Much of the world had been turning away from traditional nuclear power in recent decades. Aging plants, high construction costs, security risks and radioactive-waste challenges caused policymakers and the public to question the economics of atomic energy. Interest in the technology has only recently been revived amid pressure to hit climate goals and meet surging electricity demand.

The proliferation of data centers, in particular, has focused attention on the availability of around-the-clock power needed by the server farms that underpin the digitized economy and are the backbone of artificial intelligence.

Unlike intermittent energy from wind turbines and solar panels, whose generation depends on how strongly the wind blows or brightly the sun shines, nuclear plants can supply electricity 24/7 — and also without the planet-warming emissions that come from burning gas and coal.

If a nuclear renaissance comes to pass, it could be propelled by new supply chains configured to build small modular reactors. These SMRs, which have drawn the backing of billionaires including Bill Gates, have the potential to be a less costly and more nimble source of nuclear energy — if they can reach commercial viability and overcome safety concerns.

How do small modular reactors differ from conventional nuclear reactors?

The basic process of generating power remains the same. Uranium atoms are split to release energy via a reaction known as fission. This energy is used to heat water and produce steam that spins a turbine to generate electricity.

However, as the name suggests, SMRs are smaller than conventional reactors — both in terms of their physical footprint and power-generating capacity. Large-scale reactors usually start at 1,000 megawatts, and the so-called nuclear island they’re housed in measures about 80 meters (262 feet) in height, with a radius of around 35 meters.

SMRs are normally up to 300 megawatts, although some, such as Rolls-Royce Holdings Plc’s 470-megawatt design, are a little bigger. The 77-megawatt reactor from startup NuScale Power Corp. — the only SMR developer to have its designs approved by the US Nuclear Regulatory Commission – is contained in a module that’s about 23 meters tall and has a diameter of 4.5 meters.

Some of the first commercial nuclear reactors would have been considered SMRs in today’s market. However, engineers from the 1960s intentionally chose to design bigger reactors in order to make generation more efficient.

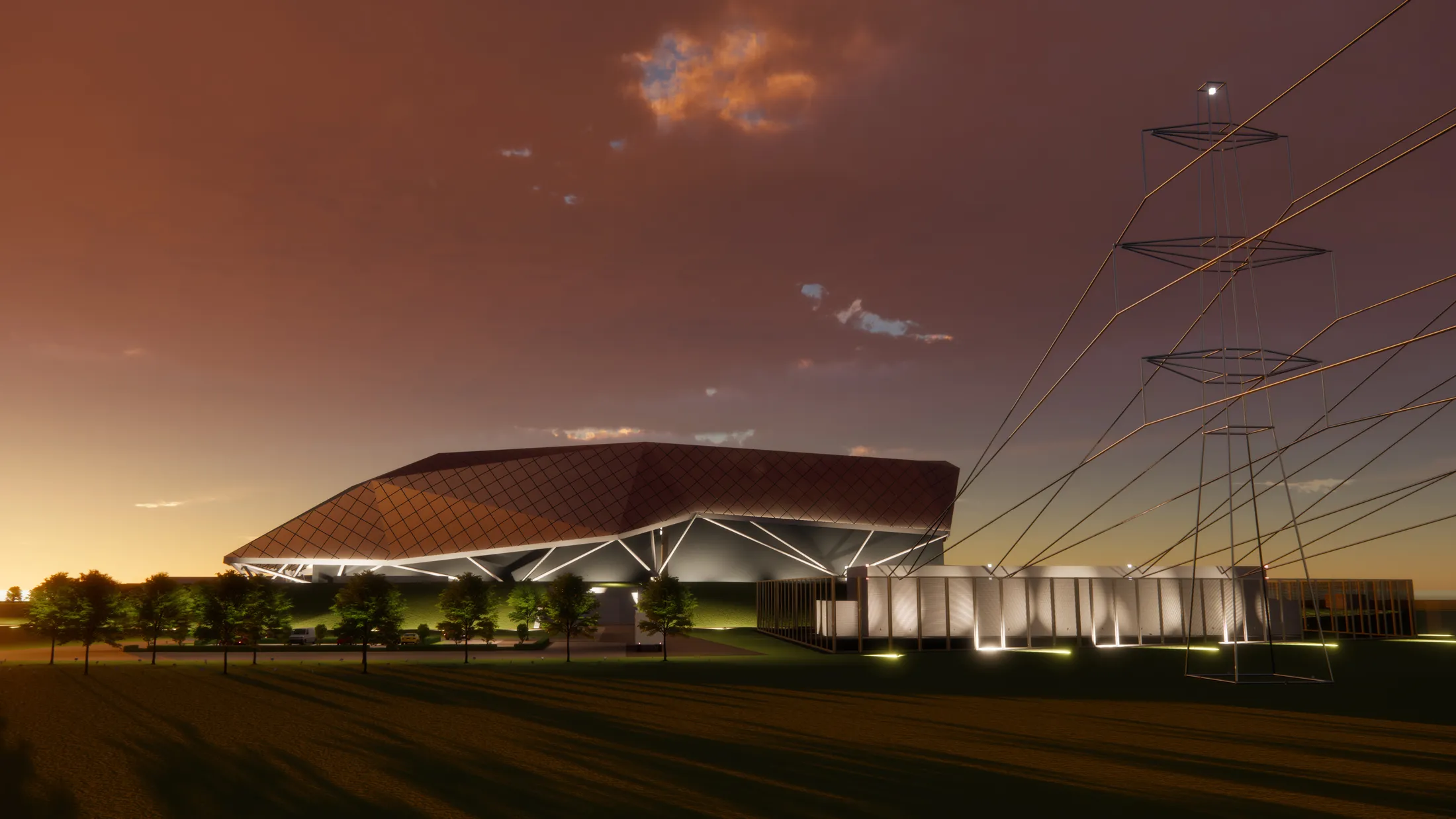

The more compact footprint of SMRs could open up nuclear to new locations where large plants aren’t appropriate, and allow reactors to be sited closer to power demand centers, reducing the amount of new transmission infrastructure required. SMRs could be built alongside industrial facilities and provide the high-temperature heat needed for the likes of steelmaking or desalination of seawater. The smallest designs could even power remote, off-grid operations that currently rely on diesel generators, such as mines.

As their name also indicates, SMRs are modular, meaning they’re designed to be built largely in factories and then assembled on-site. The prefabrication of standardized components should, in theory, lower upfront costs through economies of scale and shorten construction times. This could avoid the budget and schedule overruns that have beset traditional nuclear power plants. The last two conventional reactors to be built in the US — Vogtle 3 and 4 in Georgia — were completed seven years late and cost more than double the initial $14 billion estimate.

The modular nature of SMRs should enable more flexible configurations that can be customized depending on generation needs. More reactors can be added to meet rising energy demand.

Among the 127 unique SMR designs in various stages of development, many are also being engineered to operate on novel fuel. Using a higher concentration of uranium isotopes should allow the reactors to run hotter and longer without refueling. However, the absence of a standardized approach risks delays in deployment because regulators need to certify fuel safety in each reactor model — a process that requires years and sometimes decades.

How cost-competitive are small modular reactors?

SMRs could theoretically undercut conventional nuclear reactors and compete with other power technologies that are readily available today — if startups can meet their cost estimates. The economic competitiveness of SMRs has yet to be proven and there’s a risk of overpromising and underdelivering.

NuScale canceled plans to build its first plant — the six-reactor Carbon Free Power Project in Utah — in 2023 amid rising costs and a lack of utilities signing up to take the electricity. The targeted power price rose from $58 per megawatt-hour to $89 per megawatt-hour (although would’ve been even higher without government subsidies).

That’s more expensive than the levelized cost of electricity — the long-term power price a plant needs to break even — that BloombergNEF estimated for a new SMR in the US in its assessment published in February. It’s also pricier than a new gas-fired facility, although comparable with new onshore wind and solar projects coupled with battery storage to store surplus power and discharge it to the grid when needed.

The promised cost savings of SMRs won’t kick in until there’s enough demand for the reactors to be mass produced. Reaching that point will likely hinge on the current number of designs being whittled down.

Wide-scale deployment could yet take decades to materialize, and companies will first have to undertake lengthy and expensive regulatory processes. It took NuScale more than three years and over $500 million to receive US regulatory approval for the 60-megawatt version of its reactor.

Are small modular reactors already in operation?

The only SMRs currently in commercial operation are Rosatom Corp.’s two 35-megawatt units on a floating power plant in the Arctic region of Russia, which were fully commissioned in 2020, and China National Nuclear Corp.’s pair of 100-megawatt reactors in Shidao Bay, which came online in 2023.

Several more SMR plants are planned and under construction around the world.

Who is investing in small modular reactors?

Companies developing SMRs include established nuclear industry players such as state-owned Electricite de France SA, Rosatom and China National Nuclear, as well as a host of startups.

TerraPower, founded by tech billionaire Gates, and utility PacifiCorp, owned by Warren Buffett’s Berkshire Hathaway Inc., are working together to roll out SMRs in the US. They broke ground at the site of an abandoned coal-fired power station in Wyoming, although TerraPower still requires regulatory approval for its 345-megawatt design, which uses sodium rather than water for cooling.

The need to power energy-hungry data centers has prompted tech giants including Amazon.com Inc., Google and Oracle Corp. to explore SMRs. Data centers could account for about 9% of US electricity demand by 2035, according to BloombergNEF, from around 4% today.

Google struck an agreement last year to procure nuclear energy from Kairos Power, which should enable the buildout of 500 megawatts of the latter’s SMRs. They’re aiming for the first reactor in Tennessee to generate electricity by 2035.

Meanwhile, data center operator Equinix Inc. also signed a deal in 2024 to procure 500 megawatts of power from SMR developer Oklo Inc., a startup backed by OpenAI founder Sam Altman, and this year pre-ordered 20 microreactors from California-based Radiant Nuclear.

Safety regulators at the US Nuclear Regulatory Commission have yet to award operating licenses to any of the reactor projects under development.

Are governments supporting the development of small nuclear reactors?

While the Trump administration has sought to undercut clean energy sources in the US such as wind and solar, it has maintained government support for nuclear power, including SMRs.

The Department of Energy reissued a $900 million Biden-era funding program for SMRs with modified criteria in March. Separately, the DOE has already agreed to provide billions of dollars to startups, including up to $2 billion for TerraPower’s Wyoming project as part of a 50-50 cost-sharing arrangement.

President Donald Trump wants the US to become a leader in atomic energy, and signed executive orders in May to streamline the regulatory approval process and help quadruple US nuclear capacity to 400 gigawatts by 2050. The DOE expects to begin testing on some novel SMR fuels in 2026.

During Trump’s state visit to Britain in September, the US and UK signed a memorandum of understanding to accelerate the deployment of SMRs and hail what they called a “golden age” of nuclear power. They agreed that safety checks in one country could be used to inform the regulatory process in the other to speed up permitting.

The announcement came as Rolls-Royce seeks regulatory approval in the US for its SMR. In June, the company was selected by the UK government as the preferred bidder to develop the country’s first small power stations. The UK is investing £2.5 billion ($3.4 billion) in SMRs and is aiming for the first reactor to be operational by the mid-2030s.

Are small modular reactors safe?

The reputation of nuclear power has been tarnished by high-profile disasters, such as the meltdown of three reactors at the Fukushima Daiichi plant in Japan in 2011. That disaster was triggered by an earthquake and tsunami that knocked out the electricity supply and the pumps that circulated water for cooling, and culminated in the exposed fuel rods reacting with water vapor to produce hydrogen, which then ignited and exploded.

Proponents say SMRs will be more secure because they’re designed with passive safety features. Some use molten salt and liquid metals as coolants in lieu of water, allowing the reactors to operate at lower pressures. This means SMRs can rely on natural processes such as gravity to prevent overheating, rather than electric pumps and human intervention.

That said, because the smaller footprint of SMRs enables them to be located closer to population centers, potential dangers from accidents or infrastructure attacks could also increase. And like their larger brethren, SMRs produce long-lived radioactive waste that must be stored safely for centuries.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS