By Mark Burton and Kate Sullivan

US President Donald Trump is close to striking a deal to grab a share of Ukraine’s natural resources as he pushes for an end to Russia’s three-year war in the country.

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

Trump has sought to pressure President Volodymyr Zelenskiy into agreeing to let the US benefit from any of Ukraine’s untapped resources, at a time when Washington is seeking to secure supplies of critical minerals. His pursuit has seen him make some huge demands: At one point he wanted the equivalent of $500 billion from rare earths, materials that play a key role in defense and other high-tech industries.

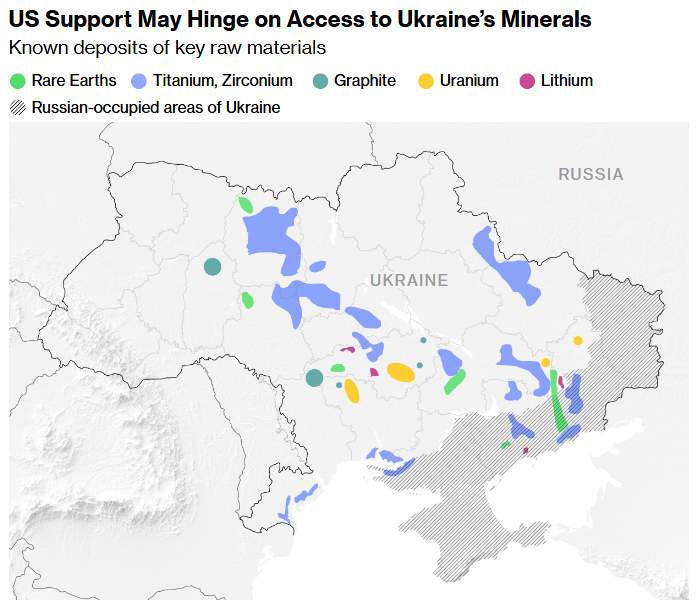

But Trump’s focus on Ukraine’s commodities has also raised questions about what the nation really has to offer — for example it has no major rare-earth reserves that are internationally recognized as economically viable. It’s unclear to what extent the US may benefit, though the deal appears broader than first thought. Ukraine is an established producer of coal, iron ore, uranium, titanium, and magnesium, and expanding those sectors could be profitable for the US.

The proposal is to share revenue from future extraction of government-owned minerals and energy resources such as gas, as well as from terminals and port infrastructure, according to draft text seen by Bloomberg. That would apply to new projects rather than existing ones, and could require hefty investment in mines, as well as any processing facilities.

What does Trump want from Ukraine with a minerals deal?

Trump argued during his election campaign that Washington has provided too much aid to Ukraine and claimed repeatedly, without foundation, that it has contributed far more than European countries.

He now wants the war-battered country to ringfence 50% of all revenues earned from “the future monetization” of its natural resources, including minerals, hydrocarbons, oil, natural gas, as well as ports and other infrastructure, according to a draft agreement.

“I do deals. My whole life is deals,” Trump said at the White House on Feb. 24 after discussing the war with French President Emmanuel Macron.

What commodities are easiest to exploit?

Some reports have suggested that Ukraine has mineral deposits worth at least $10 trillion, including lithium, graphite and titanium. But again, not much is known about how many are commercially viable.

Bulk commodities like coal and iron ore, as well as uranium, are perhaps the most logical deposits for the US to target. That’s because after building mines and extracting them, it’s easier to sell supplies straight into the market than other materials that require additional processing, like graphite and rare earths.

Processing such minerals outside of China would need investing in facilities, and often comes with environmental and technical issues. Another hurdle is that many commodities that Ukraine could potentially extract are currently well supplied globally, so prices may not be attractive enough to warrant large investment.

In terms of reserves, Ukraine is widely seen as being in the top 10 for coal, uranium and iron ore, but its costs of production may be significantly higher than the world’s leading suppliers. Natural gas — of which there are sizable reserves — and shale gas could potentially also be tapped.

What other metals deposits does Ukraine have?

Kyiv has also been keen to promote its lithium, graphite and titanium deposits. It says it has Europe’s biggest deposit of battery metal lithium, but prices have cratered in recent years with output rising much faster than demand.

When it comes to titanium, Ukraine isn’t necessarily producing the type that America’s defense industry needs — it has no capacity to make titanium sponge, the form of the metal used in jet engines, armor plating, and other defense applications, according to US Geological Survey data.

Again, extracting these sort of commodities is easier than processing them. Processing materials like titanium, rare earths and graphite would require a lot of investment, according to CRU Group.

“Access to the resources is a necessary, but not sufficient, step to increasing the supply of these minerals, or creating a larger volume of supply that’s not mined or processed in China,” said Willis Thomas, principal consultant at CRU.

What about rare earths?

Trump has particularly highlighted rare earths, elements used in everything from iPhones to laser-guided missiles and whose supply is dominated by China. While Ukraine has reported a series of deposits, little is known about their potential. Even the former head of Ukraine’s geological survey said there had been no modern assessment of its resources, according to S&P Global.

Outside of China the biggest reserves are in places like Brazil, India, Australia and Russia, as well as the US itself, according to the USGS.

Like many critical minerals, rare earths are relatively abundant globally, but don’t often exist in large enough concentrations to be extracted and refined economically. The global market is also minuscule compared with commodities like copper or oil.

Even if Ukraine’s rare earth deposits are commercially viable, they’ll need to be processed. Right now, China accounts for about 90% of separation and refining capacity.

Another thing to note is that the world’s top miners, who’ve spent much of the last two decades scouring the globe for untapped deposits of commodities, showed little interest in Ukraine before the war.

How important is Ukraine in oil and gas?

Ukraine has made efforts to increase its gas production in the past decade. It’s estimated to have around 5.4 trillion cubic meters of gas reserves, including 1.1 trillion cubic meters proven reserves, among the biggest in Europe, according to the NATO Energy Security Centre of Excellence.

It also holds significant untapped reserves of shale gas, according to the International Energy Agency.

The country already has one of the biggest networks of gas pipelines and underground storage. Before the war, its Soviet-era pipelines could transit more than 140 billion cubic meters of Russian gas toward Central Europe, equal to more than 20% of the continent’s overall gas demand, but the flows stopped after a transit deal expired at the start of the year.

In oil, Ukraine’s modest petroleum reserves would represent just a tiny fraction of those already under development in the US.

What is the US willing to provide in exchange?

The draft doesn’t offer explicit security guarantees to Ukraine. Instead, it cites a “durable partnership” between the US and Ukraine based on their economic ties. Contributions to a fund that will be set up will be reinvested in projects in Ukraine to promote the country’s “safety, security, and prosperity.” Treasury Secretary Scott Bessent has said the US can help propel war-torn Ukraine onto a “great growth trajectory.”

Zelenskiy had pushed for formal US security guarantees, though US officials have said that binding Ukraine to the US through economic ties would provide a de facto security shield.

One White House official said the US would not commit to any kind of guarantee about future aid to Ukraine or US personnel in the region. European governments, concerned this won’t be enough to deter Moscow, have pushed for a more explicit commitment from Washington to support a potential deployment of European troops to help defend Ukraine.

Source: Ukraine Geological Survey (UGS); Institute for the Study of War and AEI’s Critical Threats Project

Note: Russian-occupied areas as of Feb. 5, 2025. Mapped mineral deposit areas are generalizations taken directly from a report by the UGS.

The Reference Shelf

- Bloomberg Economics analyzes Trump’s minerals proposal to Ukraine and what it means in terms of Kyiv’s position with respect to other lenders.

- Bloomberg Opinion’s Javier Blas explains why Trump’s fixation on extracting rare-earth elements from war-torn Ukraine is a folly.

- Trump has also homed in on Greenland’s mineral riches — mooting a potential takeover of the Danish territory — and targeted Panama over access to its crucial waterway.

— With assistance from Elena Mazneva, Kateryna Chursina, Anna Shiryaevskaya, Thomas Biesheuvel, James Herron, Jonathan Tirone, and Daryna Krasnolutska

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS