By Alex Longley

TotalEnergies SE said it sees limited growth in oil production outside the OPEC+ alliance after next year, while global consumption will continue to climb to the end of the decade.

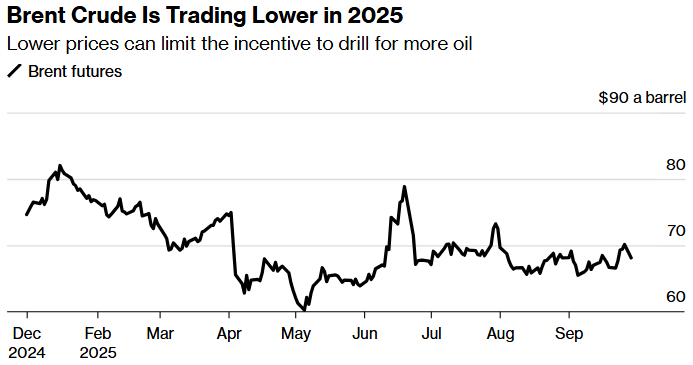

Global spare output capacity is set to shrink from 2027 as lower oil prices curb investments, the French energy giant said in a strategy update in which it announced billions of dollars of spending reductions. It sees non-OPEC+ supply falling from 2028 through 2030, while global demand rises.

That shows the Organization of the Petroleum Exporting Countries is “regaining control” of the market, Total said. The producer group has been restarting idled output at a rapid clip this year in a bid to outpace rival drillers.

Source: ICE, Bloomberg

While oil traders have long warned of an oversupply into next year, many have also started to look ahead to what comes later. BP Plc flagged earlier this year that supply growth from non-OPEC producers will stall in early 2026, while demand remains strong.

Total said it expects the market to show a significant surplus in the first quarter of next year. The current oversupply has been limited by robust buying by China, the world’s biggest importer, while the threat of disruption to Russian supplies from Ukrainian drone strikes has helped support prices.

Read More: TotalEnergies Pares Investment to Sustain Dividend Growth

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS