Bloomberg News and the Hyperdrive newsletter have covered the report’s key findings. Here are four additional takeaways:

1. EV sales are up, everywhere

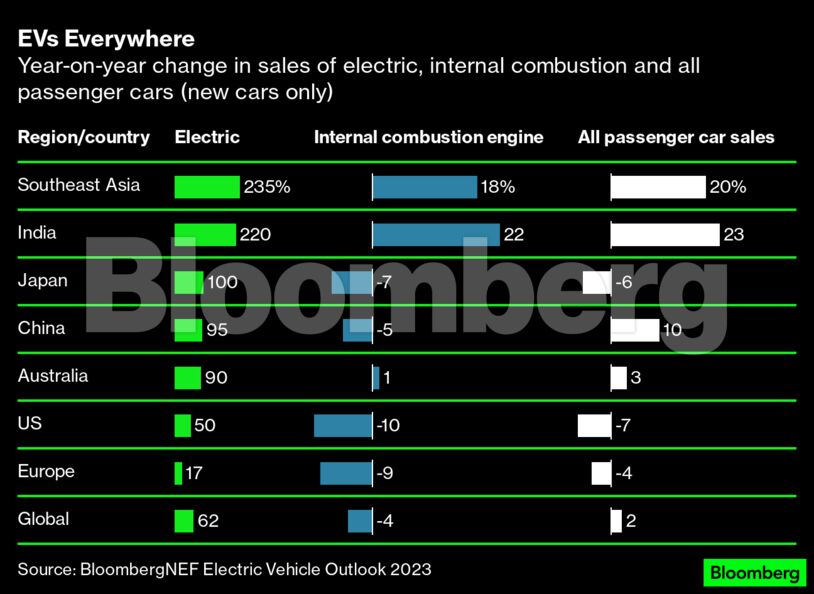

Sales of passenger electric vehicles increased globally by more than 60% in 2022. They also increased in every major market. In India and Southeast Asia, traditionally small markets for EVs, sales were up more than 200%. They rose by 100% in Japan, close to 100% in China, 90% in Australia, 50% in the US and 17% in Europe.

What’s more, electric car sales rose against the backdrop of an essentially flat global auto market — sales of new cars across all powertrains rose only 2% year-on-year — and a declining market for new cars with internal combustion engines. Among the wealthy auto markets, only Australia saw increasing sales of ICE cars last year, and even then they rose only 1%.

Southeast Asia and India are the only two markets where both ICE and EV sales increased year over year. It’s worth watching to see how long it takes for their triple-digit EV growth rates to reverse sales trends for ICE cars.

2. EVs as a share of autos lag solar, wind, hydro and nuclear in the power sector, but they will catch up

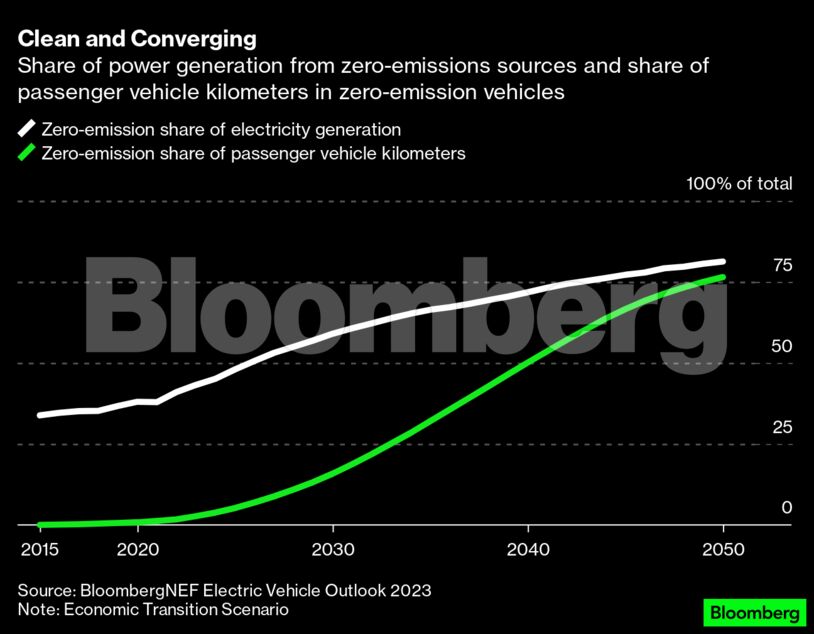

Thanks to decades of deployment of hydropower, nuclear power and renewables like wind and solar, a significant share of global power generation is now zero-emissions. Last year, more than 40% of global electricity was zero-carbon. Passenger vehicles? Not so much. Last year, EVs made up only 1.7% of passenger vehicle kilometers driven.

That’s a sign that EVs have a lot of catching up to do. But EVs can catch up with a following wind, so to speak. The power sector is continuing to decarbonize and by 2050, it will be more than 80% zero-carbon. EVs will account for an increasing percentage of global driving while their energy input becomes cleaner every year.

Read more: Bloomberg Green’s Electric Car Ratings

By mid-century, these two trend lines will have nearly converged. More than three-quarters of all driving in 2050 will be in EVs, and the power that tops them up will be more than four-fifths zero-emission.

3. Long range is not where you might expect it

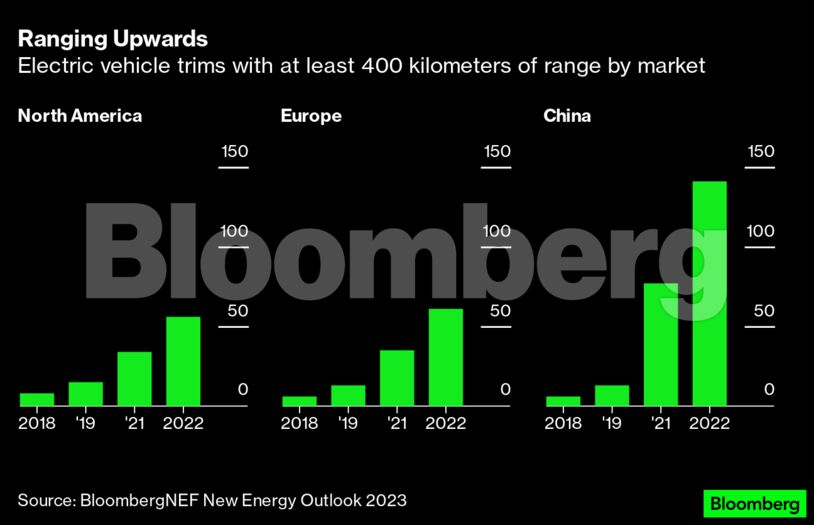

A half-decade ago, there were only nine electric vehicle options available globally with at least 400 kilometers (249 miles) of range. Last year there were more than 200. The number of long-range EV trims (pre-packaged sets of features for a particular car model) has risen in every market, but one market dominates: China, which had only six long-range EV trims in 2018 and now has 141.

North America, which had eight long-range trims in 2018, has 56 today; Europe, which started with the same number that China did, has 61.

These long-range EVs price at a premium. BMW and Mercedes-Benz’s battery electric vehicles in Europe and the US cost 30% more than their ICE counterparts. BNEF’s advanced transport team expects automakers to roll out a number of lower-range, and lower-priced, EVs in the future as their electric sales commitments become more pressing.

4. Fuel cells, small and regional

Fuel cell electric vehicles powered by hydrogen have been on the market for years. They are also a stubbornly small market, with fewer than 16,000 sold worldwide in 2022. Not only that, but this small market is intensely regional. Korea accounted for two-thirds of last year’s passenger fuel cell market, followed by the US with 18%.

More coverage of the 2023 Electric Vehicle Outlook can be found on Bloomberg.com.

Nat Bullard is a senior contributor to BloombergNEF and writes the Sparklines column for Bloomberg Green. He advises early-stage climate technology companies and climate investors.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire