Weak crude prices have eroded the incentive to drill for more oil, but LNG is a different story.

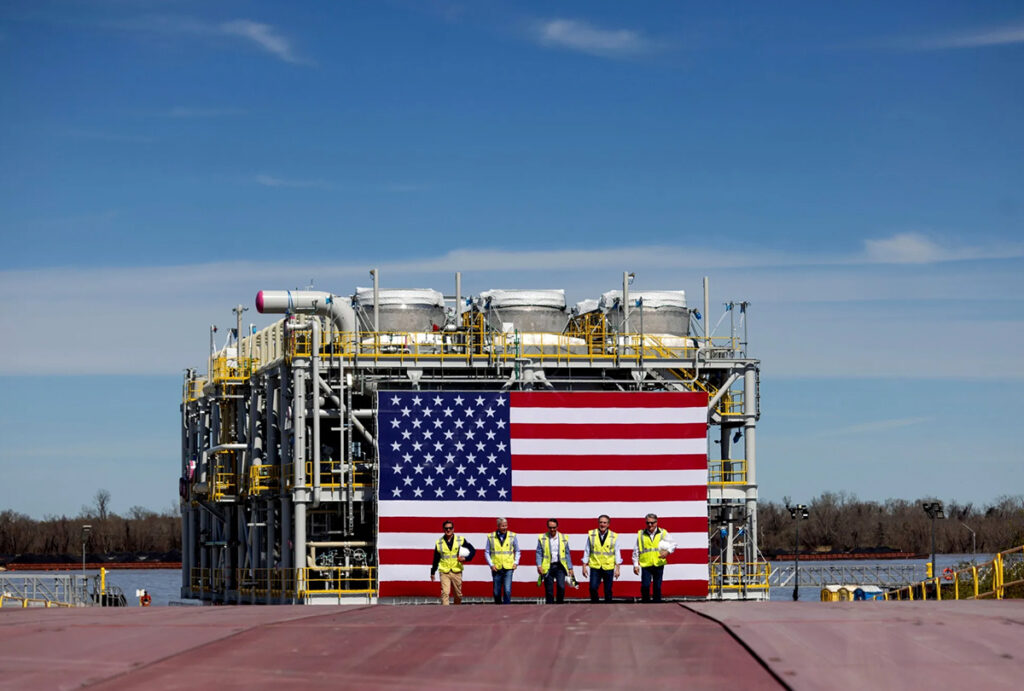

A Venture Global Inc. LNG export facility in Louisiana, with founders Mike Sabel and Bob Pender, Energy Secretary Chris Wright, Louisiana Governor Jeff Landry and Interior Secretary Doug Burgum. Photographer: Bloomberg

Welcome to our guide to the energy and commodities powering the economy. This week, we’re coming to you from global oil and gas get-together CERAWeek, where delegates confront a very different political landscape from last year. Senior reporter Kevin Crowley takes a look at what’s in store.

President Donald Trump’s “drill, baby, drill” energy policy will take center stage this week at the CERAWeek by S&P Global conference in Houston.

His administration wants to increase US oil output by 3 million barrels a day. That will be a huge challenge.

America is already the largest producer, and prices have dropped 12% since Trump took office, eroding the incentive to drill for more.

But if the production target is measured in barrels of oil equivalent — a method of energy industry accounting that can include natural gas — then achieving it is “certainly possible,” CERAWeek co-founder Dan Yergin said.

In contrast to oil, the US gas industry has more potential to expand. BloombergNEF expects the country’s liquefied natural gas export capacity, already the world’s biggest, to grow by 60% during Trump’s presidency.

An LNG tanker docked at Cheniere Energy Inc.’s Sabine Pass export terminal in Cameron, Louisiana.Photographer: Bloomberg

“The market for LNG is going to be larger and grow faster than was even thought a year ago,” Yergin said in an interview. “It’s going to be a very important tool for recalibrating the trade balance with other countries, which of course is a key concern for President Trump.”

The topic is likely to come up when US Energy Secretary Chris Wright addresses CERAWeek Monday morning. He heads a packed opening-day lineup, which also includes the bosses of Saudi Aramco, Chevron Corp., Shell Plc and BlackRock Inc.

In recent years, executives used the conference as a platform to push back against environmental hard-liners and Biden-era policies. This week is likely to be less combative as companies hunt for opportunities presented by Trump’s American Energy Dominance agenda.

But while the president is promoting fossil fuels, he’s also adamant that energy prices must remain low. That would be good news for consumers; not so much for industry profits.

“There’s never been such an abrupt change of direction as we’re seeing now on energy policy,” Yergin said. “Everybody’s coming to learn and make sense of a world that’s very different from a year ago.”

–Kevin Crowley, Bloomberg News

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

What Excites and Worries LNG Exporters in 2026: Maguire