With new machines from Ford, GM and others, Tesla’s share of the US EV market has slid.

By Kyle Stock

When Artie R. Williams decided it was time to kick his gas habit, he narrowed his search to three options: the Cadillac Optiq, a Porsche Macan EV and the Polestar 3. — none of which has been on the market for more than a few months.

Tesla wasn’t on the table.

“Nothing against Elon (Musk), but those vehicles have been out for so long,” said Williams, a healthcare marketer in Dallas, from the driver’s seat of his weeks-old Polestar. “Meanwhile, this thing is new, it’s innovative. It had a funky look to it and I knew people were going to be like ‘What are you driving?’ And I like that.”

Artie R. Williams with his new vehicle. Source: Artie R. Williams

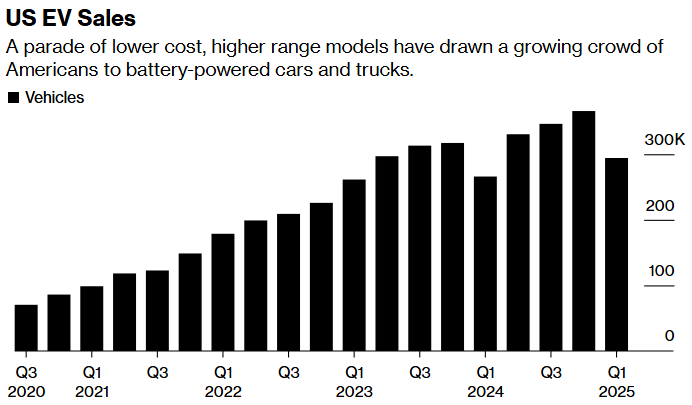

Sales of electric vehicles climbed to 294,000 in the first quarter of the year, a 10.6% increase compared with the year-earlier period. January through March is a relatively slow time for car sales, nevertheless EVs moved off the lot much more frequently than cars and trucks in general. (Total US auto sales were nearly flat in the first quarter).

EV adoption is cruising along in the US, despite a backlash against the industry’s largest player and the Trump administration’s push to wind back clean energy incentives and emissions regulations. Interest is spreading from early-adopters to mainstream consumers, from EV evangelists to the EV-curious. Williams, for example, isn’t concerned about his personal emissions or climate change. He’s just tired of paying for gasoline and oil changes and considers the preponderance of new EVs a better, more reliable form of technology.

Source: Cox Automotive Inc.

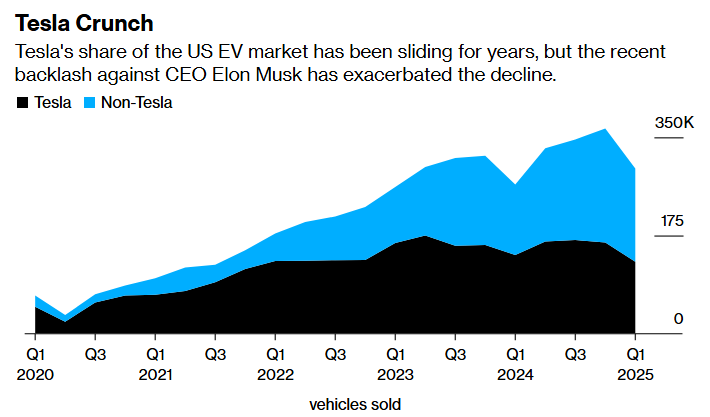

Tesla’s Pain = Others’ Gain

The gains came in spite of (and in some cases because of) struggles at Tesla, the country’s market-leader for battery-powered vehicles. Tesla sold 1.3 million cars in the quarter, a 9% decline from the year-earlier period. Sales of rival brands, meanwhile, collectively notched a gain of 32%. In two years, Tesla’s share of the US EV market has skidded from almost two-thirds to less than half.

A grassroots boycott of the brand in response to CEO Elon Musk’s heavy-handed efforts to streamline federal employment drove some of the sales swoon. JPMorgan has characterized the backlash as “unprecedented brand damage.”

Tesla net income slid 71% in the first quarter and the company widely missed analyst estimates on revenue. Tesla Chief Financial Officer Vaibhav Taneja said vandalism and hostility were to blame, in part, for double-digit percent declines in vehicle deliveries.

However, there is also a crowd of EV converts that aren’t so much put off by Musk as they are attracted to a parade of newer products. Of the 63 or so fully electric cars and trucks on the US market, one quarter weren’t available a year ago. The product blitz includes the first EV offerings from Acura, Dodge and Jeep, second models from Mini and Porsche and two more battery-powered machines each from Cadillac and Volvo.

“There’s just a lot of competition now,” explained Stephanie Valdez Streaty , director of industry insights at Cox Automotive. “And it’s not just one make or model that’s filling in that (Tesla) gap … The familiarity of these brands is really driving people.”

Many of the new EVs are relatively affordable. Cox estimates the price spread between EVs broadly and internal combustion cars and trucks has shrunk to just $5,000. General Motors, meanwhile, plans to resurrect its Chevrolet Bolt later this year with a price point around $30,000.

“We’re about giving customers a choice,” CEO Mary Barra told Bloomberg. “Over the long term, we think EV demand will grow.”

Hayden Jones, a Microsoft retiree in Seattle, loved his two Tesla Model Ys, but traded them both in a few weeks ago. He’s come to consider Elon Musk “a bit of a lunatic.”

“I was getting post-it notes when I parked,” he explained, “and it’s a slippery slope from putting a sticker on someone’s car and setting it on fire.”

Jones said both of his new cars – a BMW iX and a Polestar 3 – seem higher quality than his Teslas and comfortably haul his two massive dogs, a 170-pound Newfoundland and a 70-pound mutt. Polestar knocked $5,000 off as part of a new marketing program to lure Tesla refugees like Jones.

Source: Cox Automotive Inc.

Globally, EV sales are only expected to accelerate. BloombergNEF expects drivers to buy 22 million battery-powered vehicles this year, a 30% increase from 2024. In the US, it forecasts slightly more bullish demand, a sales increase of 31.5%.

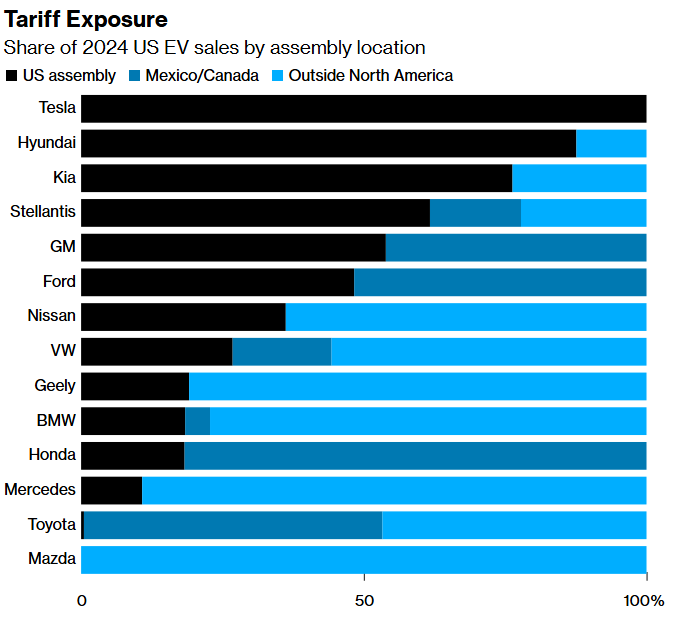

However, tariffs could broadside EV-curious shoppers. Factories from the Rust Belt to the Deep South stamp out gas-powered engines with ease, but US plants are still spooling up slowly on batteries, leaving EVs far more exposed to tariffs. Nearly 70% of lithium-ion batteries in the US come from China and now face tariffs of up to 73%.

“We definitely have some strong headwinds coming for EVs,” Valdez Streaty explained.

Of the 1.5 million EVs purchased in the US last year, slightly more than one third were imported. Today, each of those products faces a 25% tariff. BloombergNEF reckons that slice of the market will shrink by 58%, either because the vehicles will become too expensive or they won’t arrive at all. Jaguar Land Rover and Audi, for example, have paused shipments of certain models to America.

Meanwhile, an additional 25% tariff is expected on car parts in early May, a measure that would crunch the economics on EVs assembled in America, either chiseling down profit margins or inflating sticker prices – or both.

Source: BloombergNEF, Marklines

The Detroit stalwarts – Ford, General Motors and Stellantis-owned Dodge and Chrysler – are among the carmakers most exposed to Trump’s trade war. Two of the most popular (and most affordable) EVs on the market – Ford’s Mustang Mach-E and the Chevrolet Equinox EV – are both bolted together in Mexico. Meanwhile, the Chrysler Pacifica hybrid is made in Windsor, Ontario just across the Detroit River from the c-suites of Motown.

The carmaker least exposed to Trump’s trade war — at least for the moment — is Tesla, as its machines roll out of massive factories in California and Texas. Those vehicles face plenty of other challenges, though.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

What Excites and Worries LNG Exporters in 2026: Maguire