By Julian Lee and Alex Longley

When US President Donald Trump was inaugurated to his second term as president on Jan. 20, oil prices were close to the highs of the summer before. By early May, they had plunged by nearly a quarter.

That’s for two big reasons: Trump’s trade war is driving down economic growth, which hurts oil demand, and the OPEC+ oil cartel announced larger-than-expected output increases for May and June.

The lower crude prices will have important implications for oil-producing countries, which struggle to balance their budgets at these levels, and importer countries, which are benefiting from lower energy costs for transportation and industry. Here’s what to know.

Why are oil prices falling?

Between Jan. 20 and May 6, Brent, a global benchmark, fell from about $80 to $62, and West Texas Intermediate, a domestic benchmark, fell from about $76 to $59. Two important factors have contributed to the drop in crude prices.

Sources: ICE Futures Europe and NYMEX Exchange

Note: WTI didn’t trade on Jan. 20, the price is the closing value of Jan. 17, the last trading day before the inauguration.

The first was Trump’s so-called “Liberation Day” tariffs on imports from the country’s trading partners, announced on April 2, and the subsequent retaliatory tariffs from China. The levies upended forecasts for international trade and the global economy. In a report published April 22, the International Monetary Fund cut its worldwide real gross domestic product growth forecast for 2025 to 2.8%, down from the 3.3% growth it projected in January.

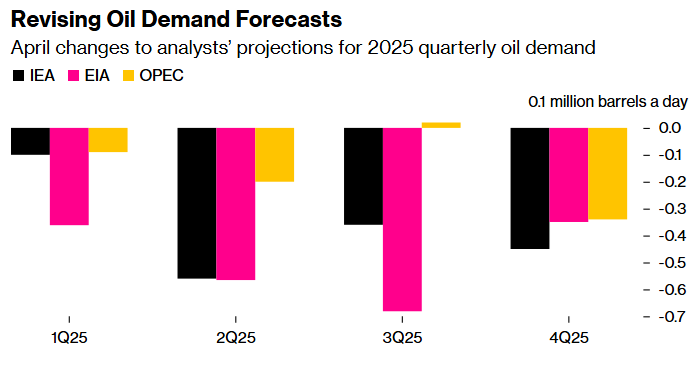

Economic growth is a key driver of oil demand, so the weaker outlook has an impact on oil use as a transport fuel and a source of energy for industry. The world’s major oil forecasting agencies all cut their outlooks for demand in 2025, with the International Energy Agency citing “the deteriorating outlook for the global economy amid the sudden sharp escalation in trade tensions.” The US and China account for about half the reduction in growth, with most of the rest from trade-dependent Asian economies.

Sources: IEA, EIA and OPEC

The trade war is also likely to have major implications for producers of petrochemical products — plastics, fertilizers, and other goods made from petroleum and natural gas. According to the IEA, Chinese producers, which source supplies from the US, will be particularly affected.

The second factor was a pair of announcements from OPEC+, the coalition of oil producers led by Saudi Arabia and Russia, that it would drastically boost supply. In April, the group announced that it would increase production in May by 411,000 barrels a day, and on May 3, it announced that it would raise production in June by a further 411,000 barrels a day. The group had previously intended to add 137,000 barrels a day each month until September 2026.

Why is OPEC+ increasing supply?

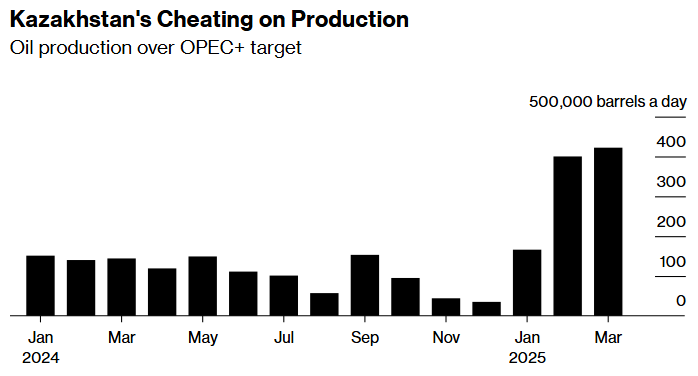

OPEC+ denied that the move was influenced by calls from Trump for the coalition to cut oil prices. Rather, the coalition says it’s raising production targets as a warning to member states that have exceeded their agreed production targets, most notably Kazakhstan and Iraq. With a strong incentive to avoid cuts to their revenue, neither country has kept production below its output target since at least the beginning of 2024, OPEC data shows.

OPEC+ reasons that increasing overall supply and driving down prices will impress upon the errant members that if they don’t toe the line, neither will others, to the detriment of all.

Source: Organization of the Petroleum Exporting Countries

Note: The target has been adjusted to account for compensation cuts pledged by Kazakhstan since May 2024.

Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, described the move as merely an “aperitif” to further output increases by the group’s biggest producer if the offenders don’t slow their production. He reiterated the threat when the kingdom announced the second increase.

How does cheaper oil affect importers?

Lower oil prices are good for importers, typically reducing fuel bills and lowering pump prices for drivers. For some importers, the effect of the fall in the price of oil has been compounded by a drop in the value of the US dollar, the currency used for international oil transactions.

While Brent crude priced in US dollars fell by 16% in the three months after Trump’s inauguration, the euro’s strength against the dollar means buyers in Europe enjoyed an even bigger drop: 24%. Crude purchasers in the UK saw a similar impact.

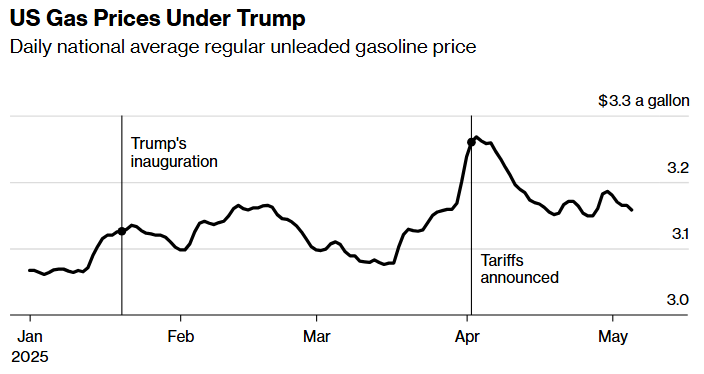

There are already signs that the drop has led to at least a marginal uptick in consumption. A distributor of heating oil in Germany said it saw record sales when prices plunged in April, as households took advantage of the dip to refill tanks after the winter. US retail gasoline prices have also drifted closer to $3 a gallon, which could help bolster demand during peak driving season in the summer.

Source: American Automobile Association

The impact on gasoline and diesel prices at the pump in Europe and the UK has been more muted, with high fixed duties on retail fuel sales dampening swings in crude prices. Data from globalpetrolprices.com shows gasoline pump prices fell by just 4% in Germany and 2% in the UK in the three months after Trump’s inauguration.

How does cheaper oil affect exporters?

While oil importers benefit, exporters suffer. Saudi Arabia, heavily dependent on oil revenues, illustrates how.

The IMF estimates Saudi Arabia needs oil prices above $90 a barrel to balance its budget at current production levels, while Bloomberg Economics puts the break-even at $112, once domestic spending by the kingdom’s sovereign wealth fund is taken into account. But 18 banks monitored by Bloomberg that published forecasts in April expect Brent prices to average between $64 and $77 a barrel in 2025. Goldman Sachs warns that Saudi Arabia’s budget deficit could soar to $67 billion this year if its oil price averages $62 per barrel.

Of course, Saudi Arabia has other options to balance its books. It could cut spending or use debt to finance ambitious plans to revitalize its economy. It already relies heavily on the latter: The kingdom’s debt levels jumped the most on record in the first quarter of 2025 due to an increase in private-market borrowing.

In normal circumstances, cheaper oil would boost demand, allowing producers to pump more to offset the lower value of their exports. But the uncertainty caused by Trump’s trade war has dampened expectations for demand growth, depriving producers of a sales boost from lower prices.

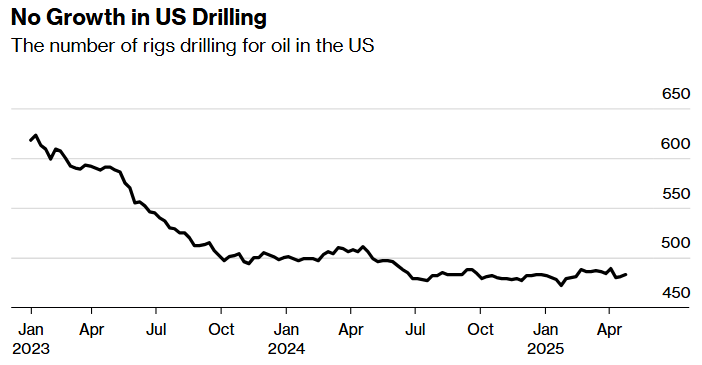

Lower prices are also causing frustration among US oil producers and jeopardizing Trump’s goal of supercharging US fossil fuel production to achieve “energy dominance.” WTI’s slump to below $60 per barrel led Texas oil executive Bryan Sheffield to urge his peers to slash drilling immediately and “hunker down to let the tariff war play out.” Oil producer Diamondback Energy Inc. forecasts that production has likely peaked in the country’s prolific shale fields and will decline in the months ahead after prices plummeted.

Source: Baker Hughes

What does cheaper oil mean for the energy transition?

The impact of cheaper oil on the energy transition is not yet clear.

In theory, the transition to non-fossil fuel energy sources is aided by high oil prices, which give consumers a cost incentive to switch, and harmed by low prices. But Russia’s 2022 invasion of Ukraine heightened concerns in Europe about the security of energy supplies, accelerating the continent’s energy transition. (The wind and solar power generation industries are relatively insulted from geopolitics.) Even though oil was exempted from Trump’s April tariffs, trade tensions have further elevated concerns about energy security.

Additionally, wind and solar industries are only marginally affected by oil prices: their real competition comes from natural gas and, in some parts of the world, coal.

The transition to electric vehicles will be more directly affected by lower oil prices: prices at the pump influence what kind of car consumers buy. But an ever-expanding slate of vehicle models, improved driving range and more charging points are all helping to boost the attractiveness of EVs globally.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS