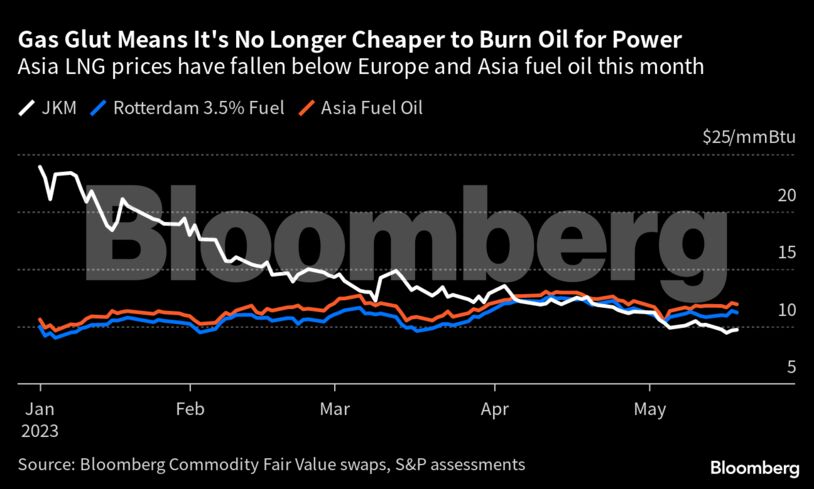

Liquefied natural gas rates have dipped below fuel oil, encouraging its use in power generation. From Thailand and Bangladesh to Colombia, emerging markets were the biggest buyers in the spot market for a second straight quarter earlier this year, according to BloombergNEF. Vietnam and the Philippines recently bought their first ever LNG shipments.

That’s a sharp turnaround from last year when many governments were struggling to ensure energy supply. Soaring prices forced poorer nations to turn to more polluting coal or fuel oil, and helped drive inflation. While they’re now getting a chance to repair their economies, their gas purchases are also providing producers with a safety net by partly offsetting weak demand from heavyweights in Europe and North Asia.

“The return of LNG prices to more normalized levels benefits emerging markets the most, as their energy affordability and availability was most impacted by the LNG price spikes last year,” said Saul Kavonic, a Sydney-based energy analyst at Credit Suisse Group AG. “Emerging markets, particularly in south and southeast Asia, are the core drivers of LNG demand growth over the next 10 years.”

Many developing nations have gas-to-power projects that can burn either fuel oil or LNG, said Chris Strong, partner at law firm Vinson & Elkins LLP in London, who specializes in energy transactions. That’s giving them the flexibility to quickly react to spot gas prices dropping below $10 per million British thermal units, and comes just in time for increased electricity demand as summer heat sweeps across Asia.

PetroVietnam Gas JSC bought its first ever shipment of LNG for delivery in June and July. Vietnam released its power development plan this month, with a focus on wind and LNG through 2030. Thailand’s PTT Pcl has been buying cargoes for the summer.

Longer Contracts

While long-term LNG deals that are typically cheaper remain challenging for countries that do not have investment grade status, interest is emerging from those that do. Buyers in India are in talks with suppliers in the US, Qatar and the UAE for 20-year deals that will protect them from extreme price volatility.

Still, producers will be wary of leaning too heavily on this demand. The increased consumption may not be enough to overshadow potential long-term weakness in regions such as Europe. Many governments are pushing for renewables in an effort to tackle climate change and calling for reduced gas use. While less polluting than coal or oil, burning gas still emits carbon.

The increased LNG buying could also be short-term as price-sensitive buyers take advantage of a currently weak market to help meet higher summer demand, said Lujia Cao, an analyst with BloombergNEF in Beijing.

Emerging nations have also taken steps to raise their clean-power capacity and boost local exploration for gas, said Ogan Kose, a managing partner at consultant Accenture Plc. That could keep LNG demand rises in check. The lure of cheap coal also remains strong.

Decade-Long Setback

Pakistan, severely affected by the surge in prices as some of its suppliers diverted cargoes to higher-paying European markets, hasn’t yet sought shipments. The nation won’t build new power plants that rely on imported coal, LNG or fuel oil over the next decade and will instead look to increase its solar, wind, locally mined coal, hydro and nuclear capacity.

High gas prices pushed the country back “by a decade,” Yousaf Inam, head of sales and marketing at Pakistan LNG, said in November.

But there could be further relief for poorer nations by the middle of this decade, when the US and Qatar start putting new supply into the market. More cargoes will be available for them as Europe’s push for renewables means there will be less demand for LNG there, Accenture’s Kose said.

It would make the move away from dirtier fuels to LNG more likely. It “could be delayed as much as three-four years, but we still believe it will happen in the longer term,” Anders Porsborg-Smith, managing director and partner at Boston Consulting Group, said in an interview.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein