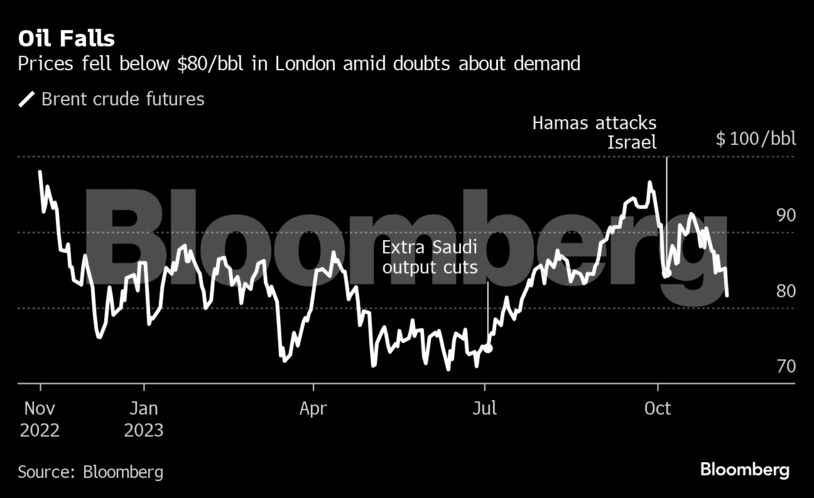

Just weeks ago, Brent crude was on the cusp of finally fulfilling industry forecasts of a return to $100 a barrel as record fuel demand and Saudi Arabia’s supply cuts depleted global oil inventories. The eruption of conflict in the Middle East shortly after heightened the risk of a price spike.

But on Wednesday the benchmark retreated to a three-month low under $80 a barrel. Concerns about supply are giving way to doubts about plunging refinery profits in China and Europe, lackluster physical cargo trading and an uncertain economic outlook for the US.

“The market seems to be shifting its focus from fear-driven geopolitics to hard-fact fundamentals,” said Norbert Ruecker, an analyst at Julius Baer & Co. Ltd. “Ample supplies, incremental production growth, and stagnating demand create an overall soft fundamental backdrop.”

It may spell relief for big consuming nations like the US, where gasoline prices near $4 a gallon have squeezed households and threatened to become a political liability for President Joe Biden. And it could offer respite for central banks such as the Federal Reserve, as it seeks to wrap up a spell of prolonged monetary tightening.

The situation is a sharp reversal from late September, when Brent rallied above $97 a barrel and the OPEC cartel projected an unprecedented decline in oil inventories amid record fuel demand and extra production cuts by Saudi Arabia.

The price surge appeared to finally vindicate industry predictions at the outset of the year that crude would return to triple digits. An attack by Hamas on Israel on Oct. 7, which threatened to draw Iran into a regional conflict and imperil shipments from the Persian Gulf, cemented the upside.

Yet as oil flows from the region have remained unaffected, attention has switched to hazards in the world’s top two oil consumers, namely a refining downturn in China and stubbornly high interest rates in the US.

Stronger Supply

Oil’s retreat is a particular setback for Saudi Arabia, which leads a coalition between the Organization of Petroleum Exporting Countries and other major crude producers including Russia. The kingdom has cut its output to the lowest in years in a bid to prop up prices, but saw its economy suffer the sharpest contraction in three years last quarter in part as it sacrifices sales volumes.

Now support from its key market ally, Russia, may be slipping. Moscow pledged last week to keep assisting Riyadh in curbing supply, but tanker-tracking data show that Russian exports have recovered to a four-month high of about 3.48 million barrels a day. President Vladimir Putin relies on petroleum revenues to finance his war against Ukraine.

Next year, oil supplies from the US, Brazil and Guyana are also projected to swell.

“Inventory draws have been less than expected, Russian shipments higher than expected and the war risk premium got too eager on the long side,” said Tor Svelland, founder of hedge fund Svelland Capital Ltd. “Demand has also been weaker due to interest rates and generally high prices.”

OPEC-watchers at Eurasia Group and UBS Group AG predict that, with oil demand set to remain under pressure, the Saudis will choose to extend their extra 1 million barrel-a-day output cutback into next year. The full OPEC+ alliance is due to meet to review policy on Nov. 26.

Refining Weakness

On the sidelines of an industry event in London this week, many traders said they were having to discount cargoes due to weaker demand from refineries, which face a slide in the profits for making fuels like gasoline and high shipping costs.

It’s not just an issue in China. “We’re also seeing weakness in Asian refining margins,” Alex Booth, head of fundamental analysis at energy trader Petroineos, said at the Argus European Crude Conference. “The region as a whole is struggling a little bit from this slight malaise.”

European consumption of diesel and naphtha — fuels that power trucks, trains, ships and construction — has plunged. Goldman Sachs Group Inc., which had led Wall Street’s calls for the return of $100 crude, said in a report last month that the acute inventory declines anticipated by the industry had yet to materialize.

Next year, US gasoline demand per capita will plunge to the lowest in two decades, just as production climbs to a record above 13 million barrels a day, according to the Energy Information Administration. The agency cited increased remote work, improvements in fuel efficiency, high gasoline prices, and persistently high inflation as reasons for the drop.

The deterioration in the balance between supply and demand is reflected in the so-called forward curve of Brent crude. The premium of near-term futures contracts over those for later delivery — known as backwardation and typically a reliable sign of supply scarcity — has diminished sharply in recent weeks, from $1.65 a barrel in early October for the front month to around 10 cents on Wednesday.

Contrary Signals

Still, forecasters such as Goldman Sachs, Standard Chartered Plc and Barclays Plc see scope for crude to pick up again as further increases in demand whittle away stockpiles. Saudi Energy Minister Prince Abdulaziz bin Salman said on Thursday that oil demand is healthy and speculators are to blame for the recent drop in prices.

“It’s not weak,” he told reporters in Riyadh. “People are pretending it’s weak. It’s all a ploy.”

While Brent fell toward $80 a barrel, US gasoline margins climbed. The fuel’s premium over crude has almost doubled since the middle of last month, indicating a growing incentive to produce the fuel that suggests end-user demand is yet to capitulate. Crude markets in the US are also being supported by ongoing purchases by the government to refill its Strategic Petroleum Reserve.

But if or when that price recovery will arrive is unclear. By some estimates, the outlook for early 2024 looks increasingly challenging.

The International Energy Agency sees global markets tipping back into surplus next year as demand growth suffers a dramatic 50% slowdown to less than 1 million barrels a day. Energy trader Gunvor group sees a more robust picture with daily consumption expanding by at least 1.6 million barrels. OPEC pegs the increase at 2.2 million barrels a day.

“The mood music has pivoted from pricing in geopolitics-induced supply-side risk premiums back to pricing in demand-side risk discounts,” said Ehsan Khoman, head of commodities research at MUFG. “Oil bulls are in distress.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein