By Robert Tuttle

An LNG carrier is loaded at the LNG Canada docks in Kitimat, British Columbia on July 14. Photographer: James MacDonald/Bloomberg

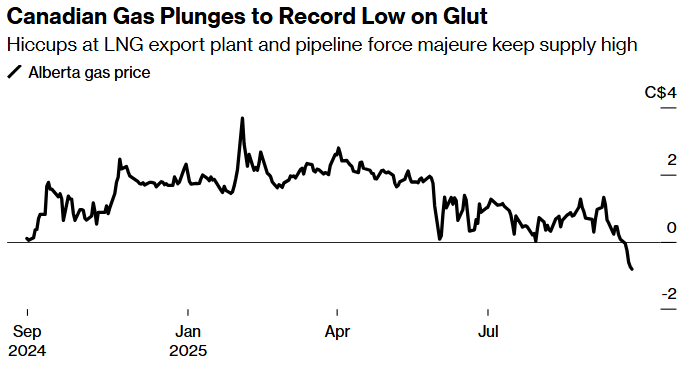

Canada’s benchmark gas price has tumbled to a record low as production hiccups at the country’s first LNG export plant on the British Columbia coast contributed to a surplus of supply.

The price at Alberta’s AECO hub fell below zero at the start of last week, and closed at minus 81 Canadian cents per gigajoule on Friday, the lowest level in data extending back to 1999. The benchmark has been on a downward trend since hitting a high for the year of C$3.68 in early February.

Source: Bloomberg

Gas production and inventories surged before the LNG Canada export plant started operations at the end of June. While the facility hasn’t always operated smoothly, seeing a temporary pause to liquefied natural gas shipments in July, its ramp-up should eventually help to chip away at the glut.

The facility, which has been undergoing repairs, is set to return to full capacity imminently with work on equipment being completed, according to people familiar with the matter.

Repairs to the Great Lakes Gas Transmission pipeline — which delivers gas from Western Canada to the east of the country and the US — have also contributed to a build-up in supply. The conduit is operated by TC Energy Corp.

“Gas storage in Western Canada is essentially at last year’s record levels,” Jefferies analysts including Sam Burwell wrote in a note dated Sept. 25. “Added pipe maintenance and LNG Canada repairs have kept builds high despite production shut-ins.”

Canada’s gas production — nearly all from Alberta and British Columbia — rose 15% in the two years before the start of LNG shipments to more than 19 billion cubic feet a day last May, data from Canada Energy Regulator show. Inventories in July in both regions were the highest for that month in figures stretching back to 2016, according to Statistics Canada.

Read More: Tourmaline Sees LNG Canada Cutting Alberta Gas Discount in Half

Major gas producers such as Tourmaline Oil Corp., the biggest in Canada, predicted prices would strengthen ahead of the start of LNG exports. Several companies, including Tourmaline and ARC Resources Ltd., said earlier this year that they planned to curtail output should prices continue to weaken.

“Companies have to pay to have their gas taken away when prices are negative,” Brian Bagnell, vice president of commodities and capital markets at gas producer Advantage Energy Ltd., said in an email. The company will curtail as much as 130 million cubic feet a day of output during “particularly weak price periods,” he added.

Adds LNG Canada repairs in fourth paragraph

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS