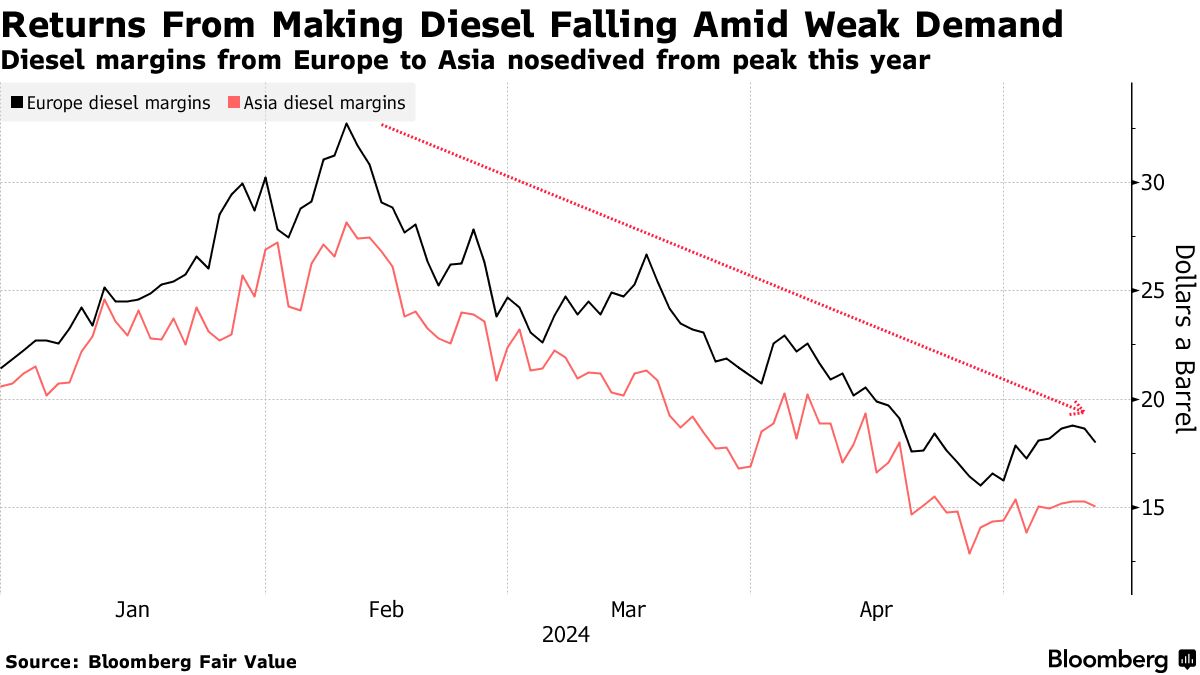

- Asian margins for the fuel have almost halved since February

- The drop in profits has come as a surprise: Wood Mackenzie

Returns from making diesel have fallen sharply over the last few months as supply of the industrial and transport fuel has outpaced demand, spurring refiners to cut run rates and focus on producing gasoline and jet fuel instead.

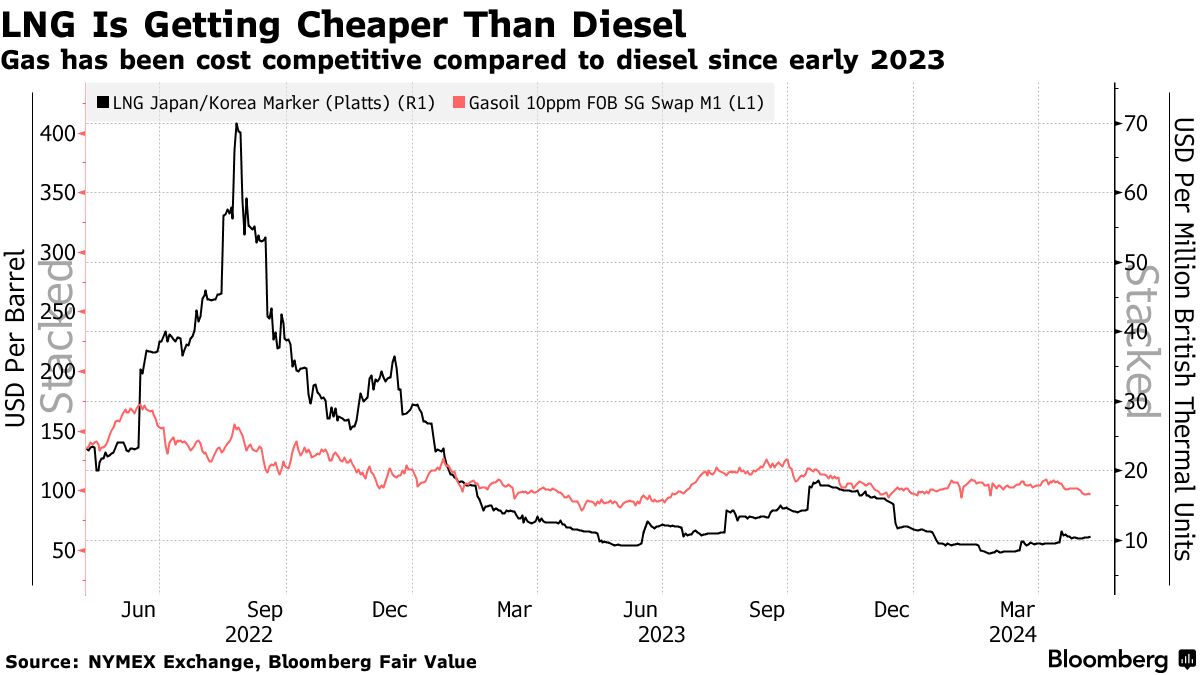

A warmer-than-expected winter in the Northern Hemisphere has meant stockpiles have stayed relatively high, while industrial demand has been tepid. In China, the growing popularity of liquefied natural gas-powered trucks is starting to eat into consumption in what could be the start of a long-term structural shift.

Asian refining profits from making diesel have dropped from close to $29 a barrel in early February to around $15, and are near the lowest level in a year. They’ve also fallen sharply in the US and Europe over the same period, although have staged a mini-recovery this month.

“We are starting to see run cuts in Europe and Asia,” Brian Mandell, executive vice president for marketing and commercial at Phillips 66, said on a recent earnings call in response to a question on diesel. The oil refiner remained “constructive” on the outlook as gasoline demand will increase over the summer driving season and jet fuel consumption is improving, he said.

It’s a far cry from a couple of years ago when diesel prices soared on supply concerns following Russia’s invasion of Ukraine. Drone attacks in recent months on refineries in Russia, a major producer of the fuel, are a potential threat to output if they accelerate, but for now they’ve been outweighed by the unfavorable supply-demand dynamics.

European diesel weakness is also being driven by elevated US flows to the region and a drop in freight rates that’s made it cheaper to bring in the fuel from Asia, according to Eugene Lindell, head of refined products at FGE.

“We were on the cusp of a wider round of run cuts, but rebounding fuel oil and naphtha cracks, together with stabilizing diesel cracks have improved the overall margin picture a bit,” he said.

In China, a jump in sales of LNG-powered trucks doesn’t bode well for diesel over the longer term. The heavy duty vehicles accounted for almost 30% of sales in the world’s biggest oil importer in March, according to Mysteel OilChem, with the rapid uptake following a similar trajectory to electric cars a couple of years ago.

China’s fleet of LNG-powered trucks now represent 800,000 barrels a day of distillate displacement, Goldman Sachs Group Inc. analysts including Callum Bruce and Daan Struyven said in a note this month. A global bear market in natural gas has taken Asian prices “sustainably” below the regional diesel price, they said.

Most of diesel’s weakness comes from dwindling demand in China, Struyven said in an interview. Diesel production was particularly high last year, and that extra supply is weighing on the market, he said.

An increase in diesel-producing capacity at refineries in Asia and the Middle East has taken a toll in the shorter term and may have a long-lasting impact. Refining throughput across The Organisation for Economic Cooperation and Development nations rose by 400,000 barrels a day in the first quarter from a year earlier, Goldman said in the note.

“Given the distillate weakness, the refiners with the highest distillate yields get hit hardest and that’s Europe and Asia,” said Alan Gelder, vice president of refining, chemicals & oil markets at Wood Mackenzie. The drop in diesel margins had “come as a recent surprise,” he said.

— With assistance from Rachel Graham, Sarah Chen, Elizabeth Low, and Jordan Fitzgerald

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS