,” says Keith Stewart, senior energy strategist with Greenpeace Canada. Several years ago, Greenpeace—which was founded in British Columbia in 1971—helped organize opposition to Royal Bank of Canada, accusing it of financing a controversial pipeline that would supply gas to LNG Canada, the export terminal. Construction of the conduit, called Coastal Gaslink, faced repeated protests and attempts by activists to block construction, actions that sometimes turned violent. Coastal Gaslink ultimately moved forward, entering commercial service in November 2024.

Drilling has slowed of late, but not because of the green pushback. Rather, production has come online so rapidly in the province that it caused an oversupply last month, turning gas prices in Western Canada briefly negative. Tourmaline Oil Corp. has deferred multiple fracking jobs to the fourth quarter, while driller ARC Resources Ltd. shut about 360 million cubic feet per day of output over the summer in gas-rich areas. Some companies in the area have adjusted to the turn in the market by targeting areas where more light oil, called condensate, is located. The ultralight oil can be extracted from gas wells, and it’s in high demand in the nearby Alberta oil sands region, where it’s used to dilute bitumen—oil as thick as peanut butter—for transport on pipelines.

But any gas-drilling slowdown will be temporary, with producers planning to ramp up again as soon as the LNG Canada export plant nears full capacity. The facility is commissioning a second production line that’s scheduled to start operation soon. The faster Canada’s export plants come online, the better they’ll be able to compete with existing LNG heavyweights such as the US and Qatar, which are also racing to supply gas-hungry buyers.

For locals, the energy industry’s interest in the region has been mostly welcome. Daneka Hussey-Hughes, executive director of the Dawson Creek & District Chamber of Commerce and a 30-year resident, can now see two flare stacks from her home at night. But it’s worth it for the economic benefit, since gas workers who either commute in for jobs or live in the area have money to spend. “When people are doing well, you see it,” Hussey-Hughes says. Restaurants and hotels are fuller than normal, and families are spending more on their kids. “They’re able to go and buy new hockey sticks and new skates.” —With Ruth Liao

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS