Some power companies have stopped calling the fuel a temporary pathway to renewable energy and are making it central to their long-range plans.

By Josh Saul

The Gateway Generating Station natural gas-fired power plant in Antioch, California. The fuel’s use is on the rise. Photographer: David Paul Morris/Bloomberg

Welcome to our guide to the commodities markets powering the global economy. Today, reporter Josh Saul examines how perspectives on the role of natural gas have flipped in recent years.

Consider this an obituary for a bridge.

Utility executives have long called natural gas a “bridge” to a carbon-free power grid. On one side lay a past of smoke-belching coal plants; on the other, a clean future of renewables gradually stabilizing the climate.

They’re saying that a lot less often these days. The power demand boom accelerated by artificial intelligence has all but killed off the analogy. So has US President Donald Trump’s support for fossil fuels and hostility toward clean energy.

Some of those same utility executives now say gas will remain central to their plans for years to come.

One recently described solar and wind power as a bridge to more gas plants, turning the whole idea on its head. Another said clean energy isn’t even on the agenda anymore.

Some power companies also purged climate targets from their communications.

BloombergNEF analysts back up the idea that the fossil fuel has a long, bright future. “Gas now plays a larger role,” with demand rising 25% through 2050, according to the New Energy Outlook.

That’s due to lower long-term prices and growing electricity demand from data centers. Most of the growth will come after 2035 thanks to an increase in the sector’s consumption, led mainly by the US.

The changing forecasts provide the backdrop for the BNEF Summit that starts today in New York. Speakers will address the energy transition, and other panels will probe the effect of artificial intelligence on gas usage.

We’ll see how many of those leaders agree with NextEra Energy Inc. Chief Executive Officer John Ketchum, who in an earnings call last week cast renewables as the bridge and gas the destination.

Solar and wind facilities, after all, are faster to build than gas plants, even if they can’t run 24/7.

“We should be thinking about renewables and battery storage as a critical bridge to when other technology is ready at scale, like new gas-fired plants,” Ketchum said.

–Josh Saul, Bloomberg News

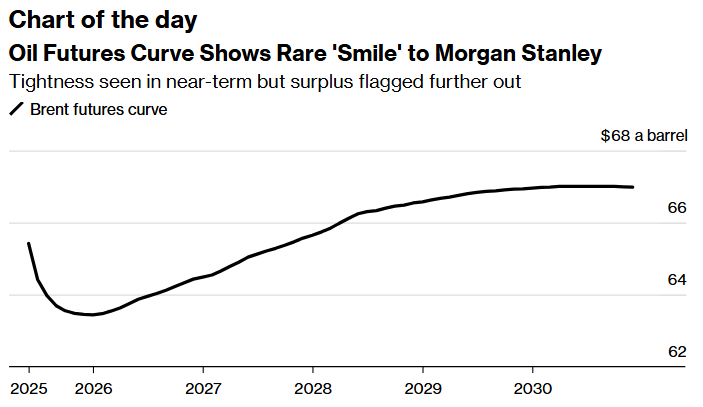

Source: Morgan Stanley, Bloomberg, ICE

The oil market is in very rare territory, with futures pricing that points to near-term tightness while also flagging a “meaningful surplus” further out, Morgan Stanley said. The Brent forward curve is downward sloping across the first nine contracts and upward sloping thereafter. Analysts expect the global benchmark to drop back into the low $60s-a-barrel this year.

Top stories

Spain and Portugal are returning to some semblance of normality today, though many questions remain about what caused one of Europe’s worst blackouts in years.

BP Plc’s plan to turn around years of poor performance got off to a rocky start as the first set of earnings since the company’s big strategy reset disappointed investors.

Four zombie vessels have emerged in recent weeks in the sensitive Venezuelan oil trade, which has become even more risky since the US imposed tariffs on countries importing crude from the South American nation.

De Beers investor Botswana says it’s optimistic that Anglo American Plc will find a buyer for the diamond unit this year.

Critical minerals are a headache for the US but not a crisis because market forces can resolve any shortages, Bloomberg Opinion’s Javier Blas writes.

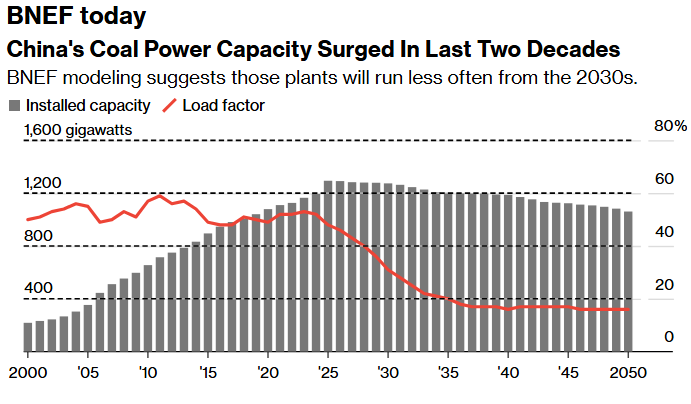

Source: BloombergNEF’s New Energy Outlook 2025

Note: NEO’s Economic Transition Scenario assumes no further policy support for an energy transition beyond existing measures, leaving technologies to evolve based on market fundamentals. “Load factor” describes the realized annual percentage of hours the fleet runs.

China’s fleet of coal-fired power stations is expanding rapidly, but many plants may be more idle than not by the mid-2030s. The nation’s capacity to generate electricity from the fossil fuel will surpass 1,200 gigawatts this year, according to BNEF. Those facilities currently feed power to the grid about half of the time. By 2035, that rate will likely slip below 20%.

Best of the rest

- The international pledge to triple atomic energy capacity by 2050 necessitates a significant increase in fuel supply. The World Nuclear News podcast polls executives and officials to find out where that’s going to come from.

- The Associated Press went to the heart of US coal country — West Virginia — to canvas how residents are receiving Trump’s push to save the industry.

- The US-based Resources for the Future think tank is proposing a single cap-and-trade system for multiple air pollutants, saying current regimes don’t address the chemical interactions that harm public health.

More from Bloomberg

- Economics Daily for what the changing landscape means for policymakers, investors and you

- Green Daily for the latest in climate news, zero-emission tech and green finance

- Hyperdrive for expert insight into the future of cars

- Supply Lines for daily insights into supply chains and global trade

- Explore all Bloomberg newsletters at Bloomberg.com.

— With assistance from Will Mathis, Reed Landberg, Kamala Schelling, and Carolynn Look

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS