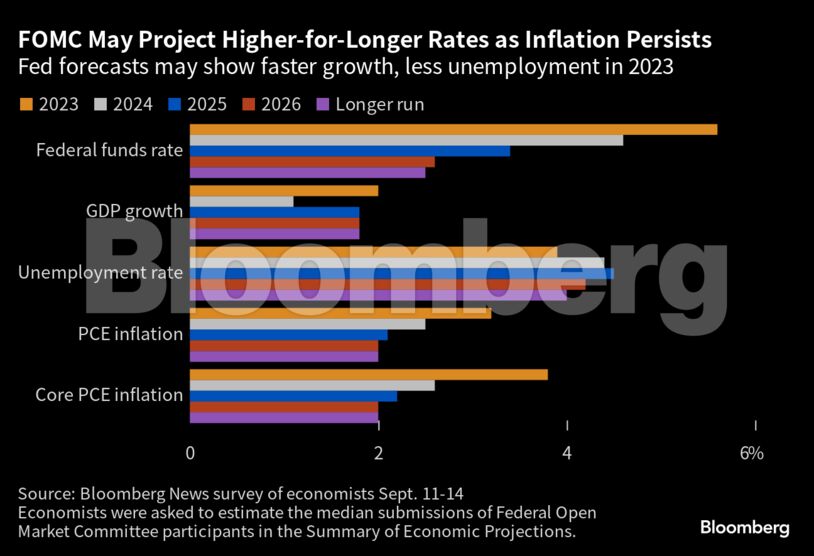

Policymakers are likely to forecast one additional rate hike this year in the so-called dot plot contained in their quarterly Summary of Economic Projections, as they upgrade their view of the US economic outlook. However, the surveyed economists think the Fed won’t go ahead with a final increase.

Fed Chair Jerome Powell and his colleagues have signaled plans to pause hikes this month as they slow the tightening campaign and approach a peak in rates. Powell said last month at the Kansas City Fed’s conference in Jackson Hole, Wyoming, that the rate of inflation remained too high and central bankers were prepared to tighten more if necessary.

A robust economy is shaping the September meeting discussion. The median committee member is likely to see economic growth this year at 2%, double the 1% forecast in June and compared with 0.4% seen in March. In addition, they are likely to forecast a hotter labor market, with the unemployment rate, now 3.8%, edging 0.1 point higher to 3.9%, or lower than the 4.1% rate seen in June and 4.5% in March.

“The most interesting element could be views on future rate hikes,” Joel Naroff, president of Naroff Economics LLC, said in a survey response. “What we don’t have any idea about is what fed funds level is considered to be too high.”

The forecasts are expected to include the committee’s first look at 2026, when the median policymaker is likely to see rates at 2.6% by the end of that year, slightly above the long-term rate, which is estimated at 2.5%.

In its forecasts, the committee is likely to continue to see the inflation rate as being elevated, with a year-end projection of 3.2%. The outlook for underlying core inflation, excluding food and energy, is slightly improved at 3.8%. The economists expect the policymakers to forecast reaching their 2% inflation goal in 2026.

The survey of 46 economists was conducted September 11-14.

What Bloomberg Economics Says…

“Bloomberg Economics expects the FOMC to hold rates at 5.5% at the Sept. 19-20 meeting, something that Fed officials – even the most hawkish ones – telegraphed well ahead of time. More consequential will be what clues the FOMC offers on the future rate path. Positive economic surprises during the inter-meeting period will likely lead officials to sharply revise up their GDP growth forecasts, while marking down core inflation.”

— Anna Wong, chief US economist

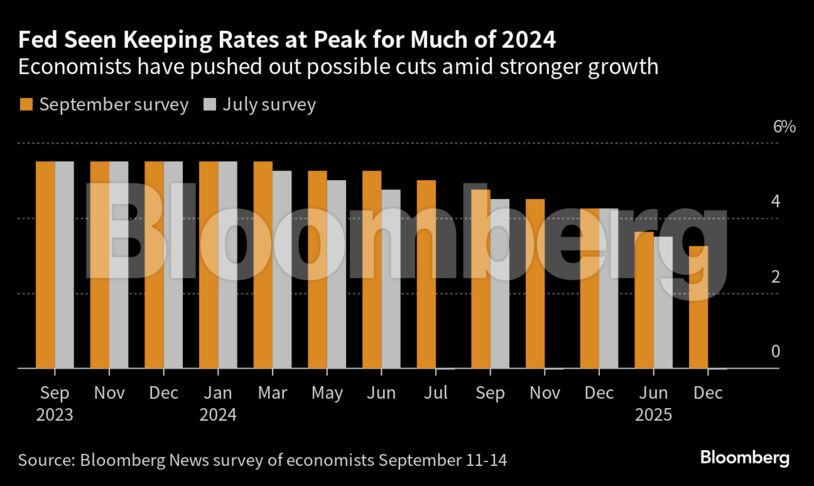

Economic data have largely surprised to the upside in recent months, meaning central bankers will need to keep rates higher for longer in order to reduce price pressures as they seek to return inflation to their 2% target. But most don’t expect the need for another hike.

“The Fed is and should take some comfort in the overall deceleration in inflation and wage growth,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co. “However, with both still running still too high for full comfort, the guidance from the Fed and Chairman Powell will risk erring on the hawkish side.”

The FOMC raised its benchmark rate in July to a range of 5.25% to 5.5%, a 22-year high. While the committee is seen penciling in one more hike in its forecasts, the economists are split on whether that will occur, with about a quarter seeing more tightening.

“Core inflation remains overly high and the economy is doing better than many analysts anticipated,” said Dennis Shen, senior director of Scope Ratings. “The risk for the Federal Reserve is of doing too little, rather than of doing too much.”

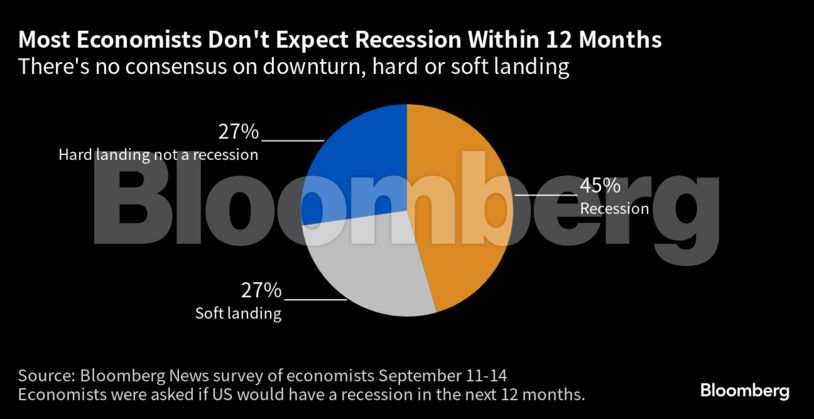

The economists have become gradually more optimistic about the outlook for the US economy, with 45% forecasting a recession in the next 12 months, compared with 58% in July and 67% in April. Fed officials have shared in the soft-landing optimism, with the Fed staff switching from a recession forecast earlier in the year to a continued expansion.

Almost all the economists expect the guidance in the statement to be maintained, with the committee hinting at the possibility of more tightening.

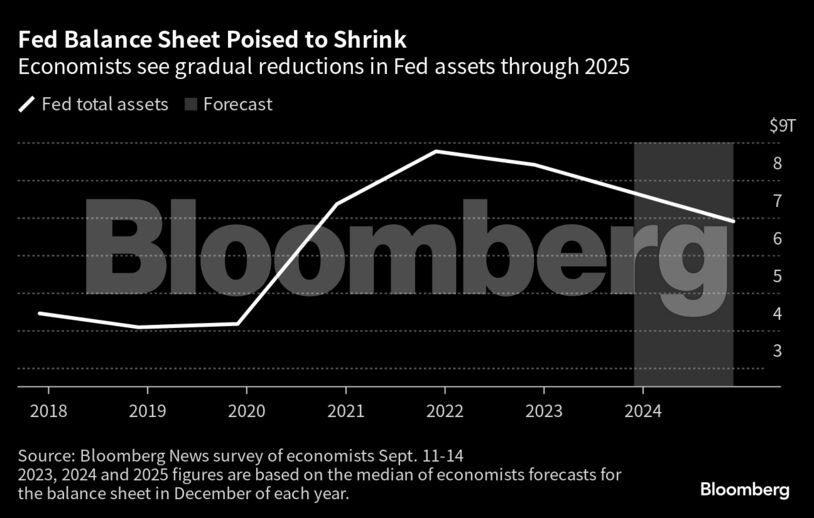

The FOMC will continue to shrink the balance sheet through not replacing maturing bonds, and the economists expect this to continue even after the start of rate cuts. The median economist expects the balance sheet to drop to $7.8 trillion by December and $6.8 trillion by 2025.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran