By Tope Alake

US investments in renewable energy projects plunged this year as developers responded to White House policy shifts targeting the sector.

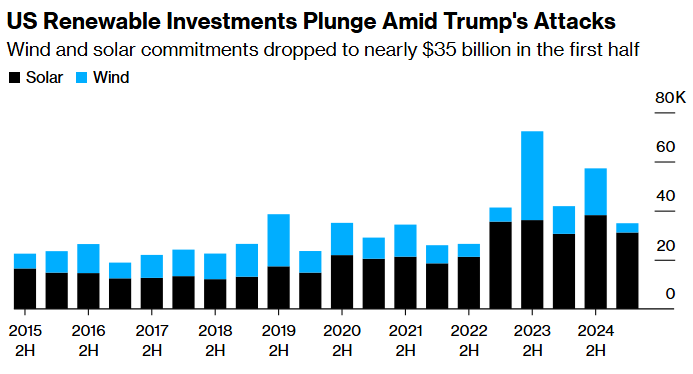

Investments fell by $20.5 billion, or 36%, in the first half of the year from the prior six months, according to a Tuesday report from BloombergNEF. Wind and solar commitments fell 18% within the period compared to the first half of 2024. In addition to policy changes, uncertainty around US President Donald Trump’s tariffs contributed to the the drop, according to the report.

Solar and wind have become the largest source of new power generation in the US, however the growth leaned heavily on government subsidies. But those subsidies saw a major rollback in Trump’s July tax and spending bill. The investment slowdown comes just as electricity demand is surging from data centers and industrial electrification.

Source: BloombergNEF

Note: Solar investments exclude solar thermal.

“We’re really now seeing the impacts of what the new reality in the US has meant for investor confidence,” Meredith Annex, BloombergNEF’s Head of Clean Power said in an interview.

Trump’s disdain of wind energy has increased investment risk and prevented any offshore projects from securing financing this year, the authors said. Wind investments fell 67% in the first half of the year compared to the same period in 2024. Spending on onshore wind dropped 80% in the first half of this year compared to the second half of 2024.

Meanwhile, investors may be reallocating capital to more favorable markets such as the European Union region, where investment in renewables surged to nearly $30 billion in the first half of the year, according to the report.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS