LITTLETON, Colorado, Oct 8 (Reuters) – Texas’s main power generation system is on track for a rare contraction in fossil fuel-fired generation in 2025, as long as output from the state’s massive wind farms rises sharply as expected during the final quarter of the year.

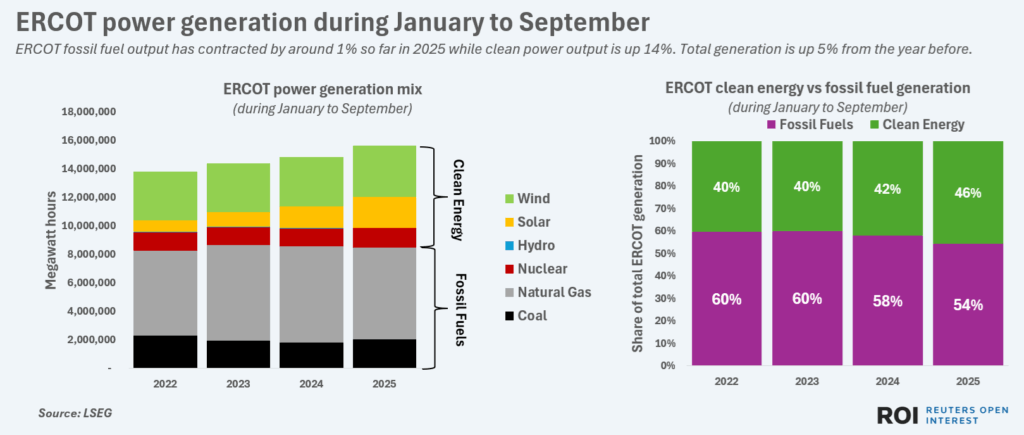

During the first nine months of 2025, fossil fuel power generation within the Electric Reliability Council of Texas (ERCOT) – Texas’ main power network – is down by 1% from the same months in 2024, data from LSEG shows.

Over the same period, generation from clean energy sources jumped by 14%, which has helped lift total ERCOT power generation by 5% from a year ago to record highs.

ERCOT fossil fuel output has contracted by around 1% so far in 2025 while clean power output is up 14%. Total generation is up 5% from the year before.

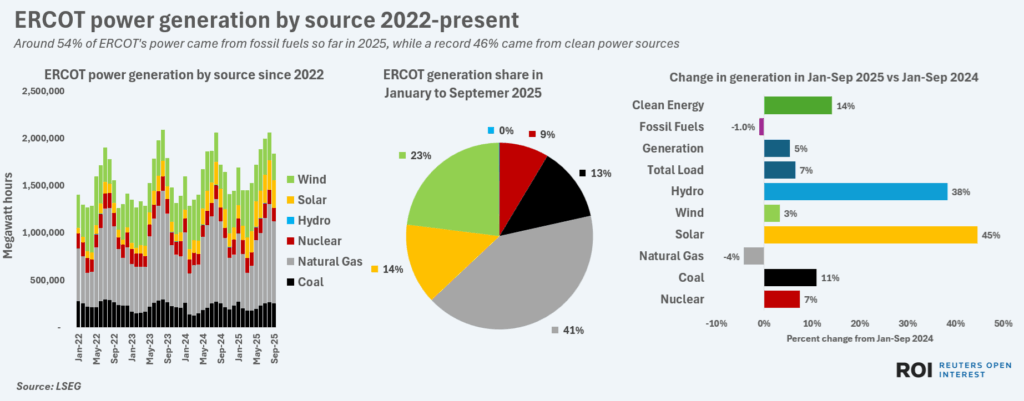

So far in 2025, Texas solar parks have done most of the heavy lifting in terms of boosting output, with ERCOT solar generation registering a 45% surge from the year before.

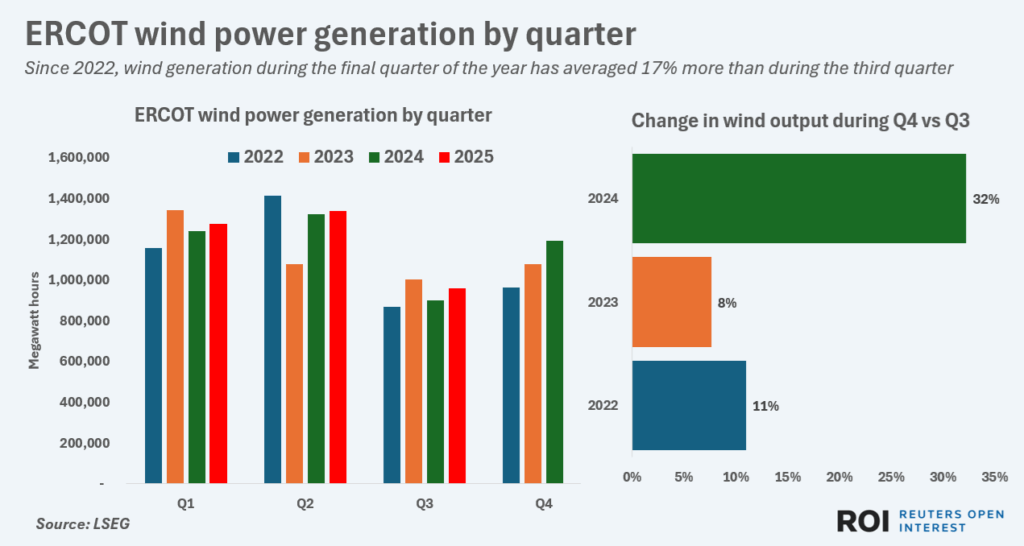

Over the final quarter of the year, however, wind farms will play a decisive role in determining the fossil fuel/clean energy generation split, so long as wind output patterns unfold as usual and rise sharply from recent lows.

CLEAN GROWTH

Clean energy sources registered a record 46% share of ERCOT’s total generation mix through the opening nine months of 2025, generating a record 7.1 million megawatt hours (MWh) of power, LSEG data shows.

All of ERCOT’s clean energy sources – wind, solar, nuclear and hydro – scaled new highs so far in 2025 as power firms capitalized on the widespread clean energy growth to lift total power generation to a record of just over 15.6 million MWh.

Around 54% of ERCOT’s power came from fossil fuels so far in 2025, while a record 46% came from clean power sources

While solar farms registered the largest year-over-year expansion, wind farms supplied the largest chunk of clean power, of 3.57 million MWh.

Solar’s output total was 2.18 million MWh, while nuclear reactors produced 1.3 million MWh and hydro dams just under 21,000 MWh, LSEG data shows.

FOSSIL CUTS

A sharp rise in natural gas prices early in 2025 spurred ERCOT generators to cut back on gas-fired output so far this year, although natural gas remains ERCOT’s single largest power source.

Gas-fired generation during January to September was 6.47 million MWh, which was 4% lower than during the same months in 2024 and the lowest for that period since 2022.

Coal-fired power generation, however, increased by 11% from the year before to 2 million MWh as utilities boosted output from relatively cheaper coal-fired power plants to make up for the shortfall in gas-fired output.

Overall fossil fuel-fired power generation during the first nine months of 2025 was just under 8.5 million MWh, which was down 1% from the same months in 2024.

WINDS OF CHANGE

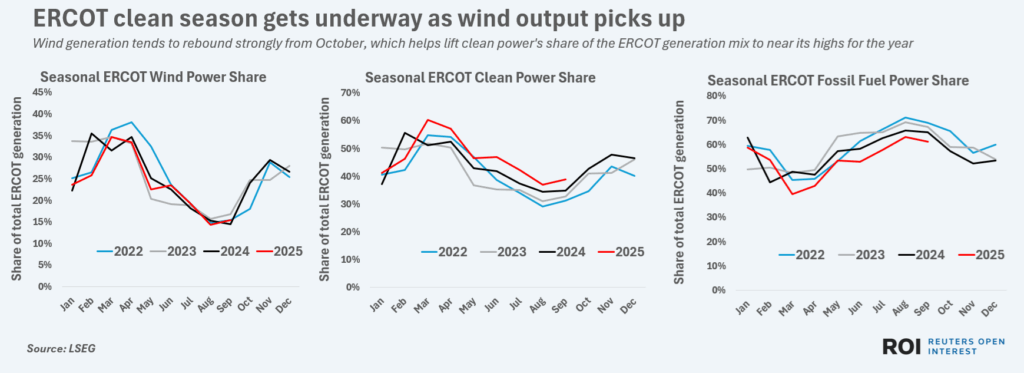

The shift in seasons into fall and winter tends to trigger a significant shift in ERCOT’s overall power mix.

On the fossil fuel front, many ERCOT power stations undergo plant maintenance during October and November so that the wear and tear incurred during the peak power demand period over the summer can be repaired ahead of the winter heating season.

ERCOT clean season gets underway as wind output picks up

Overall energy demand tends to dip during this shoulder season as use of power-hungry air conditioners declines, so power providers can generally afford to curb total operating capacity from fossil fuel plants from now through December.

On the clean energy side of the ledger, the onset of winter sparks a sharp drop in output from Texas’ solar farms but also tends to trigger a sharp climb in output from wind farms as wind speeds at turbine level pick up.

Wind generation during the July to September quarter is generally the lowest of the year as wind speeds tend to slump during summer.

ERCOT wind power generation by quarter

From 2022 to 2024, ERCOT wind power generation increased by an average of 17% during the final quarter of the year compared to the prior quarter, LSEG data shows.

That upswing in wind generation in turn has helped lift wind power’s share of the ERCOT generation mix from around 17% of the total mix during the third quarter to around 26% of the total mix during the October to December quarter.

WIND WATCH

ERCOT power trackers will be closely following wind generation forecasts to determine overall system generation needs through the end of the year.

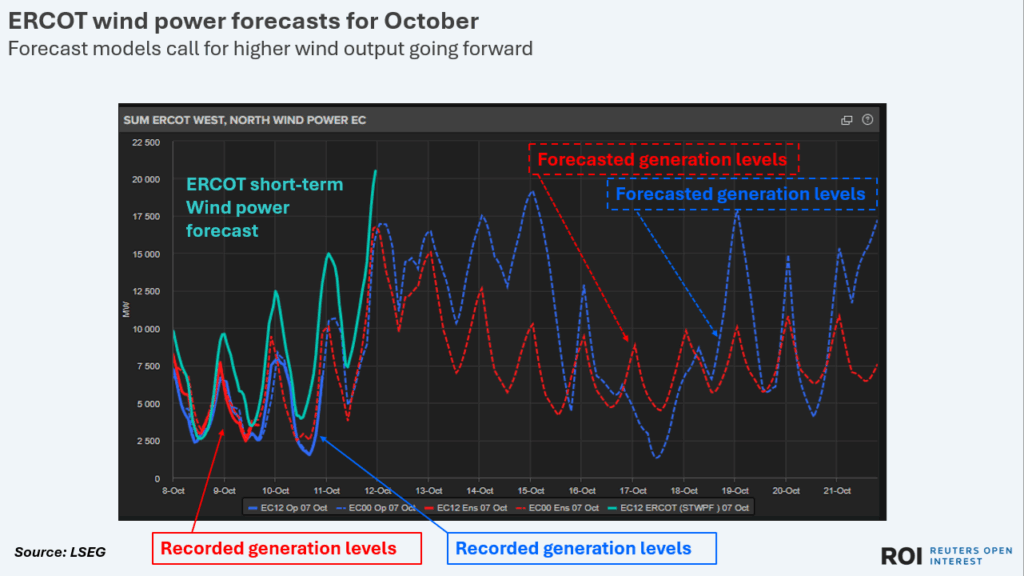

The latest wind models from LSEG call for generation during the latter half of October to average around 20% to 25% more than recorded wind output during the opening week of October.

ERCOT wind power forecasts for October

If wind speeds consistently pick up from October onwards, then sustained higher output from wind farms can be expected and mean that less overall deployment of fossil fuel plants may be needed.

That in turn could mean that ERCOT’s overall output of fossil fuel plants could register a rare decline this year, even as total power generation continues to expand thanks to higher clean energy output.

If wind output levels remain patchy or below average, however, then ERCOT managers will need to boost generation from fossil fuels to plug the resulting gaps, resulting in another year of growth for fossil fuels.

The opinions expressed here are those of the author, a columnist for Reuters.

Reporting by Gavin Maguire; Editing by Lincoln Feast.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS