- US shale oil producers are feeling aggrieved due to President Trump’s trade war, which has led to a market rout and plummeting oil prices.

- The industry, which heavily supported Trump’s election campaign, is in shock over the rapid decline in oil prices, with many executives expressing frustration and alarm.

- If oil prices continue to fall, US oil production could drop significantly, leading to job losses, idled rigs, and a potential erosion of production capacity.

The angry mutterings at the Permian Basin Petroleum Association’s “Spring Swing” golf tournament this week weren’t all about missed putts or lost balls. The Texas oilmen on the fairways had a more serious concern: The president they helped elect was tanking oil prices.

The market rout sparked by President Donald Trump’s trade war is touching almost every part of the economy. But there are probably few industries feeling more aggrieved right now than US shale oil. Over the last 15 years, it has made America the world’s top crude producer, lowered energy costs and fueled a boom in petrochemicals and natural gas exports. It also contributed heavily to Trump’s election campaign.

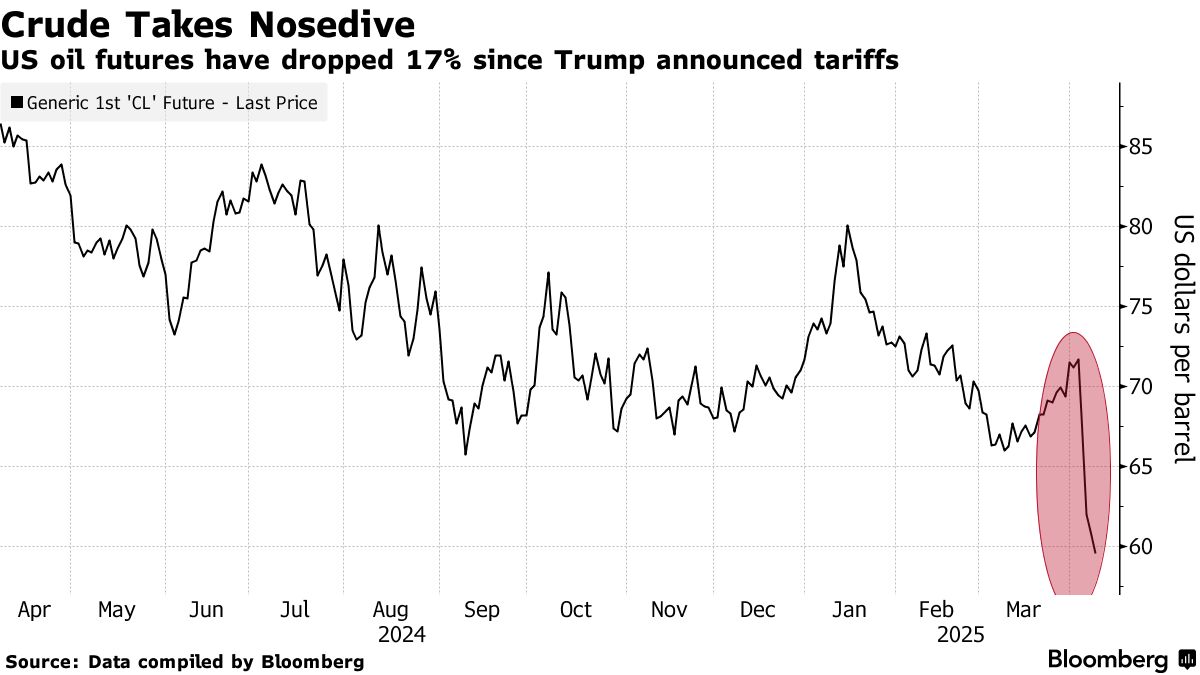

And yet half of the 20 worst-performing stocks on the S&P 500 Index since Trump announced his tariffs April 2 are in the oil, gas and petrochemical sector, while crude prices have plunged to the lowest in four years.

“I don’t know an industry that was more supportive of Trump than the oil and gas industry,” said Kirk Edwards, a former chairman of the Petroleum Association who attended the tournament Monday in the West Texas town of Odessa, which lies in the middle of the Permian amid a landscape dotted with pumpjacks. “People are in shock at how quickly he can get the price of oil down.”

The growing unease reflects how Trump’s effort to re-write global trade rules is undermining his goal to supercharge US fossil-fuel production and achieve “energy dominance.” Executives are loathe to boost US oil supply with West Texas Intermediate down about 23% since Trump’s inauguration less than three months ago. It’s now hovering under $60 a barrel, below the level they say they need for new wells to break even, according to a survey by the Federal Reserve Bank of Dallas.

Adding to their woes, OPEC and its allies last week pledged to triple a production increase previously scheduled for May. The cartel announced it hours after Trump unveiled his tariffs.

“Those two things together shocked the whole industry,” said Linhua Guan, CEO of Houston-based oil producer Surge Energy.

The president has long made it clear where he stands on oil prices.

On the campaign trail last fall, Trump said he didn’t “give a damn” if oil companies drilled themselves out of business as long as prices fell. Now, as oil executives watch plunging prices with alarm, Trump is gleefully celebrating the fact. Gasoline, he predicts, could fall to the lowest level in years.

“It’s going to be in the $2.50-a-gallon range — and maybe below that,” Trump told reporters Monday in the Oval Office. “We’re really doing amazing. I mean, we’re cutting prices.”

Gasoline prices are still well above $2.50 in most of the US. But the fact that the president is cheering on a further decline doesn’t sit well in the oil patch.

Several senior oil executives, who asked not to be identified criticizing the president as the trade fight plays out, expressed frustration with Trump for continually talking down the price of their key commodity, while also expressing appreciation for his push to cut regulations, ease permitting and make more federal land available for exploration.

Even before Trump announced the tariffs and helped triggered the price collapse, oil executives were privately grumbling about his trade policy. In the March 26 survey by the Federal Reserve Bank of Dallas, shale executives submitted a raft of blistering anonymous comments criticizing the president’s tariff agenda, with one calling it “a disaster for the commodity markets.”

Then on Sunday, the president of Diamondback Energy Inc. — the biggest independent oil producer in the Permian Basin — took to the social media platform X as oil prices were in freefall to say that the Trump administration “better have a plan.”

“Trump is from New York — he’s a Yankee,” said Bryan Sheffield, a managing partner of Austin-based Formentera Partners LP, an energy investment firm. “I’m not sure he’s as close to our industry that we think he is.”

US crude futures fell for a fourth-consecutive trading session Tuesday, dropping to $59.58. It was the first time WTI closed below $60 a barrel since 2021.

If prices fall to $50 a barrel, production in the Lower 48 states could drop by more than 1 million barrels a day over the next 12 months, according to S&P Global Commodity Insights. That’s about 7% of the current US total.

“You’re going to get squeezed from a production standpoint on prices and input costs,” said Haag Sherman, CEO of Tectonic Financial, Inc. a Houston-based bank. If low prices persist “you’ll see capex come down in the latter part of this year.”

Even if prices bounce back to $65, shale operators probably would shut down 25 drilling rigs and hold US oil production flat, Citigroup Inc. analysts warned last month.

The drop would be particularly damaging because output from shale wells declines much faster than conventional wells in the Gulf of Mexico or elsewhere, falling 60% or more during the first year they come online. That means drillers need to tap new wells just to keep production steady.

“You will see the Permian Basin roll over” at $50 a barrel, Sheffield said. “Once that starts rolling over, it will be impossible to get it back to increasing its production above the treadmill.”

With their easy-to-drill wells, the Permian and other shale basins have made the US a swing producer in the global oil market, able to quickly bring fresh supply online when demand surges. A significant drop in production, however, could endanger that.

Less drilling activity means jobs losses, idled rigs and a potential erosion of production capacity if oil prices were to bounce back, as happened after Covid-19.

“I don’t think the administration understands we have a great employee and service base,” said Edwards, the former Petroleum Association chairman who now runs a small independent oil producer.

One of the companies hit hardest on Wall Street amid the fallout in crude prices is Liberty Energy Inc., the fracking firm formerly run by Energy Secretary Chris Wright. It’s down 38% since the tariff announcements on April 2.

“These are critical times, and Chris Wright knows it,” Edwards said. “He’s one of us.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS