The revival of a project that would transport Russian gas to China has the potential to upend Trump’s plans for energy dominance.

By Liam Denning

It’s a potential prize fight for the ages: US “energy dominance” versus the Power of Siberia. A proposed pipeline to bring natural gas from Russia, across Mongolia and into northern China threatens to complicate President Donald Trump’s energy diplomacy, upend energy markets and even shape the artificial intelligence boom.

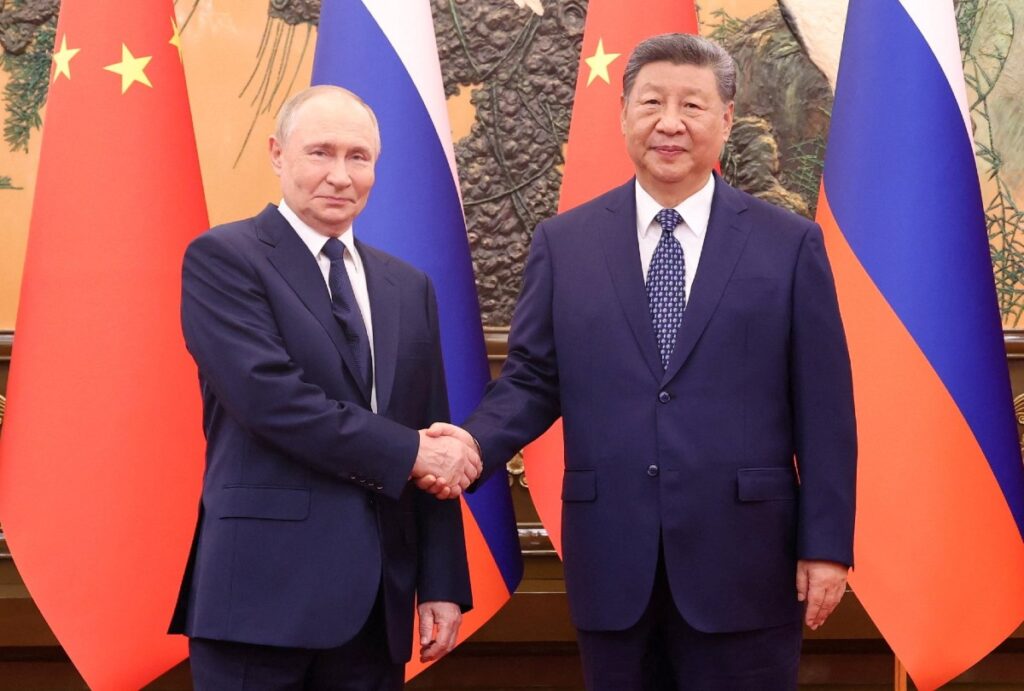

The apparent revival of the Power of Siberia 2 gas project during Russian President Vladimir Putin’s recent summit with Chinese leader Xi Jinping represents an enormous wildcard for the US gas sector. Together with mooted expansions of two other pipelines, this would open up 58 billion cubic meters per year (or 5.6 billion cubic feet per day) of capacity to feed Russian gas directly into China. To put that into perspective, it is equivalent to almost half the expected increase in Chinese gas demand over the next decade, and a quarter of the world’s extra demand overall.

More pertinently for the US, it would exacerbate and extend a looming glut in an energy sector at the heart of Trump’s “dominance” agenda: Liquefied natural gas. The US is the world’s biggest exporter of LNG already and is spearheading a huge expansion in liquefaction capacity. Energy Secretary Chris Wright said at a Council of Foreign Affairs event last week that he expects LNG to become the country’s single largest export.

The International Energy Agency’s latest long-term outlook, published late last year, had annual global demand for LNG rising by 144 billion cubic meters between 2023 and 2030. Yet, supply capacity is set to increase by almost double that amount. The industry’s great hope is that this glut will clear as demand keeps growing and the boom in export capacity tails off. Injecting 58 billion cubic meters of effectively stranded Russian gas into the equation would dash that hope.

A persistent glut has direct implications for the US market. Over the past five years, net LNG exports soaked up two-thirds of the increase in domestic gas production, significantly outpacing the only other major source of rising demand for US gas, power generation. All else equal, a glutted global LNG market would expand gas available domestically, suppressing US prices. This would be analogous to the Energy Department’s “high oil and gas supply” case in its long-term projections, which results in gas prices in 2030 and 2035 that are 25% and 37% lower, respectively, than in its base case.

US gas producers and LNG developers would suffer, of course. If Power of Siberia 2 moves closer to being a reality, some anticipated LNG capacity in the US simply won’t get built and some drill-baby-drill won’t happen. This is where Trump’s push for energy dominance may have created its own obstacle, by giving China a reason to sign up for the pipeline.

Russia, whose invasion of Ukraine spurred Europe to drastically cut its imports of gas from Siberia, needs new export options. Its Arctic LNG projects have been hampered by sanctions, and the new pipelines to China would, at full capacity, effectively replace Europe’s prior demand. Moreover, the expected glut in LNG capacity, even before considering the impact of new pipelines, meant Europe would have less reason to consider taking Russian gas again in the event of a peace deal. Russia had previously balked at China’s hardball negotiations over pricing and minimum volume commitments, but the debacle in Ukraine has left Moscow more dependent on Beijing for support.

From a purely economic perspective, China doesn’t need Power of Siberia 2, given the availability of LNG. That may mean the pipeline remains just a Russian dream. But the global energy trade is tilting ever further away from pure economics. Anne-Sophie Corbeau, a gas expert with Columbia University’s Center on Global Energy Policy, noted recently that China’s imports of LNG from the US plunged to zero in March, after the two countries’ trade war intensified.

Power of Siberia 2 would diversify China’s gas sources, bind Russia closer strategically and economically, and strike a blow against Trump’s signature energy policy. China has, notably, begun cranking up imports of blacklisted Russian LNG and is also reportedly preparing to reopen its domestic bond market to Russian energy firms, according to a recent Financial Times article.

This would fit with China’s broad diversification strategy, having poured money into developing a world-beating electric vehicle industry to limit dependency on oil imports, along with renewables and nuclear power. As much as Trump has seized upon the shale boom as a source of supply-led diplomatic leverage, he appears to have forgotten that customers threatened with the energy weapon tend to pay up for other options (as the industrialized world did after the 1970s oil shocks and, indeed, Europe did after Russia’s latest attack on Ukraine).

Moreover, dominance efforts to date appear detached from underlying market realities. Yes, Europe has become reliant on US LNG since 2022, but a mature economy committed to reducing emissions cannot absorb an additional wave of cargoes. Prospects are similarly limited when it comes to Japan and South Korea, which have, like Europe, made nebulous commitments to buy vast amounts of US “energy” to seek a trade accommodation with Trump. “It’s very strange to try to target slow-growing or declining markets,” Corbeau observes.

The one obvious beneficiary of cheaper excess gas in the US would be datacenter developers, who are targeting gas-fired generation to meet their burgeoning electricity needs. Gas demand from the power sector in 2035 is 38% higher in the Energy Department’s ‘high supply’ case relative to the base projection. Conversely, cheap gas is poison for coal-fired power (another Trump priority) and an added challenge for a renewables sector already under attack from the president. But if AI hyperscalers ultimately benefit from Trump’s zero-sum energy diplomacy, it would be due to the inherent limitations of dominance.

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS