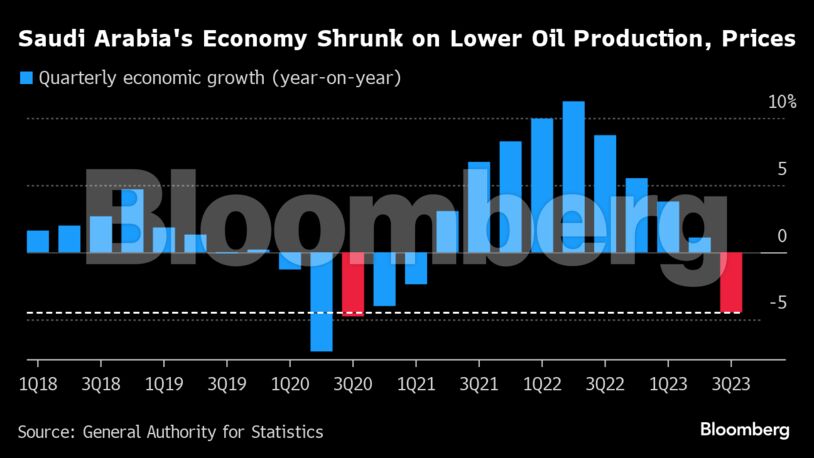

Gross domestic product shrunk 4.5% in the third quarter compared to a year earlier, driven by a 17% drop in the oil economy, according to preliminary data by the General Authority of Statistics. Growth in the non-oil economy also slowed.

That’s the biggest contraction in three years, when the coronavirus pandemic was wreaking havoc across global economies, and the first output drop since the start of 2021.

The world’s biggest crude exporter enacted a unilateral oil production cut in July, putting its output at 9 million barrels a day. The kingdom’s now producing almost 1 million barrels a day below its average for the past decade, and seems likely to remain at current output levels until at least the end of this year.

Economic growth in the kingdom reached nearly 9% last year, the fastest among the Group of 20 nations, driven by record crude output and Russia’s war on Ukraine roiling energy markets. That helped Saudi Arabia’s GDP surpass $1 trillion for the first time.

Brent traded close to $88 per barrel as of 7:40 a.m. in London, down from last year’s average of $100 a barrel.

“The contraction in the oil sector is likely going to be the sharpest in the third quarter,” according to Monica Malik, chief economist at Abu Dhabi Commercial Bank PJSC, who expects the Saudi economy to shrink by 0.8% this year.

“We expect a narrower contraction in the oil sector in the fourth quarter in yearly terms with production remaining broadly steady,” she said.

The World Bank is estimating the Saudi economy will shrink by nearly 1% in 2023. By contrast, the International Monetary Fund still expects modest growth at 0.8% as a result of robust performance in the non-oil sector.

Non-oil growth, the main driver of employment and in which Crown Prince Mohammed bin Salman is investing trillions of dollars to diversify the economy, grew 3.6%, according to the preliminary data.

On a quarterly basis, non-oil growth rose 0.1%, the softest pace of acceleration since the end of 2020. Overall GDP dropped around 4% quarter-on-quarter.

What Bloomberg Economics Says…

“The slowdown in non-oil activities was unexpected given that oil prices were high, averaging $86 per barrel during the quarter. This should have provided the government with plenty of windfall to spend on the domestic economy.”

— Ziad Daoud, chief emerging-markets economist.

“The non-oil data points to a softening in momentum,” said ADCB’s Malik, “though the high government spending backdrop is visible in the third-quarter data and will be supportive.”

Weaning the Saudi economy off a reliance on oil sales is a key part of Prince Mohammed’s Vision 2030 plan, which was launched in 2016. The government said it was likely to record deficits until 2026 as it accelerates spending on projects intended to foster new industries like tourism and manufacturing. Still, oil and closely-related products such as chemicals and plastics accounted for around 90% of exports last year, according to Bloomberg Economics.

Finance Minister Mohammed Al-Jadaan said, during the kingdom’s flagship financial conference last week, that he is mainly concerned with boosting non-oil growth. He added that he expects growth in the sector to average 6% by the end of this year.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS