Total Talks Up New York Listing With Sector Abuzz About Switches

- Shell, Glencore already subject of speculation over move to US

- ESG more important to European investors than on Wall Street

TotalEnergies SE is increasingly making noise about moving its stock listing to New York, adding to chatter around European giants potentially being lured by US investors’ greater enthusiasm for oil and gas companies.

The French energy giant is considering the switch “in part because ESG policies in Europe have more weight,” Chief Executive Officer Patrick Pouyanne told a French senate hearing on climate-change goals Monday. “We are losing European shareholders,” while US investors are buying the stock, he said.

The company will “seriously” study such a step and present its findings to the board in September, Pouyanne told analysts last week, expanding on an idea he first disclosed in an interview with Bloomberg Opinion earlier this month.

His comments are sure to cause discomfort around Europe’s major bourses. Speculation is already buzzing about the future of Shell Plc’s presence on the London exchange, while signs this week of investor resistance to Glencore Plc’s proposed coal spinoff might reignite talk of a US listing.

“Europe’s virtuous attitude when it comes to ESG norms, free trade or say on pay may have been naive at times in front of trading partners that put economic interests above all,” said Eric Meyer, head of RBC Capital Markets in France.

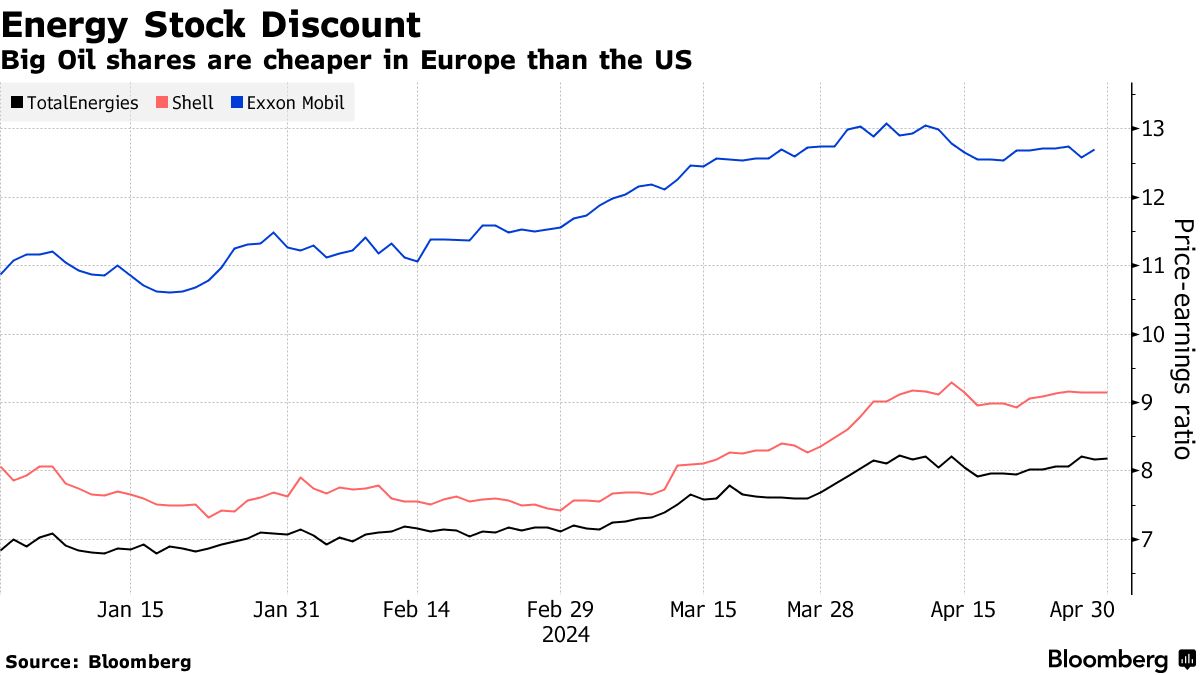

A third of European mutual funds exclude fossil fuels, compared with a negligible number of their US peers with that view, Deutsche Bank AG analysts wrote in a March note, citing Morningstar Direct data. The divergence over environmental, social and governance measurements shows up in valuations, with TotalEnergies’ stock priced at eight times earnings expected a year from now, against 12 times for US giant Exxon Mobil Corp.

And considerations over ESG are not the only factor for European resources companies weighing their options, said RBC Capital’s Meyer.

“When there is a notable valuation gap between Wall Street and Europe, temptation is high to follow the money,” he said. “This is particularly true for the oil and gas industry, which is way more part of the fabric of the US economy, more populated and better followed by investors.”

A representative for Euronext Paris, where Total is listed, declined to comment.

For Glencore, European fund managers shunning coal is a pressing concern. Almost half of the region’s mutual funds exclude the dirtiest-burning fuel from their portfolios, the Deutsche Bank analysts noted. They warned that shareholder opposition to carving out its coal business could prompt Glencore to consider switching its listing to New York. Several of the mining and commodities trading giant’s largest shareholders favor retaining the coal assets, Bloomberg News reported Monday.

“If the scenario of keeping coal were to materialize, it could have major implications for Glencore’s strategy, capital structure and capital availability at a pivotal time for London-listed mining companies,” JPMorgan Chase & Co. analyst Patrick Jones wrote in a note to clients Tuesday.

Another storied commodities company’s European listing is also in peril. After London heavyweight Anglo American Plc rebuffed a takeover proposal by BHP Group, the Australian miner is considering an improved offer, Bloomberg News has reported.

— With assistance from Francois De Beaupuy and Henry Ren

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein