But with the start of the Biden presidency and the appointment of a new director, the LPO has taken off. The passage last year of the landmark Inflation Reduction Act supercharged it, authorizing it to lend up to $400 billion. It’s recently made conditional loans for lithium production, a virtual power plant and EV battery factories.

Every month since late 2021, the office has published what it calls the Monthly Application Activity Report . This details how many dollars of total loan authorization the office has made, using its congressionally authorized funding provisions.

The numbers, of late, are substantial. And they shed light on how investors approach the promise of government money, and how even the most dynamic of programs work on a curve.

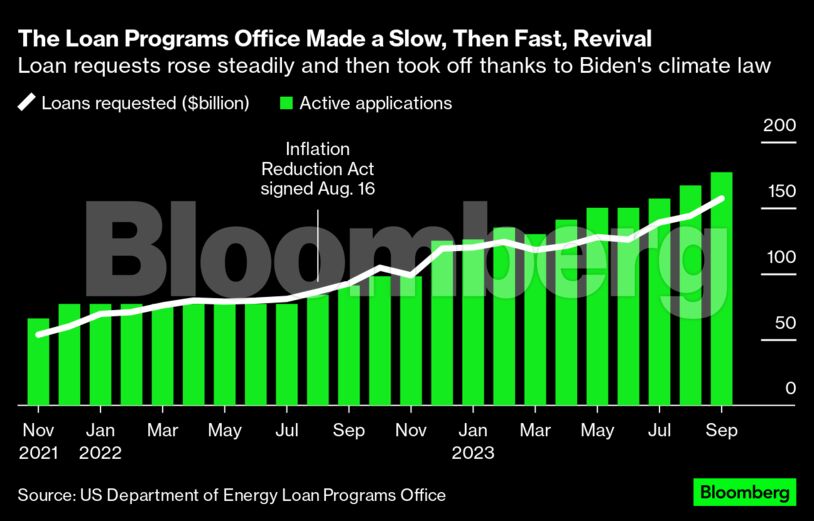

At the time that it began publishing the monthly reports, the LPO had 66 active applications, totaling $53 billion of loans requested. The number of applications bumped up to 77 in December 2021 and stayed there until July 2022. Not coincidentally, the next month saw the passage of the IRA and with it, a surge of interest in large energy infrastructure projects in the US.

Active applications rose by half between August and January 2023, and then again roughly by half between January and September of this year. Total loans requested, from the start of LPO’s public records until September of this year, nearly tripled.

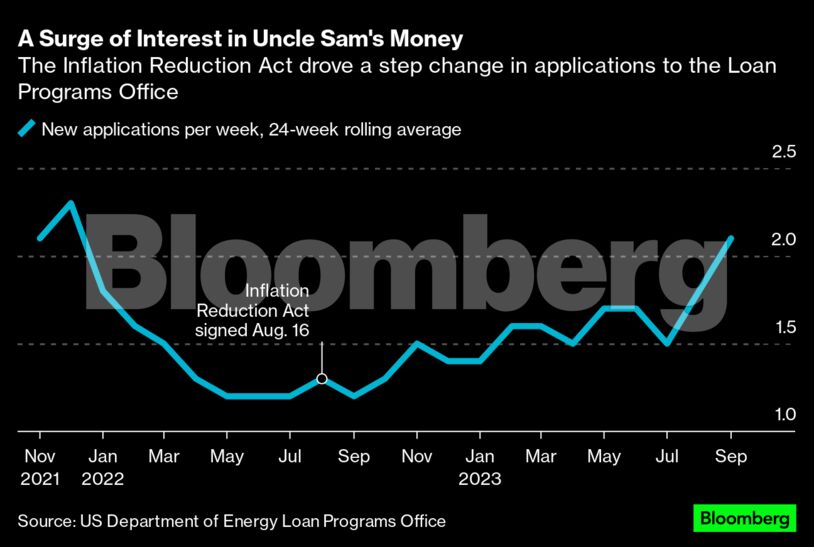

The number of weekly applications (on a rolling 24-week basis) fell from the start of the Biden administration all the way until (again) the IRA. In September 2022, the office received 1.2 applications a week. Last month, that number had risen to 2.1 per week.

Finally, in a shorter data series (beginning only this year), the DOE shows that there are now 216 proposed project locations nationwide, up from 152 at the start of the year.

Cold calls, black starts

There are lessons here for complex governmental processes that aim to move quickly. The first is, simply, that even moving quickly takes time at first. It takes time to establish priorities and to express those as institutional processes. It also takes time to socialize a new opportunity with the parties that will most benefit from it.

The second lesson is that once a system is designed for scale, it still requires impetus to get moving. Government rulemaking and notices are not enough. When the LPO’s director Jigar Shah — a past guest on the Zero and Odd Lots podcasts — took office, he began actively seeking out new applications. The process for that? Cold-calling executives to make them aware of the program and get them interested.

In the startup world, this effort would be called overcoming a “cold start problem.” It is a way to generate interest in something that does not yet benefit from a network effect of people recommending it to peers and therefore creating an expanding basis for growth. Even something as important and consequential as the Loan Programs Office may be a hard sell if no one is yet doing it. Working past that cold start requires an effort to create interest if not quite out of nothing, then out of very little.

There is another analogy here that applies as well, and appropriately enough it comes from the world of power plants: a black start.

What a black start requires is energy — enough electricity, in the case of a power plant, discharged from a battery to initiate a diesel generator, and enough diesel generation to start a larger power plant that can then power itself, and others.

If the LPO director’s cold calls worked to get past the cold start problem, then it was the Inflation Reduction Act that provided the additional energy to build a bigger network. That energy took the form of new capital, but it also took the form of new attention, and a new sense of urgency and opportunity. Fortunately for climate investment, that energy was there.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS