“There’s a psychological Buffett effect,” according to Stacey Morris, head of energy research at VettaFi. Investors rationalize, “Warren Buffett likes this stock, so I should too,” she said in an interview.

With crude prices stuck below $100 a barrel since August, energy has been the worst-performing sector in the S&P 500 Index so far this year, falling nearly 8% against the benchmark’s 12% gain. With some peers notching double-digit losses the stock has fallen less than 6% as Berkshire’s consistent buying shelters Occidental from the worst of the damage.

The storied-investor’s stake in the Houston-based firm has grown so large that he had to quash speculation he would seek full control last month.

It may have another benefit: tamped down stock swings. The stock’s 90-day volatility trails similarly sized peers, trading closer to that of Exxon Mobil Corp. or Chevron Corp. — which are eight- and five-times Occidental’s market value, respectively.

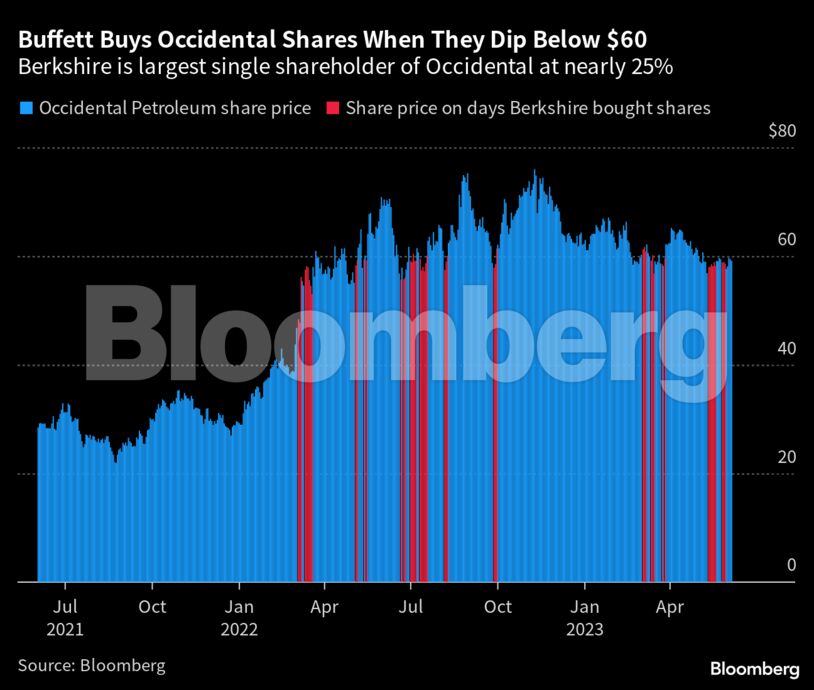

There are few other examples in the energy sector of major investors supporting a stock as commodities plunge, according to Morris, though Energy Transfer LP is one. That stock has struggled to hold above billionaire founder Kelcy Warren’s $13.01 strike price, while Occidental has spent very little time below Buffett’s $60 trigger.

Investors are also cheered to see Occidental has been redeeming Buffett’s preferred shares, which were issued when Berkshire Hathaway helped the oil producer finance its blockbuster $38 billion acquisition of Anadarko Petroleum in 2019.

“He continues to add at lower oil prices,” said Cole Smead, chief executive officer of Smead Capital Management. Smead — whose firm holds more than 7 million Occidental shares according to Bloomberg compiled data — expects shares to trade at $100, though he didn’t give a time frame.

Wall Street is less bullish. Bloomberg compiled estimates put Occidental’s average price target at $68, implying a roughly 15% return compared to 22% for the S&P 500 Energy Index. And 17 analysts rate the company the equivalent of a hold, outnumbering the 11 analysts who rate it a buy.

Still, Occidental was the most-purchased stock by hedge funds in the first quarter of the year. And there could be more buying from the Oracle of Omaha after regulators gave Berkshire the go-ahead to notch its stake up to as high as 50% last year.

Roth MKM analyst Leo Mariani expects Buffett to keep buying when the stock slips below $60. “A lot of people own it for that reason,” he said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire