His executive orders supporting digging and drilling may not be enough to revive the beleaguered sector.

By Shoko Oda

Welcome to Energy Daily, our guide to the commodities markets powering the global economy. Today, reporter Shoko Oda looks at the market realities facing the White House’s love for coal.

President Donald Trump is again signaling support for the struggling US coal industry, yet even that may not be enough to spark a turnaround.

During his first term, officials drew up plans to order grid operators to buy electricity from faltering coal and nuclear plants in an effort to keep them open for longer. This time, there’s also the backdrop of surging power demand from artificial intelligence and data centers.

Already, producers have extended, or are considering extending, the lives of some facilities ticketed for extinction.

Trump signed an executive order declaring a national energy emergency, and he’s directed his administration to help boost fossil fuel production. Last week, Interior Secretary Doug Burgum told Bloomberg Television the government was considering using that declaration to reopen closed coal-fired plants and stop others from shutting.

But even Trump has to grapple with economic realities: Coal’s yearslong decline coincides with the rise of cheaper energy, public pressure to reduce emissions and tighter federal regulation.

Coal on barges on the Monongahela River.Photographer: Justin Merriman/Bloomberg

At best, the power demand outlook, combined with the president’s deregulation push, could keep these facilities online a bit longer, said Josh Price, director of energy and utilities at Capstone LLC.

But it’s especially challenging to reopen ones already shuttered, he said. Coal isn’t just dirtier than natural gas, solar and wind — it’s often not economically viable.

Restarting a plant requires capital expenses to make sure it runs properly, and it’s unclear who would bear that cost. The coal industry would also struggle with a labor shortage and inadequate rail infrastructure for transportation, he said.

Then there’s the possibility that climate-focused policies will be revived under a new president as soon as January 2029.

“Power-plant owners, operators and developers don’t think of investments in terms of administrations,” said Timothy Fox, an analyst at Washington-based ClearView Energy Partners LLC. “They think 10, 15, 20 years down the road.”

–Shoko Oda, Bloomberg News

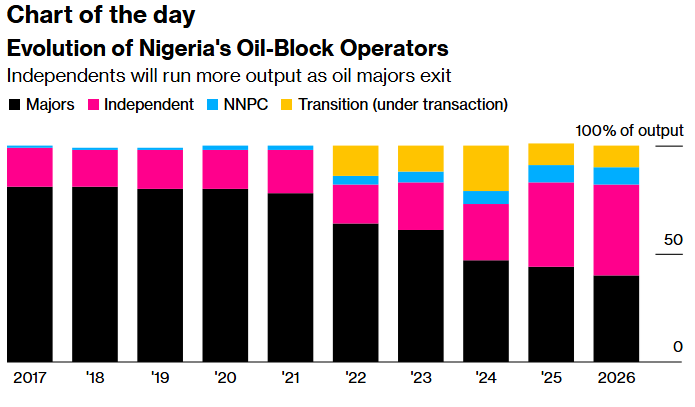

Source: Welligence Energy Analytics

A Nigerian oil company controlled by a computer services firm is among the emerging local enterprises taking over the nation’s crude fields. Panout Oil & Gas Ltd. outbid TotalEnergies SE and Chevron Corp. for blocks last year. Panout is affiliated with a Lagos-based information and communications technology company called Blueprint Business Technologies Ltd. More than half the country’s production is run by independents, the state-owned oil company, or is in the process of transitioning to new owners.

Top stories

Copper marched past its key threshold of $10,000 a ton after weeks of global trade dislocation triggered by the White House’s push for tariffs on the crucial industrial metal.

RWE AG will cut €10 billion ($10.9 billion) from its planned spending on green technologies by 2030 because the German energy company says projects face higher investment risks, particularly in the US.

The US has agreed to extend a sanction waiver, thus allowing Turkey to continue buying Russian natural gas until May, according to a Turkish official with direct knowledge on the matter. The initial three-month exemption was set to expire today.

The UK’s Financial Conduct Authority fined the London Metal Exchange £9.2 million ($11.9 million) for having inadequate systems and controls to deal with a massive short squeeze in the nickel market in 2022.

The problem of today’s petroleum market is that there’s a lot more oil than crude, Bloomberg Opinion’s Javier Blas writes.

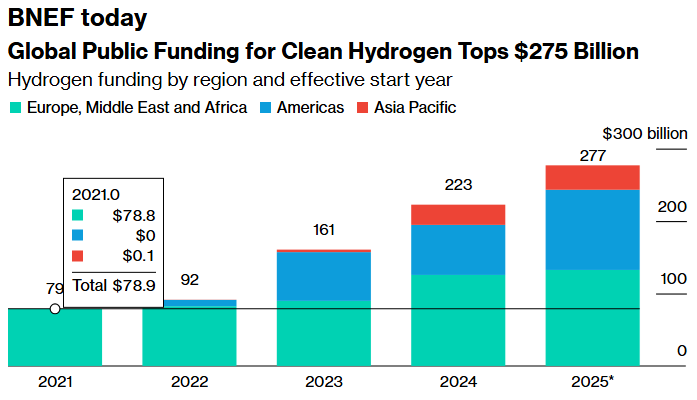

Source: BloombergNEF. Corrects color for Americas to blue and corrects 2025 value for Americas to $110.7 billion. Corrects color for Europe, Middle East and Africa to teal and corrects 2025 value to $132.5 billion. Preceding year values also corrected.

Note: The year 2025 includes funding that may start distribution in 2026, 2027, and 2028. Includes funding mechanisms that are announced, available, and/or allocated. Includes tax credits, grants, contracts for difference and fixed-premium subsidy mechanisms. Excludes loans and loan guarantees.

Governments around the world are increasing their assistance for clean hydrogen to help it compete with fossil fuels. At least 10 markets introduced new funding since April 2024, according to BloombergNEF. Global subsidies for clean hydrogen have surpassed $275 billion, with the European Union and its members offering the most at $118 billion. US spending is about 23% lower.

Best of the rest

- This New York Times dataviz piece shows what the rise of clean energy looks like from space.

- Europe is at a crossroads with its energy policy, the Cleaning Up podcast says. How can the bloc tackle sky-high prices while simultaneously reducing reliance on both US LNG and Chinese clean tech?

- The Australian Financial Review does a deep dive into how struggling Mineral Resources Ltd. wound up with net debt worth about five times earnings and offers ideas for generating cash.

More from Bloomberg

- Economics Daily for what the changing landscape means for policymakers, investors and you

- Green Daily for the latest in climate news, zero-emission tech and green finance

- Hyperdrive for expert insight into the future of cars

- Supply Lines for daily insights into supply chains and global trade

- Explore all Bloomberg newsletters at Bloomberg.com.

— With assistance from Ari Natter, Jennifer A Dlouhy, Will Wade, and Payal Kaur

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS