By Mitchell Ferman and James Herron

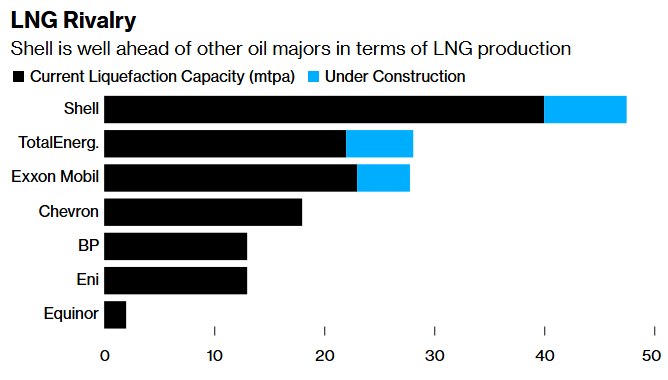

Shell Plc said it would boost investor returns through the end of this decade by reinforcing its position as the world’s top trader of liquefied natural gas.

The London-based energy giant will expand LNG sales, the key driver of profit growth in recent years, by 4% to 5% annually until 2030, according to a statement on Tuesday. This will help the company return as much as half its cash from operations to investors, with a preference for share buybacks.

It’s the first glimpse at Shell’s long-term strategy after Chief Executive Officer Wael Sawan’s two-year “sprint” to shake up the company by cutting costs, improving reliability and shedding under-performing units. The CEO will lay out his plans for investors in greater detail later in the day in New York.

“We want to become the world’s leading integrated gas and LNG business,” Sawan said in the statement. “Today we are raising the bar across our key financial targets, investing where we have competitive strengths and delivering more for our shareholders.”

Shares of the company rose 2.3% to 2,787.5 pence as of 12:06 p.m. in London trading.

Source: Company reports, Bloomberg Intelligence

Shell outlined a raft of measures including further cost reductions and a tight rein on spending. It will review its chemicals business and explore partnership opportunities in the US and potential asset sales or plant closures in Europe.

These plans mean Shell’s free cash flow per share will grow by an estimated 10% a year to 2030, and the company will distribute 40% to 50% of cash flow from operations to shareholders, up from a previous target of 30% to 40%.

Rising payouts have been a key part of the industry’s appeal to investors in recent years. Shell has been buying back $3.5 billion of shares a quarter and increasing its dividend by 4% annually, reaching 34.4 cents a share in the fourth quarter of 2024.

That’s still below the 47 cents a share Shell paid out at the end of 2019, before slashing its dividend in 2020 as energy prices slumped during the Covid-19 pandemic. Even so, investors have so far liked what they’ve seen from Sawan, with the company’s shares up almost 20% in past two years, compared with a decline of more than 10% for fellow London-based major BP Plc.

“Since new management has come in, Shell’s share price has outperformed the peer group handily, and so it should not be a surprise that today’s update reads as more evolution than revolution,” RBC analyst Biraj Borkhataria said in a note. “We’d put this in the ‘boring but good’ category.”

Shell is betting that LNG will play a key role in the transition to lower-carbon energy, with global demand continuing to expand well into the next decade. By 2030, Shell’s LNG business will be 20% to 30% larger than it was in 2022, the year before Sawan became CEO.

That growth comes from a mixture of Shell’s own production, bolstered by projects such as LNG Canada, and the trading of fuel purchased from others, which has been a lucrative business in recent years amid big regional price swings.

Shell plans to grow overall oil and gas production by 1% annually until 2030, with liquids output stable at about 1.4 million barrels a day. That represents a firmer commitment to fossil fuels after the CEO began to pivot away from renewables in 2023.

Shell has provided little detail about its oil production beyond 2030. Chief Financial Officer Sinead Gorman said the company will likely add “small-scale” bolt-on acquisitions to help with its crude output next decade.

“We believe that oil is going to be needed for a long time to come,” Gorman told journalists on Tuesday.

Shell’s greater focus on natural gas instead of oil means the carbon emissions intensity of the products it sells will decline over time. The company maintained its existing climate targets.

(Updates with CFO comment in paragraphs 14 and 15.)

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS