MELBOURNE, Feb 13 (Reuters Breakingviews) – U.S. President Donald Trump says trade wars are easy to win. If so, his 25% tariffs on steel and aluminium imports ought to have big overseas producers like Rio Tinto (RIO.L), (RIO.AX) begging for mercy. Yet shareholders in the $107 billion miner and rivals like BHP (BHP.AX) have already shrugged off concerns. Granted, they may be overly optimistic, or reckon the levies, set to go into effect next month, won’t be imposed. But it also could be because the duties would hurt the U.S. the most.

These universal tariffs would hit the major exporting countries like Canada and Mexico as well as other mining players equally. That means none would suddenly have an advantage to jostle for a larger slice of the pie. That may yet change: Trump has indicated he may grant an exemption to Australia. But it’s the source of just 1.5% of U.S. aluminium imports and a similarly de minimis amount of steel.

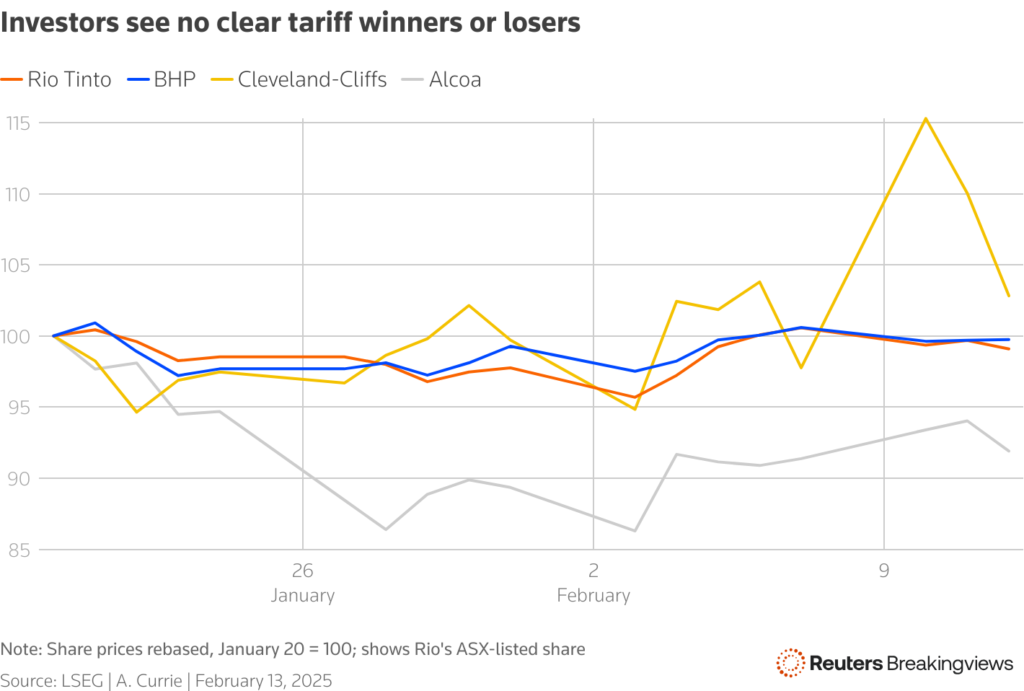

A graphic showing the relative stock price changes since January 20 for Alcoa, BHP, Cleveland-Cliffs and Rio Tinto

Regardless, the U.S. will bear most of the pain. It relies on Canada for around a quarter of its steel and around 60% of its aluminium imports. The only country with the capacity to step in would be top producer China.

But one of the reasons given for imposing the tariffs is to reduce the dominance of the People’s Republic – though that’s overstated. Sure, its exports of the metal last year of 110 million tonnes were double that of 2020. But only a trickle went directly to the United States. Some get there indirectly, but the vast majority went to countries that use it domestically, a senior industry insider told Breakingviews.

Moreover, another rationale for the levies is to support U.S. producers. With the industry running at around 75% of capacity, steelmakers could increase output. But the short-lived bump in shares of players like Cleveland-Cliffs (CLF.N) suggests investors are sceptical.

The outlook is even bleaker for aluminium: domestic players provide around 650,000 tonnes, with imports almost 10 times that. Building more smelters would be costly, take five years or more, and require a degree of certainty about long-term returns that Trump’s volatile trade policy cannot provide. It’s probably why Alcoa’s (AA.N) stock has retreated.

That means the main impact of tariffs would be to make the U.S. pay more for its dependence on the same overseas suppliers. That would push up prices for everyone buying end-products from tin foil to cutlery to wind turbines to cars. As the largest consumers, Americans would be the biggest losers.

Follow @AntonyMCurrie on X

CONTEXT NEWS

U.S. President Donald Trump on February 10 imposed a blanket 25% tariff on all imported steel and aluminium. The measures take effect on March 12.

Trump also revoked exemptions to his 2018 levies on the metals that had been granted to countries and blocs including Canada, Mexico, Australia, the European Union, and the UK. At the time, he imposed a 25% tariff on steel and 10% on aluminium.

Editing by Robyn Mak and Ujjaini Dutta

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein