By Mitchell Ferman, Alberto Brambilla, and Anna Shiryaevskaya

Exxon Mobil Corp. and Chevron Corp. are bullish on China’s future appetite for liquefied natural gas even if Russia succeeds in adding another pipeline to the Asian nation.

That’s because China, the world’s largest coal consumer, still has a long way to go to switch to cleaner fuels, such as natural gas, in power generation and industry, according to Exxon Mobil senior vice president Peter Clarke. And the nation will want a diverse mix of suppliers to avoid over-reliance on Russian gas as Europe once had, said Chevron’s president for global gas, Freeman Shaheen.

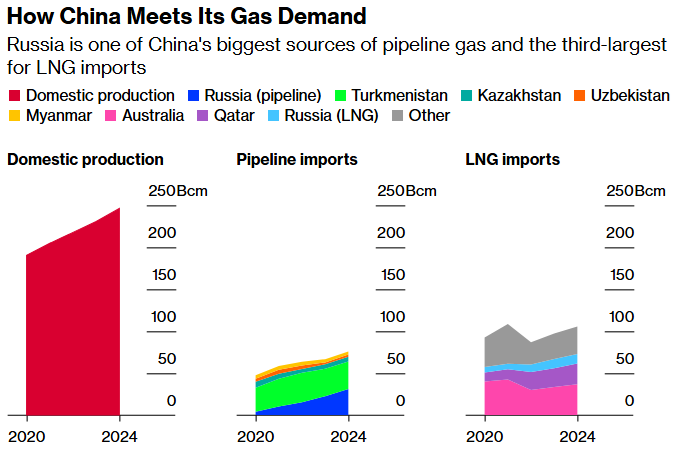

China’s recent deal with Moscow to move forward with another major gas pipeline was widely seen as reshaping global gas flows next decade. China is already embracing more piped gas supply — and domestic production is booming — with LNG imports slumping this year just as geopolitical rival the US has become the world’s biggest exporter of the super-chilled, seaborne fuel.

Read: Why New Russia-China Gas Pipeline Threatens LNG Trade: QuickTake

But while most analysts predicted a decline in China’s demand for LNG if Russia’s plans materialize, most likely on the other side of 2030, the US majors remain upbeat.

“Actually as you bring more pipeline gas into China, potentially, you just see a demand response because there’s so much market there that is not connected, can’t be supplied today,” Exxon’s Clarke said in an interview with Bloomberg in Milan. “And as you bring supply in, you actually create new demand.”

While global LNG supply is expected to start tilting toward some excess, more supply is widely expected to lead to lower prices, potentially making the fuel more acceptable to price-sensitive markets, from China to India to southeast Asia.

“So ultimately we still remain very positive on China growth over the long term,” Clarke said on the sidelines of the Gastech event, a big annual gathering for the industry. “And then of course we see that developing Asia will follow in China’s footsteps.”

Source: BloombergNEF, {DSET APAC_GAS_BALANCES} and {AHOY JOURNEY} on the Bloomberg Terminal, China Customs.

Note: Bcm refers to billion cubic meters. Breakdown of pipeline imports by country after 2022 is estimated by BNEF as official data is no longer available.

For TotalEnergies SE Chief Executive Officer Patrick Pouyanne, oversupply is something the entire industry will have to face. New volumes from a flurry of projects is expected to come from the US, but that will be “good news for consumers, including European consumers,” he said on a panel at Gastech.

Chevron expects market growth to be lumpy when “production comes on and it pushes prices down and then it balances back out,” according to Shaheen, who said the company’s traders will manage that exposure.

Diversity of supply is crucial too, he said. Europe, and in particular nations such as Germany, relied on Russian piped gas for decades until the Kremlin’s war in Ukraine resulted in just a fraction of that supply circulating in the region. While Moscow’s relations with Beijing are warm, the exact parameters of the Power of Siberia 2 gas pipeline remain uncertain and the two nations have been known to drag on negotiations on new supply and prices for years.

“I think the Chinese are very intelligent,” Shaheen said. “So while they are doing some deals with Russia and they’ll do that, I think you’ll continue to see a diversity of supply into China. And it just makes a lot of sense because you don’t want what happened to Europe to happen in other places.”

(Updates with more comments from fifth paragraph, and chart.)

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS