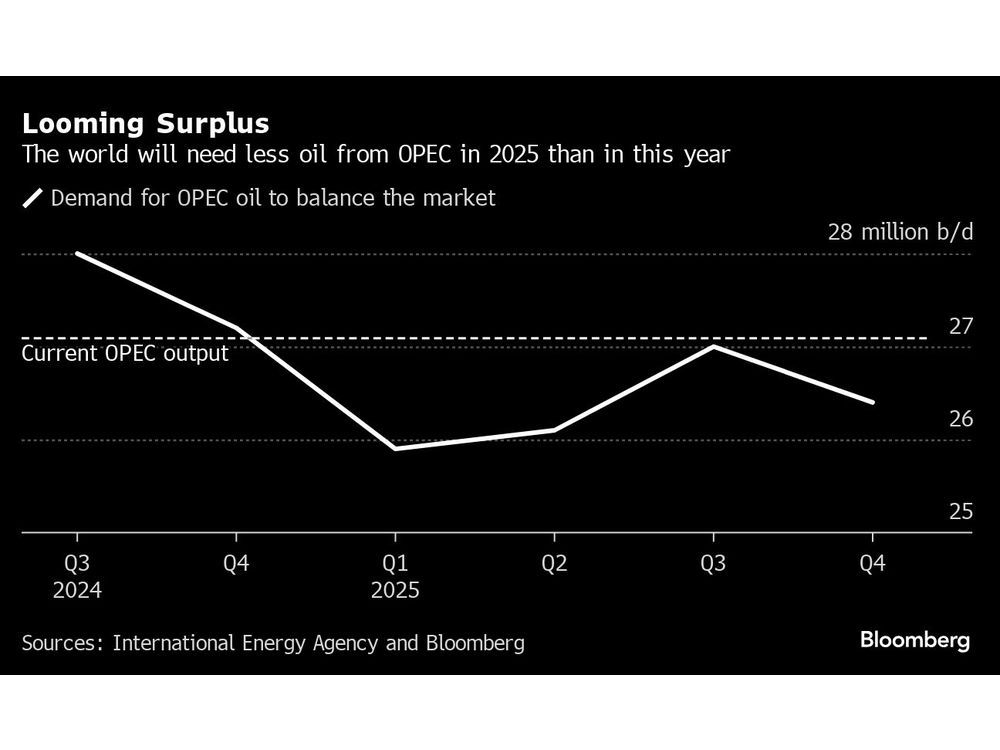

Even if OPEC+ continues to constrain production throughout 2025, a surplus will still emerge

OPEC+ has staved off an oil surplus this year by deciding to restrain production a little longer. But the temporary fix won’t hold back the supply glut awaiting global markets in 2025.

The group led by Saudi Arabia and Russia chose on Thursday to delay plans to restore output by two months, after faltering economic growth in China and swelling American supply pushed crude prices to a 14-month low.

Yet even if OPEC+ continues to constrain production throughout 2025, a surplus will still emerge amid subdued demand growth and burgeoning output from the U.S., Guyana, Brazil and Canada, according to the IEA. Prices are set to slump toward US$60 a barrel, Citigroup Inc. and JPMorgan Chase & Co. predict.

The market’s decline offers some relief to consumers and central banks after years of rampant inflation, and even a potential tailwind for Vice President Kamala Harris’s election campaign. But it leaves prices too low for the Saudis and others in the Organization of Petroleum Exporting Countries to cover government spending.

“It doesn’t look good at all for OPEC+ in 2025,” said Christof Ruehl, senior analyst at Columbia University’s Center on Global Energy Policy. “Everybody would agree that non-OPEC supply is strong enough to create a surplus in the market. And holding back supply now to keep prices up encourages that, of course.”

China, the engine of oil demand for the past two decades, is showing a diminished appetite for the commodity. Imports have dwindled to the weakest pace in almost two years as economic growth cools and top industry officials envisage a shift away from fossil fuels.Muted global consumption growth will be outmatched more than 50 per cent by the tide of new production from outside the 23-nation OPEC+ alliance, with 40 per cent coming from the U.S., according to the IEA. While the nation’s shale boom has eased, it continues to provide substantial volumes of new supply.As a result, global oil inventories stand to accumulate next year, beginning with a hefty build-up of 1.3 million barrels a day during the first quarter, according to the IEA. In this context, OPEC+ has only “limited scope” to add barrels, BP Plc chief economist Spencer Dale warned last month.

China, the engine of oil demand for the past two decades, is showing a diminished appetite for the commodity. Imports have dwindled to the weakest pace in almost two years as economic growth cools and top industry officials envisage a shift away from fossil fuels.Muted global consumption growth will be outmatched more than 50 per cent by the tide of new production from outside the 23-nation OPEC+ alliance, with 40 per cent coming from the U.S., according to the IEA. While the nation’s shale boom has eased, it continues to provide substantial volumes of new supply.As a result, global oil inventories stand to accumulate next year, beginning with a hefty build-up of 1.3 million barrels a day during the first quarter, according to the IEA. In this context, OPEC+ has only “limited scope” to add barrels, BP Plc chief economist Spencer Dale warned last month.

The United Arab Emirates — one of the organization’s biggest producers — has been keen to deploy recent investments in new capacity, which Abu Dhabi says has reached a substantial 4.85 million barrels a day. That’s roughly 5 per cent of world supplies.

Other members such as Iraq, Russia and Kazakhstan have struggled to deliver the cutbacks they were supposed to make at the start of the year. Baghdad has long chafed at OPEC+ quotas while it tries to rebuild an economy shattered by decades of conflict and sanctions, while Moscow seeks revenue to fund President Vladimir Putin’s war against Ukraine.

Despite the OPEC+ decision to pause, JPMorgan and Bank of America Corp. lowered forecasts for crude prices. For group leader Saudi Arabia, the deteriorating outlook threatens financial pain.

Riyadh needs prices close to US$100 a barrel to fund the economic transformation plans of Crown Prince Mohammed bin Salman, which span futuristic cities and premium sports players, data from the International Monetary Fund indicate. The kingdom has been forced to scale back spending on flagship projects after a four-quarter economic slump.

If the OPEC+ strategy continues to struggle, the group could consider a more extreme alternative, Bank of America and BNP Paribas warn: ramping up production to claw back market share and squeeze out rivals like U.S. shale. Neither consider this the most probable scenario, but its likelihood may be rising.

“One wonders when the patience of intentionally giving up market share with no return in sight could run out,” said Tamas Varga, an analyst at brokers PVM Oil Associates Ltd.

With assistance from Salma El Wardany, Fiona MacDonald and Nayla Razzouk

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire