By Emma Sanchez and David Wethe

Shale-oil companies are taking some of the harder lumps on Wall Street as crude prices tumble and President Donald Trump’s trade war runs headlong into his goal to turbocharge US energy production.

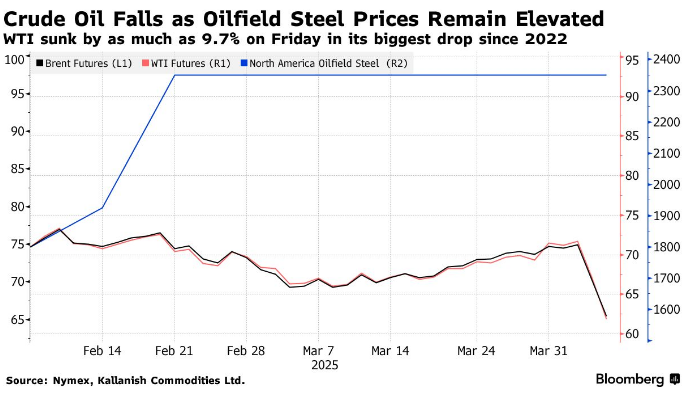

The S&P 500 Energy Index is down more than 15% since the president announced the sweeping tariffs that have helped send crude to a four-year low, with every stock in the index falling sharply Friday. Meanwhile, the S&P oilfield-services index, which includes both frackers and deepwater drillers, is down the most since the darkest days of the pandemic in mid-2020.

Diamondback Energy Inc., Devon Energy Corp. and APA Corp. are among the worst faring in the shale patch — all posting declines over the last two days of more than 20%. US Energy Secretary Chris Wright’s former company, Liberty Energy Inc., is down about 30%.

Shale companies are the engine that drives US oil-production growth, responsible for the surge in output over the past 15 years that’s made America the top global oil producer. They are the centerpiece of Trump’s “energy dominance” agenda.

Yet US crude futures have now tumbled below $62 a barrel — below the $65 threshold that many companies need to profitably drill new wells, according to a recent survey by the Federal Reserve Bank of Dallas. At the same time, Trump’s levies are driving up the price of the drilling equipment, with steel pipe costs rising about 30% compared to pre-tariff levels.

“The concept of ‘drill, baby, drill’ wasn’t really happening prior to the crash in prices of the last few days,” Leo Mariani, an analyst at Roth Capital Partners, said Friday in a phone interview. “Now you’re going to get the inverse of that in a lower price scenario.”

Even before the tariffs sent markets into a tailspin, most US producers were targeting modest growth of around 2% or 3% for this year, opting to focus on returning cash to shareholders instead of investing in more wells. If oil prices keep falling, they may become even more conservative, said Vincent Piazza, an oil and gas analyst for Bloomberg Intelligence.

“You may see folks rethink those drilling programs even more,” Piazza said in an interview.

Oil company executives strongly supported Trump’s campaign and welcome his push to cut regulation and make drilling for oil and gas cheaper and easier. Yet in private they’ve expressed deep concern about his trade policies.

In last week’s Federal Reserve Bank of Dallas survey, shale executives submitted a raft of blistering anonymous comments criticizing the president’s tariff agenda, with one calling it “a disaster for the commodity markets.”

Read More: Shale-Oil Bosses Slam Trump’s Tariffs in Anonymous Survey

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS