Global equity funds had outflows of $16.9 billion in the week through Sept. 20, according to a note from the bank citing EPFR Global data. US stock funds led the exodus, while in Europe, redemptions reached 28 weeks.

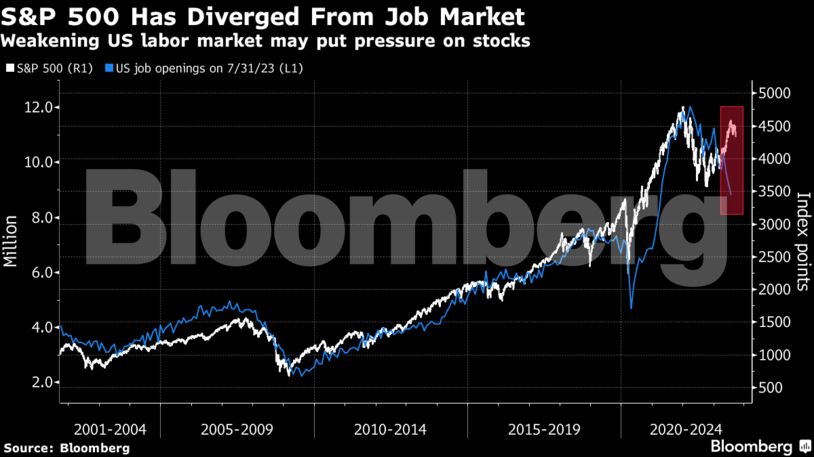

The team led by Michael Hartnett said persistently high interest rates could lead to a hard economic landing in 2024, and result in “pops and busts” in financial markets. The “tells” are already appearing, Hartnett wrote in the note dated Sept. 21 — including a steepening yield curve, a rise in both the unemployment rate and personal savings, and higher defaults and delinquencies.

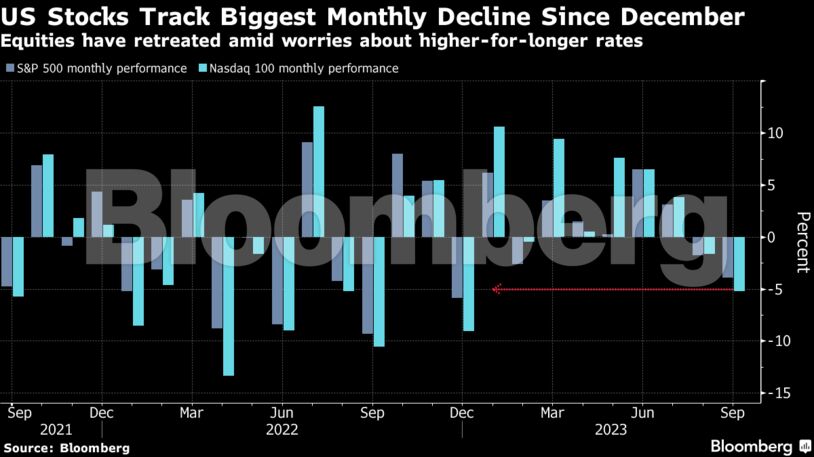

The strategist has remained bearish even with the S&P 500 up about 13% this year to 4,330. The rally has tempered since late July, with risk demand taking a bigger hit this week as the Federal Reserve signaled it could keep interest rates higher for longer. The S&P 500 and the technology-heavy Nasdaq 100 are both heading for their biggest monthly decline since December.

Other market strategists including JPMorgan Chase & Co.’s Marko Kolanovic have also warned about the risks to the US equity rally from higher real rates and the restrictive cost of capital. Morgan Stanley’s Michael Wilson said this week that clients perceive a tougher outlook for stocks in 2024.

BofA’s Hartnett said an important sign for the trajectory of stocks will be the reaction in this year’s market leaders once bond yields drop. If lower yields spark another rally in US homebuilders and chipmakers, it’s “Bull5000,” but if they can’t generate gains, “it’s sell the last rate hike and back to ‘Bear4000,’” the strategist said.

Other highlights from the note:

- Global bond funds have a 26th straight week of inflows at $2.5 billion, while $4.3 billion leaves cash funds

- Tech leads sector inflows, while energy sees the largest addition since March

- Financials and health care have the biggest outflows

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein