Chief Executive Officer Chris Kendall will receive the final portion of equity awards valued in total at $68.7 million by year end, according to this year’s proxy statement. His three top lieutenants will also split the remainder of their $52.8 million package, just as the company looks to close a $4.9 billion takeover by Exxon Mobil Corp. Kendall’s total is just shy of the value of stock awards Exxon CEO Darren Woods received over the past three years for running a company 100 times Denbury’s size.

Denbury’s payouts, which are tied to share performance and staying with the company, are due to the executives in December regardless of any takeover, though a sale would expedite the process. The coincidental deal with Exxon — whose offer was only marginally higher than Denbury’s stock price — highlights the lucrative compensation plan and how awards granted during a company’s darkest days can swell to extraordinary levels if its fortunes turn.

“It’s not a bad payday for a company that came out of bankruptcy two-and-a-half years ago,” said Timm Schneider, an analyst at Schneider Capital Group. “It becomes interesting from a shareholder perspective because they’re doing this deal at no premium. The optics don’t look great.”

Denbury shareholders must still approve Exxon’s all-stock takeover, which won unanimous backing of the company’s board. Exxon’s $89.45-a-share offer was just 2% higher than Denbury’s share price when announced July 13 and the deal was almost 20% less than the average target price among analysts at the time, according to data compiled by Bloomberg.

Emergence Equity

Most of Denbury’s incentive package stems from so-called post-emergence grants given to executives following its exit from Chapter 11 proceedings in 2020. This type of equity award is commonly given to executives of bankrupt companies to entice them to stick with the business through a reorganization and to make up for the fact that their pre-existing equity was probably wiped out — as was the case for Denbury’s executives.

“The vast majority of Denbury’s executive compensation results from the 2020 emergence grants, which are nearly completely vested and were scheduled to be delivered in December 2023, regardless of the company’s pending merger,” a company spokesperson said by email.

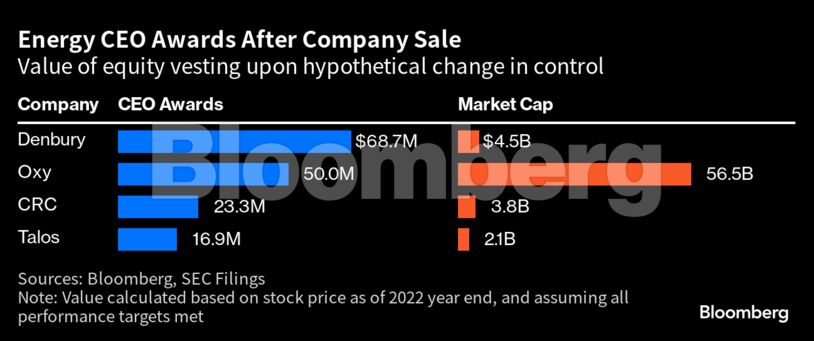

Like most public companies, Denbury’s compensation plan included an accelerated payout schedule if the company gets sold — which would get triggered if the Exxon deal closes as planned in the fourth quarter. Kendall’s equity package is more than double what the CEOs of California Resources Corp. and Talos Energy Inc. would stand to receive in the event of a sale and higher than that of Occidental Petroleum Corp., a company twelve times Denbury’s market value. California Resources also declared bankruptcy in 2020.

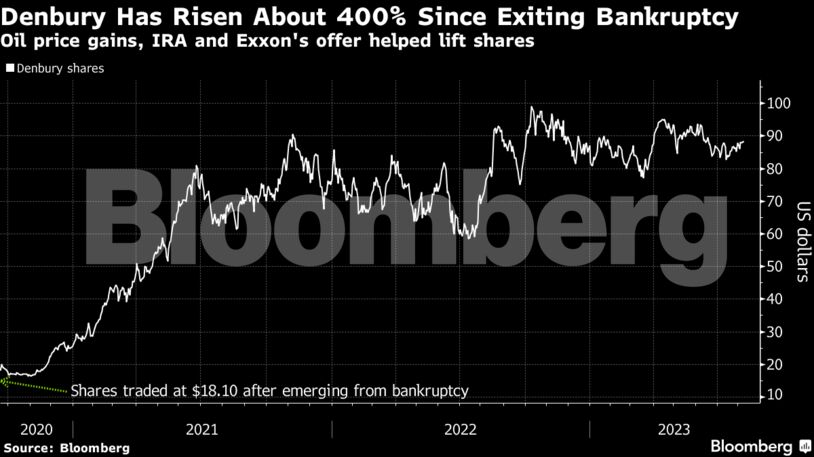

Denbury’s payout stands out in part because its stock has seen a fivefold increase since the company emerged from bankruptcy, more than its peers.

Bankruptcy

Denbury was one of many US oil and gas producers to fall into bankruptcy when Covid-19 struck, causing energy prices to plunge. Its specialization in enhanced oil recovery, a high-cost method of producing crude by pumping carbon dioxide into old wells, left it unable to pay debts, prompting the company to file for Chapter 11.

Kendall, who became CEO in 2017, led Denbury through bankruptcy and remained in charge when the company re-listed in September 2020. On Dec. 4 that year, the board granted him and key executives equity awards, according to a 2021 filing. Half the shares would vest in equal increments over three years while the rest would pay out in full if the stock topped a series of price hurdles, with the highest being $25.75 a share.

Denbury’s stock easily surpassed these thresholds, averaging $27.50 in the first two months following the award and more than doubling within six months as oil prices rebounded, ensuring the executives would be entitled to the full award if they stayed with the company.

“It is uncommon to see performance targets so obviously unchallenging,” said Maria Vu, a senior director of North American compensation research at proxy advisor Glass Lewis & Co. She described Denbury’s price targets as “unusually lacking” in rigor.

Denbury said in a filing at the time the awards were granted that the hurdles “were rigorous and would represent significant value creation for stockholders,” with the full package representing a 42% increase from the 30-day average on the grant date.

Denbury also benefited from 2022’s Inflation Reduction Act that included generous tax rebates for carbon capture and storage, a key climate solution favored by Big Oil, and especially Exxon. The firm owns the largest network of carbon dioxide pipelines in the US, largely situated near refineries and chemical plants on the Gulf Coast — the most concentrated source of emissions in the US. Denbury could easily repurpose the pipes for carbon capture.

Exxon Offer

Denbury’s stock rose with oil prices through 2022, and shortly after the IRA passed in August, Bloomberg reported that the company began working with advisers on a potential sale. Its shares jumped more than 12% on the news. On Oct. 10, Exxon was reported to have expressed preliminary interest in buying the company, causing another share spike for Denbury.

When announcing a deal with Exxon last month, Kendall said the board “considered a number of alternatives to maximize long-term value.” Denbury chose Exxon because of its ability to grow the carbon dioxide business and prospects for the oil giant’s stock, which pays the S&P 500’s third-largest dividend, he said.

Tim Rezvan, a KeyBank Capital Markets analyst, praised Kendall as a CEO of high integrity, but acknowledged that investors are unhappy that Exxon’s offer didn’t have much of a premium.

“Shareholders we spoke to were uniformly disappointed,” Rezvan said. “Disappointment all the way to cursing to me on the phone because they were upset.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS