She made no mention of oil flows, the most obvious way of hurting Iran, and it’s easy to see why. Anything that materially cuts the flow of resurgent Iranian oil exports would only heighten demand for barrels from rivals such as Russia — where the Treasury is starting to ratchet up enforcement of existing measures. It would also tighten the global market.

“A barrel is a barrel,” Mark Finley, a fellow in energy and global oil at Rice University’s Baker Institute for Public Policy, said in an interview. “All other things being equal, if you take a barrel out through policy actions, through trying to tighten these sanctions, you need another barrel to come from somewhere else in order to avoid a spike in prices.”

Between them, the two nations a pumped about 13% of global oil supply in recent months, and Iran has gone a long way to replacing lost output from OPEC+ countries — including both Russia and Saudi Arabia — who’re withholding supply to boost oil prices.

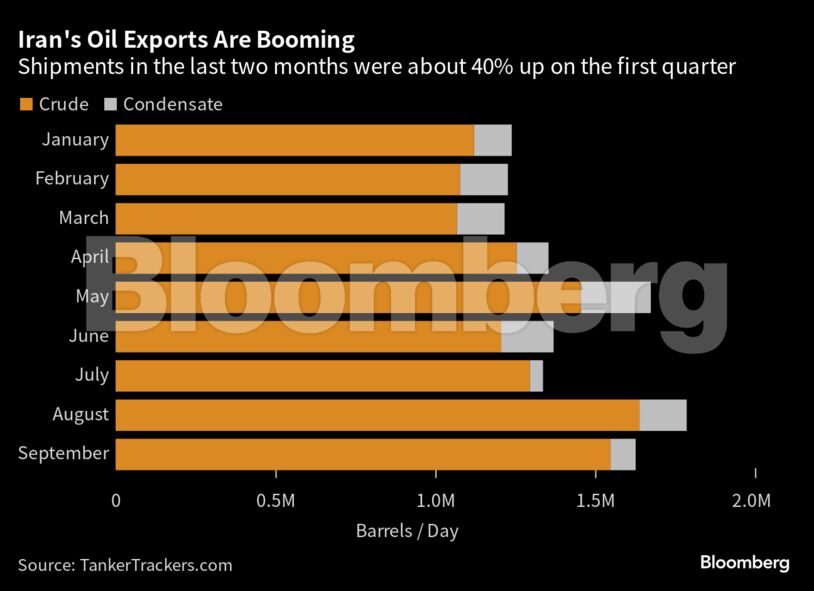

Iran’s exports have been booming. In August and September, they were about 40% higher than during the first quarter of the year, according to data from TankerTrackers.com.

US officials privately acknowledged back in August that they had gradually relaxed some enforcement of existing sanctions on Iranian oil sales as part of a wider efforts at a diplomatic rapprochement. Speaking to reporters at the annual meetings for the International Monetary Fund and World Bank this week, Yellen rejected the idea that a softer line has been taken.

Either way, the reality is that Iran’s flows are soaring and have been the second-largest source of extra supply to the global seaborne market this year, behind only the US itself, meaning cutting them would be risky for oil prices.

Goldman Sachs Group Inc. analysts including Callum Bruce and Daan Struyven said that a scenario where Iran’s oil exports fall due to increased Western scrutiny could reduce flows to year-ago levels and see Brent prices rise beyond $100 a barrel next year.

Iran’s representation to the United Nations has rejected claims that Iran was involved in Hamas attacks on Israel.

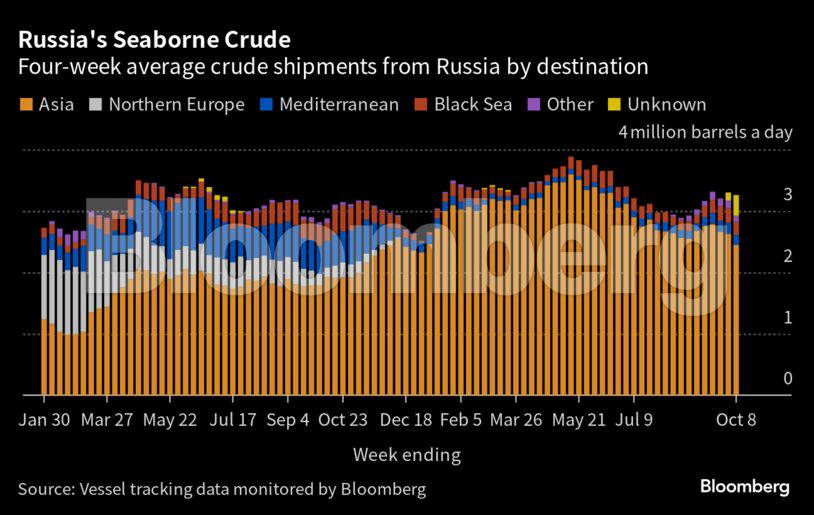

As for Russia, a Group of Seven price cap was designed to keep barrels moving in the face of planned European Union sanctions that would have barred carriage on EU ships, or the provision of services by companies in the bloc. UK sanctions mirrored those of the EU.

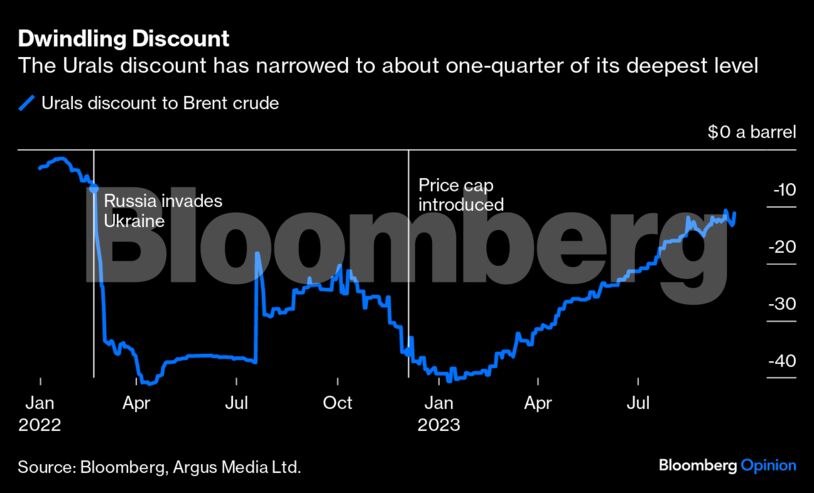

In recent times, it has appeared as though the cap was being flouted extensively. Even the discounts at which Russian barrels traded shrank relative to international benchmarks, suggesting Moscow was working around the restriction.

The nation’s crude and fuel prices surged well above the Western-imposed thresholds, often still with the help of western service providers.

On Thursday, the Treasury Department reacted by imposing the first sanctions for violations of the price cap. While they appear designed to have minimal immediate impact, they nonetheless spooked some shippers, mindful they themselves could be next.

The so-called shadow fleet of mostly aging tankers that’s been amassed to carry Russian oil outside of the price cap may still not be big enough to handle the whole trade, so the US needs to tread carefully if it wants to keep western service providers involved.

Almost a third of the fleet moving Russian barrels is using some form of western service — be it European owned ships or insurance routed through London.

In short, hitting Iran and Russia simultaneously in the oil market won’t be easy without risking higher fuel prices.

With Saudi Arabia and Russia reaffirming their close cooperation in the oil market with a public show of unity at a major industry event in Moscow on Thursday, the US can’t count on Riyadh filling any void with tens of millions of extra barrels either.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran