By Ruth Liao, Priscila Azevedo Rocha, Mitchell Ferman, and Alberto Brambilla

Global gas traders are leaving a major industry conference in Milan without a clear consensus on when — or even if — demand from Chinese buyers will rebound, a key risk as liquefied natural gas supplies keep piling up.

While European buyers clinched a flurry of supply agreements on the sidelines of the Gastech conference this week — part of preparations for phasing out Russian fossil fuels — China has been notably subdued in the market. Traditionally, it’s among the largest purchasers and a key anchor for seaborne cargo prices worldwide.

The country’s persistently sluggish consumption — as well as its recent acceptance of deliveries from a sanctioned Russian plant — has left traders wondering whether the nation’s purchases on global markets will pick up this winter and beyond. There are doubts over the long term, as China recently agreed to a preliminary pact to expand its flows from Russia with the construction of a new pipeline from next decade.

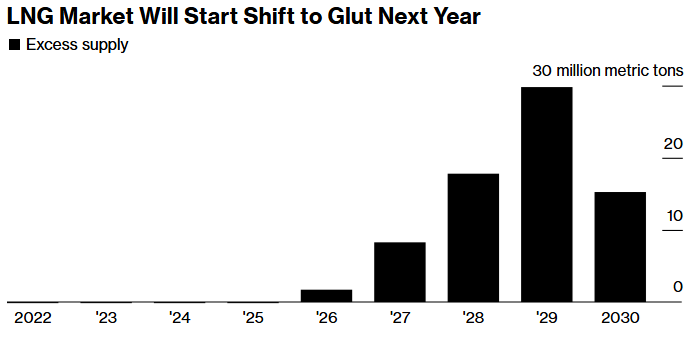

That may become a problem for producers, who face a multiyear supply glut starting in 2026. Exports from the US are already booming as Venture Global Inc.’s new plant in Plaquemines, Louisiana ramps up faster than expected, and more big projects will follow with the enthusiastic support of the Trump administration.

Source: BloombergNEF Global LNG Market Outlook 2030, July 14, 2025

“The industry continues to predict the rise in Chinese demand for LNG, but it hasn’t happened yet,” said Steve Hill, executive vice president for gas and LNG trading at Mercuria Energy Group Ltd. “However, China will clearly need to significantly increase its LNG import volumes for the market to absorb the upcoming supply growth.”

Oil and gas giants such as Exxon Mobil Corp. and Chevron Corp. were among those who maintained an upbeat tone at the conference. They expect China to source gas beyond the upcoming winter from diverse suppliers to fulfill its energy needs as the nation looks to replace dirtier coal.

“We still remain very positive on China growth over the long term,” said Peter Clarke, senior vice president at Exxon. “And then of course we see that developing Asia will follow in China’s footsteps. So we are seeing the interest from a whole raft of countries in Asia as they try to follow the path of substituting coal with gas.”

For now, however, China’s LNG imports have declined for ten straight months. The country’s own gas output has picked up, and its new pipeline deal with Russia is seen further squeezing LNG purchases. That’s left some market participants skeptical about how much scope there is for Chinese demand to recover.

Meanwhile, low domestic prices mean it isn’t always economical to purchase shipments from overseas, with importers instead choosing to resell supply to more profitable markets. China’s rapid deployment of solar and wind is also starting to eat into fossil fuel power generation, reducing future needs for gas in the electricity sector.

If global prices drop further, that could entice more price-sensitive buyers to return, according to Boston Consulting Group managing director and partner Anders Porsborg-Smith. Prices below $8 or $9 per million British thermal units could spur some purchasing behavior, he said, compared to current levels of roughly $11 per mmbtu in Europe and Asia.

But with China’s industry still hit hard by tariffs and macroeconomic uncertainty, Porsborg-Smith doesn’t expect any major demand drivers to materialize anytime soon, likely leaving more supplies for other buyers.

“Unless we have a material weather event, I don’t think they’re going to come back and buy,” he said. “They have enough for this year.”

— With assistance from Anna Shiryaevskaya, Stephen Stapczynski, and Kathy Chen

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS