We first launched this report at COP26 in Glasgow to provide a comprehensive picture on where we are on the journey to cleaning up road transport globally.

Here are four interesting storylines from our latest report, which is available for download here.

No sign of an EV slowdown

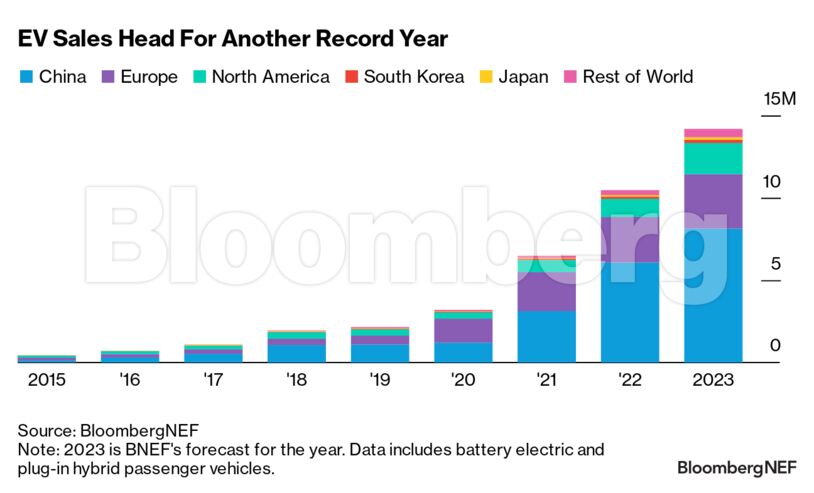

For all the headlines written recently about how EV demand is faltering, the data definitely doesn’t support this — at least not yet.

Sales of passenger EVs are on pace to hit 14 million this year, up 36% from 2022. In the US, where most of the concerns about demand have been raised, sales are growing even faster and will be up 50% this year. Sales might be short of what some manufacturers were hoping for, but have been in line with BNEF’s forecast from the beginning of the year, and most industries would be very happy with this kind of growth rate.

A slowdown could still be coming, but for now, this looks much more like a winnowing down of who is competitive in the market than a general drop-off in demand.

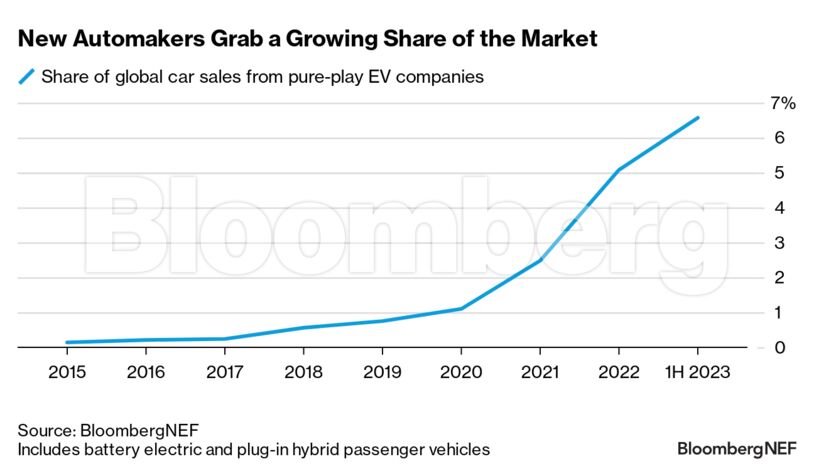

Pure-play EV makers such as Tesla, BYD and Li Auto will capture 7% of the global vehicle market this year, up from just 1% in 2020. Many legacy automakers have launched products that are not competitive on price, range or features and will have to go back to the drawing board.

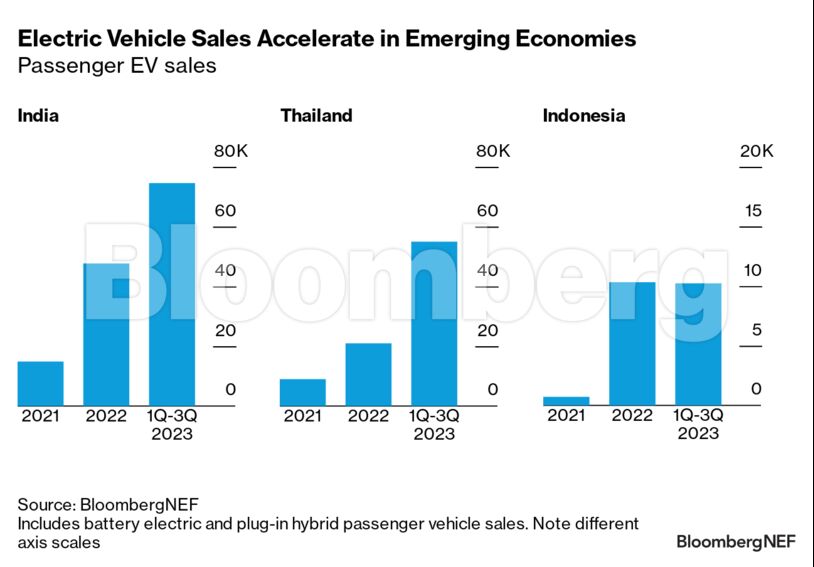

More EV progress in emerging economies

EV adoption is rising quickly in emerging economies including India, Thailand and Indonesia, where low-cost models are driving demand.

EVs are already 9% of cars sold in Thailand — an adoption rate similar to the US — which runs counter to the argument that EVs are only a rich-country phenomenon. The numbers are still modest overall, but the growth rate is encouraging in these fast-growing auto markets. With more new models in the $10,000 range hitting the market, growth should continue.

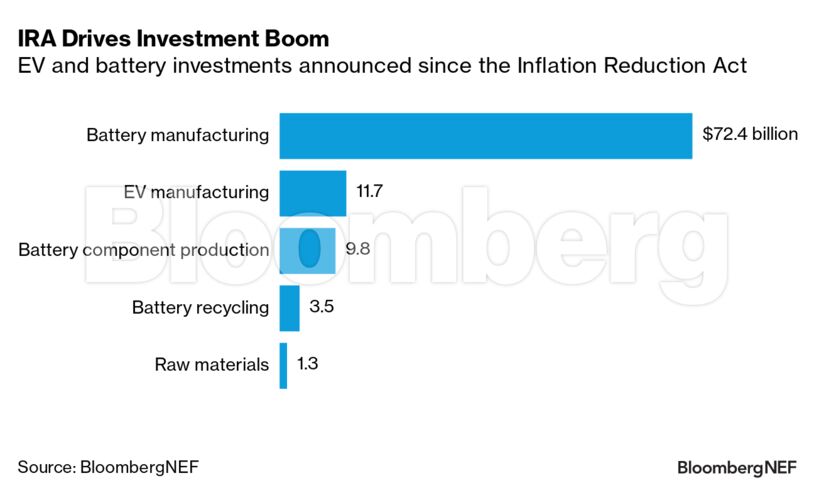

The Inflation Reduction Act supercharged investment

BNEF data shows that the IRA has helped spark $100 billion of newly announced investment in EV and battery manufacturing.

Construction is already underway for some of these projects, and BNEF expects the first IRA-related EV and battery manufacturing facilities to open fully in the second half of 2024, with more ramping up in 2025 and beyond. Canada and Mexico also benefit, given their integration in the US auto supply chain and access to critical minerals.

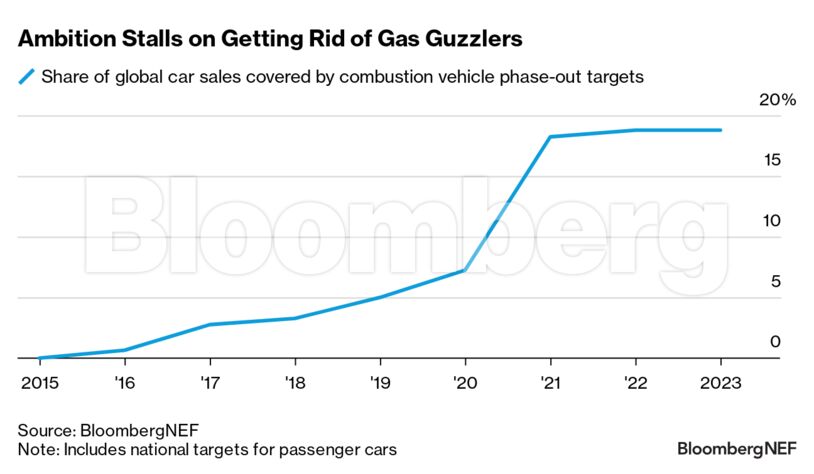

Phase-outs of combustion vehicles have stalled

From 2015 to 2021, the number of countries committing to ending sales of new combustion vehicles rose quickly. The biggest boost came in 2021, when the European Union announced its plan for a 2035 phase-out.

Progress has stagnated since then, with only a few minor additions to the list the last two years. Countries with phase-out targets in place now represent 19% of new passenger-vehicle sales.

Full phase-outs are not the only targets that matter. Indeed, both the US and China have partial targets in place for 2030, with China aiming for EVs to be 40% of sales and the US aiming for 50%. China could achieve its goal as early as next year, but the US meeting its objective will be more challenging. Setting targets is easier than delivering on them.

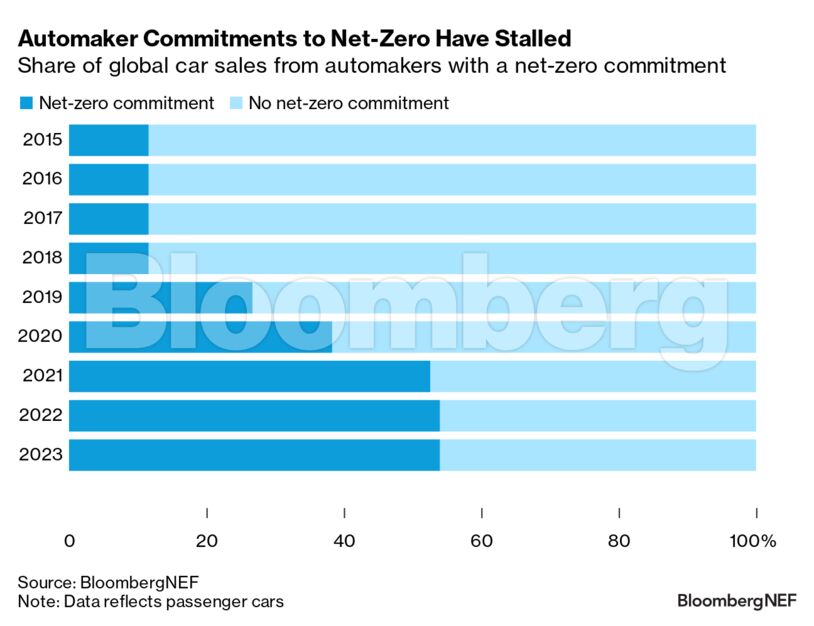

Automaker announcements also have stalled. A total of 18 carmakers of various sizes have announced net-zero commitments, targeting 2050 or sooner. These automakers represent 54% of the global passenger-vehicle market, but not all of them have clarified whether their targets will cover the vehicles they sell or just their own operations. The number of companies formally committing to ending sales of new combustion vehicles is smaller and covers 32% of global sales.

No new automakers announced net-zero or combustion-vehicle phase-out commitments in 2023, and some, including Ford and General Motors, moved their near-term EV targets back this year, citing lower-than-expected demand.

Electric vehicles remain one of the fastest-moving parts of the energy transition. There are plenty of reasons for optimism, but a stronger push from both policymakers and automakers will be needed to keep up the momentum in the years ahead.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS