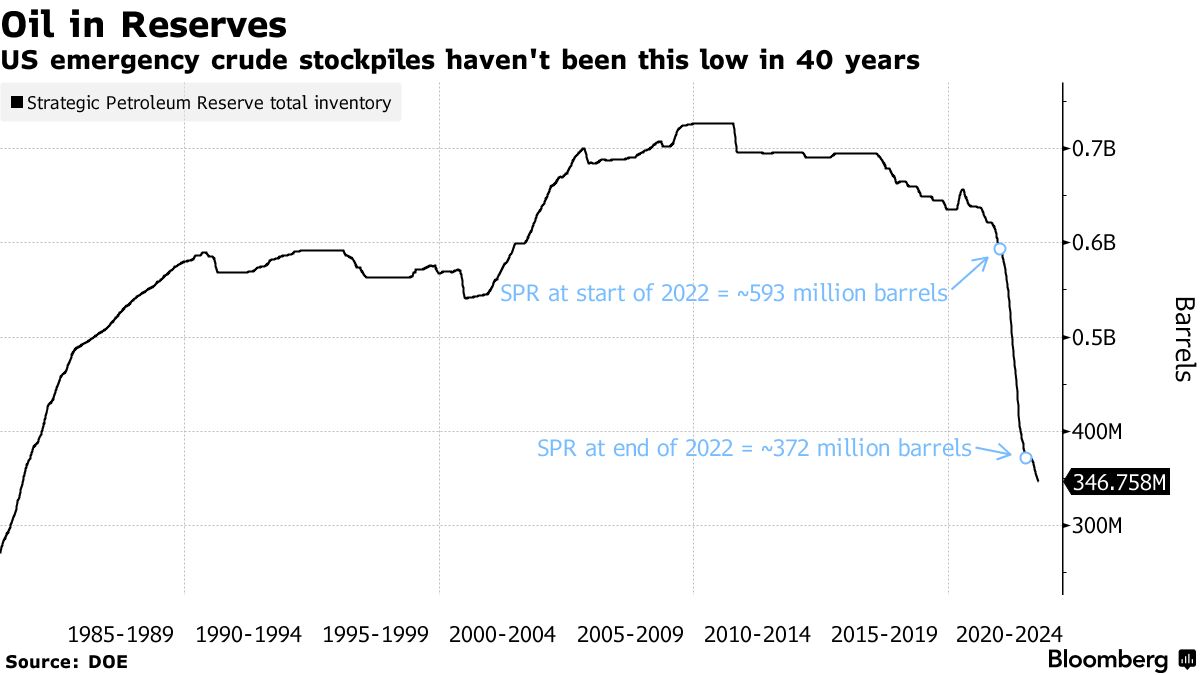

These reserve sites are supposed to hold enough backup supply to ensure the US never runs short of oil. Right now, they’re sitting half empty.

It only took about six months for the Biden administration to sell off 180 million barrels from the federal stash in the fastest withdrawal on record. But refilling it to capacity will likely take decades, if it happens at all. Experts say that a lack of funding and aging infrastructure will plague the process, even as the Energy Department has pledged to keep buying.

In the meantime, with the reserve at its lowest level in 40 years, the US could be vulnerable to oil price shocks. It also means that during domestic supply crunches, the nation will be left to the mercy of global exporters like Saudi Arabia, Russia and the rest of the OPEC+ cartel. The issue has also created yet another political firestorm, as Republicans have blasted the Biden Administration for its record drawdown.

Mandated yearly sales starting in 2017 meant that the reserves had already been seeing small, but steady, declines. Then came Russia’s invasion of Ukraine in early 2022, and with it, a surge in global oil prices that fed through into fuel inflation. To combat the spike, President Joe Biden undertook an unprecedented selling campaign — ordering 180 million barrels out of the Strategic Petroleum Reserve, nearly five times bigger than any previous sale. Gasoline prices soon began to peak, and are down more than 20% in the past year.

The Strategic Petroleum Reserve, known as the SPR, currently stands at 346.8 million barrels, the lowest level since 1983 and equal to about about 18 days worth of supplies. The total authorized storage capacity is 714 million.

Now that energy costs are back down comes the task of refilling the reserve. That will be a complicated, expensive process. Oil prices are now much higher than when most of the inventory was originally bought — the average price paid for oil in the reserve was $29.70 per barrel, which compares with the current benchmark cost for US crude futures at about $75.

And there’s the balance between needing to buy and not purchasing too much at once, lest the oil market gets spooked and prices jump higher.

“It would be a very slow process even if you had the money and the facilities were are all in good shape,” John Shages, who previously oversaw the oil cache for the Energy Department, said in an interview. “It could take decades.”

Oil Embargo

The emergency cache was first set up in the 1970s after the Arab oil embargo that created a global energy supply shock and a shortage of gasoline in the US. Americans would line up for hours to fill their tanks — some stations even became by appointment only.

While the US itself has since become the world’s biggest crude producer thanks to prolific shale fields in the Permian basin, the country is still also an importer. That means the SPR still serves an important function, like a kind of doomsday insurance against catastrophes and geopolitical turbulence that can disrupt the flow of shipments. In 2005, for example, when Hurricane Katrina knocked out Gulf production, reserve sales helped to bolster domestic supplies.

Energy Secretary Jennifer Granholm recently reiterated a pledge to refill the stockpiles. But the department has also conceded that a complete refill is unlikely anytime soon.

Political Battle

Republicans from both chambers of Congress have dismissed the Biden administration’s oil releases as a ploy to bring down gasoline prices before the midterm elections last year in November. They have accused the administration of having no credible plan to refill the reserve.

“DOE’s mismanagement of the SPR has undermined America’s energy security, leaving the nation more vulnerable to energy supply disruptions, and increasing the ability for OPEC and Russia to use energy as a geopolitical weapon,” top House and Senate Republicans wrote in a May letter to the Government Accountability Office, asking the federal watchdog for an audit of the reserve.

Tight Budget

So far, the pace of the refill stands to be a trickle.

The DOE plans to replace at least the barrels sold last year and counts the cancellation of previously-mandated sales towards its goal to replenish the reserves, the agency said previously in an email to Bloomberg. This leaves at least 40 million barrels left to purchase, of which the agency has already committed to purchasing 12 million barrels for deliveries later this year.

But returning the SPR to its 2009 peak would mean purchases of more than 300 million barrels.

Congress stripped away some $12.5 billion from the Energy Department earmarked for reserve oil purchases last year when it cancelled 140 million barrels worth of sales that had been previously mandated.

Now the department is left with with roughly $4.3 billion to purchase oil — enough for roughly 61 million barrels at prices of around $70 a barrel, said Kevin Book, managing director of Washington-based consulting firm Clearview Energy Partners. With Congress hyper-focused on reducing deficits and the budget, it’s unlikely more funding will be provided anytime soon, he added.

The DOE didn’t address Bloomberg’s queries about budgetary constraints to refilling the reserve.

Aging Facilities

The Gulf Coast salt caverns that comprise the 70s-era reserve were built with a 25-year life span in mind. They were designed for just five drawdowns and refills, said William “Hoot” Gibson, the reserve’s former project manager. The more the system is used, the higher the risk the salt caverns will dissolve.

Two of the reserve’s sites in Texas and Louisiana are currently offline for maintenance. A $1.4 billion modernization program, funded through oil sales, is behind schedule and over budget — with the Biden administration asking Congress for an additional $500 million for the project last year.

“There are infrastructural challenges at the reserve simply because of how it is designed and how it has been used over the past decade,” said Tristan Abbey, who received routine briefings on the state of the reserve while serving as a director on the National Security Council during the Trump administration. “The caverns are made out of salt, and they are not really intended for a daily ATM-type operations.”

The Energy Department said it doesn’t have concerns about the quality and integrity of the caverns.

While there has been a lot of discussion about refilling the reserve, little consensus exists on what the right level to fill it to is, said Benjamin Salisbury, director of research at Height Capital Markets. That means the reserve may never reach the pre-war level, he said.

“Do we really want to spend $7 billion or $8 billion to refill the SPR if we are still perfectly capable of producing our own oil?” Salisbury said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire