By Yongchang Chin, Alex Longley, and Christopher Charleston

Asian oil refiners have been hunting for crude from further afield than their usual suppliers in the Middle East, but this more diversified strategy isn’t stirring a market that’s bracing for a glut.

The region that consumes around 40% of the world’s oil normally subsists on a diet dominated by barrels from the Persian Gulf. But President Donald Trump’s scattergun approach to trade and foreign policy — including the sudden targeting of Russian flows — has forced the processors to snap up shipments from the US to Brazil and Nigeria.

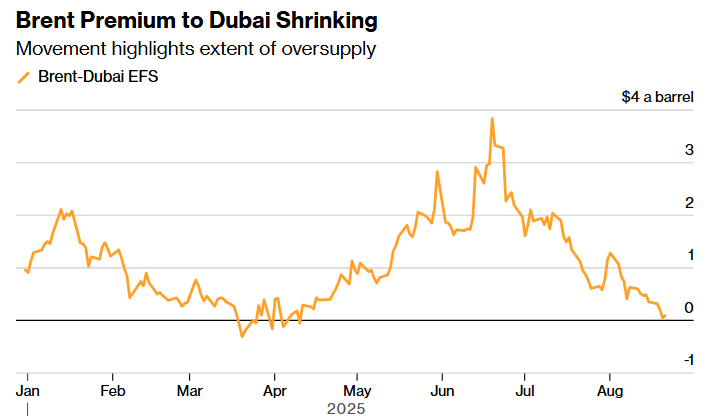

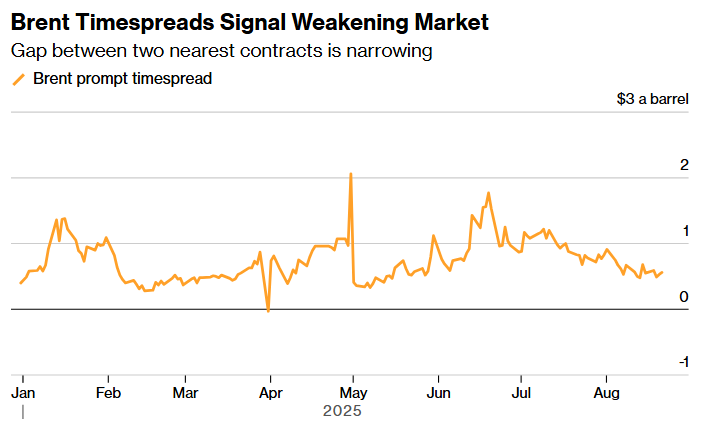

The flurry of purchases of the type of light, low-sulfur crudes that play an outsized role in determining the price of Brent should be supporting the global benchmark, as well as buoying timespreads, closely watched gauges of market health. And yet, they haven’t.

Instead, Brent’s premium to Dubai, the benchmark Middle East crude, has fallen to the lowest since April. That’s in part because traders expect the market to be awash with crude in the coming months, contending with more barrels from both outside and within the OPEC+ alliance.

“We’re getting closer to the oversupply,” said Gary Ross, a veteran oil consultant turned hedge fund manager at Black Gold Investors LLC. “People have been talking about it for a long time — everyone has bearish fourth quarter balances — and we’re getting closer to the cliff.”

Source: Bloomberg

The glut expected from next quarter is mainly due to OPEC+’s restoration this year of many of the barrels sidelined during Covid-19, and producers outside the alliance — such as the US, Brazil and Guyana — pumping more.

OilX, part of industry consultant Energy Aspects Ltd., sees average global production so far this year running 1.4 million barrels a day ahead of where it was at this point in 2025. That’s more than double the International Energy Agency’s most recent estimate for demand growth for the entire year.

“The fourth quarter of this year and the first quarter of next in particular are definitely looking soft,” said Aldo Spanjer, head of energy strategy at BNP Paribas SA.

Read More: Global Oil Markets Face Record Supply Glut Next Year, IEA Says

Trump’s aggressive foreign and trade policy is also rerouting flows and spurring a lot of uncertainty and volatility. Indian refiners have snapped an unusually high 20 million barrels or so of oil in the spot market this month, according to Bloomberg calculations, as they avoided Russian supply. Although in recent days they’ve returned to buying crude from the country, but whether this will last is unclear.

There are also signs that pressure from Trump on countries to narrow their trade surpluses with the US is having an impact. A refiner in Pakistan agreed in late July to buy the nation’s debut shipment of US oil, and Japan’s Idemitsu Kosan Co. said earlier this month it bought a small volume of US crude due to tariff pressure.

The very narrow Brent-Dubai spread is allowing US and West African crudes to flow into Asia competitively, said June Goh, senior oil market analyst at Sparta Commodities. “WTI in particular is pricing very cheaply into the Asia, opening new markets into Pakistan and Vietnam.”

Source: ICE

The increased demand for American oil has bolstered prices at the US Gulf Coast — where the barrels are exported from — but done little to support domestic benchmarks more broadly. Timespreads for West Texas Intermediate are near the lowest level since May, while stockpiles at the storage hub in Cushing, Oklahoma have risen for seven weeks straight.

The market is also contending with a dour and uncertain demand outlook. It’s still not clear to the extent to which Trump’s tariff barrage will damp global economic growth, and the world’s pivot away from fossil fuels continues, most notably in China. World oil demand this year and next is growing at less than half the pace seen in 2023, the IEA said.

And in Europe, a steady stream of plant closures — including two of the UK’s six refineries — in recent months means that the region’s crude processing is set to decline this year, according to IEA data. An upcoming bout of refinery maintenance in the US and Europe is also sent to dent refinery demand.

The major banks are broadly bearish on oil — Goldman Sachs Group Inc. sees Brent dropping slightly the mid-$60s by year-end — but the current array of indicators suggest prices could fall more-than-expected.

“I think the market is waiting for the right time” to go bearish on Brent and WTI, said BNP Paribas’ Spanjer. However, supply growth should slow into the second half of 2026, and “things should start to look better from then,” he said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS