Pioneer was the standout performer this week, with the stock rising Wednesday despite a decline in oil prices after saying its higher production this year would be achieved with lower capital spending.

The improvements in recent months came after an overall decline in productivity last year, the first major reversal in a decade as US drillers have tapped many of their best sites. Pioneer and Chevron Corp. both changed their drilling plans to improve substandard performance while private companies have pulled back, meaning a smaller portion of overall wells are now being drilled by less efficient producers.

Pioneer President Rich Dealy was among executives who touted technical advances that allow producers to extract more oil by drilling wells sideways at greater lengths — improvements upon the techniques that revolutionized the American energy industry more than a decade ago. Others warned of higher risks, as errors can be costly 15,000 feet underground.

Chevron, the Permian’s biggest producer, credited improving well performance for record volumes in the second quarter. The company redrew its drilling plans earlier this year, and they appear to be paying off: two-mile-long wells drilled on the Texas side of the basin in the first half of the year yielded more oil than similar ones drilled in all of 2022, Chevron said July 28.

Chevron expects to grow Permian output by 10% this year, more than twice the target of most independent rivals and on track to reach 1 million barrels a day in the next few years. Meanwhile, Occidental Petroleum Corp. raised its full-year output guidance by 1.3% after producing 11% more oil from wells in the Delaware part of the Permian so far this year.

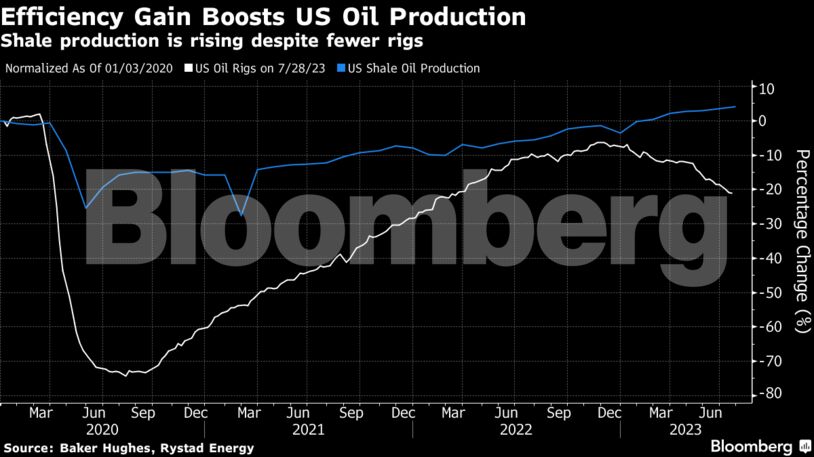

Rising efficiency has enabled shale production to accelerate even as the number of rigs drilling for oil has fallen by 15% so far this year, and oilfield contractors expect more cutbacks in the third quarter.

“We see these declines as more of a function of customer budget and production discipline, rather than a response to short-term commodity price movements, which is a prime example of the behavioral change in the industry,” John Lindsay, chief executive officer for Helmerich & Payne Inc., the biggest shale-drilling contractor, told analysts and investors last month.

Producers say they are starting to see discounts for oilfield pipes and drilling rigs, and expect fracking costs to eventually fall.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire