Exxon will extract the metal from underground saltwater reservoirs in the Smackover Formation in southern Arkansas, employing a novel method called Direct Lithium Extraction not currently deployed at scale. Exxon aims to produce its first lithium by 2027 and ramp up output to the equivalent of 1 million electric vehicles annually by 2030.

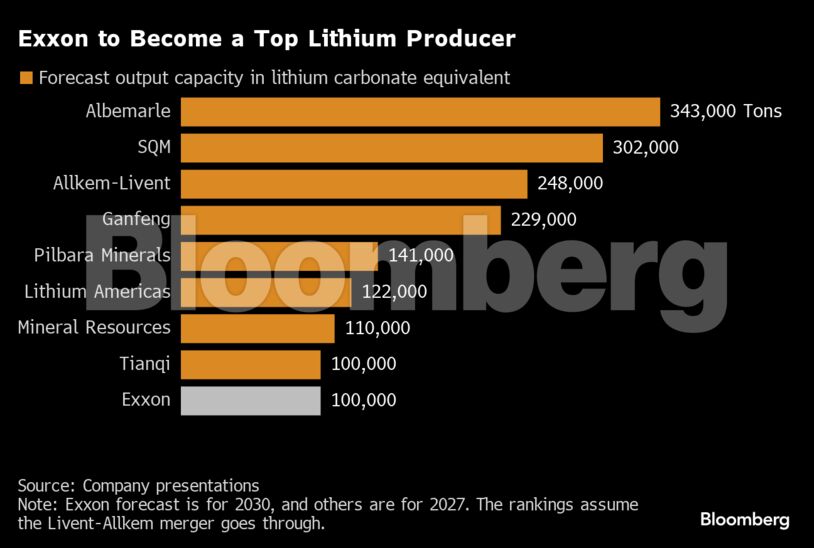

That level of production would amount to about 100,000 tons a year, Dan Ammann, president of Exxon’s Low Carbon Solutions business, said during an interview Monday. It would also make Exxon one of the top ten producers globally.

“We’re producing lithium here domestically instead of importing it from China and elsewhere,” Ammann said. “We’re going to do that with a much smaller environmental footprint and we’re going to build a profitable and high-growth business.”

Although lithium is not geologically scarce like other battery metals such as cobalt and nickel, mining high-grade quantities at scale is a major challenge.

Exxon believes DLE has several advantages over the hard-rock mining techniques and brine ponds currently in use, including smaller surface-land use. Ammann also sees similarities between DLE and pumping oil, making the company “quite confident in the production approach.”

DLE’s success could be a game-changer for worldwide lithium production. It would unlock vast resources of the silvery-white metal in North America, reducing the need for imports. It may also prove cheaper and greener than traditional production in South America, home to roughly half the world’s reserves.

Ammann also said the company will evaluate expanding lithium production globally as the market develops.

Exxon scientists led by Dr. Stanley Whittingham invented the lithium-ion battery in the 1970s, paving the way for a rechargeable energy source now commonly used in everything from laptops to large-scale power storage. At that time, Exxon also had extensive investments in uranium mining and nuclear technology as part of an initiative to branch out beyond fossil fuels.

Exxon didn’t provide specific capital-expenditure forecasts. The first lithium module would cost in the “hundreds of millions” of dollars and spending would likely reach “billions” by 2030, Ammann said.

The project would help Exxon win a large share of a market it expects to quadruple by 2030 and help mitigate losses from the expected reduction in gasoline and diesel demand over the coming decades. The oil giant has held talks with Tesla Inc., Ford Motor Co., Volkswagen AG and other automakers this year as it seeks to build a business around the metal, Bloomberg News reported in July, citing people familiar with the matter.

Talks with customers are “extremely positive,” Ammann said, without confirming the identities of prospective counterparties. “People are excited to see a company of the scale and capability of Exxon Mobil come into this space which is currently comprised mostly of small- to medium-sized companies.”

Spot lithium prices have tumbled this year due to a slowdown in China and concern over the affordability of EVs in the US and Europe. Still, the long-term picture looks healthy. BloombergNEF expects global demand for lithium to grow almost five times by the end of the decade.

Occidental Petroleum Corp. and SLB, the world’s biggest oil-services provider, also have said they’re exploring brine-based lithium production.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS