The stock surged as much as 7.2% in early trading, before trimming gains to 3.2%, still taking it to the highest level since September.

The new dividend will be “in the amount of 50%-70%” of Saudi Aramco’s annual free cash flow, net of the base payout and other amounts including external investments, the world’s largest energy company said on Tuesday, shortly before it released earnings. The amount will be “determined with the annual results.”

The move could increase Aramco’s dividend — which at $75.8 billion last year was already the highest of any listed firm — by more than $20 billion in 2023, according to Bloomberg Intelligence. RBC Capital Markets LLC forecasts an increment of $12 billion to $18 billion.

The decision “reinforces our commitment to maximize long-term shareholder value,” said Chief Executive Officer Amin Nasser.

Aramco said in March it wanted to grow the dividend over the coming years.

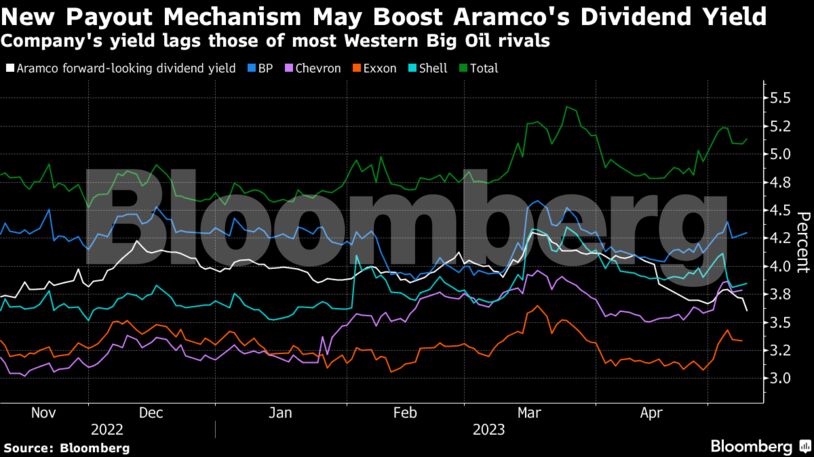

The Saudi Arabian government owns 90% the shares directly, with a further 8% held by the sovereign wealth fund. The stock is now up 15% this year in Riyadh, outperforming that of Western Big Oil rivals such as Shell Plc and Exxon Mobil Corp.

The country’s de facto ruler, Crown Prince Mohammed Bin Salman, has said the government may sell more shares in Aramco through a secondary offering.

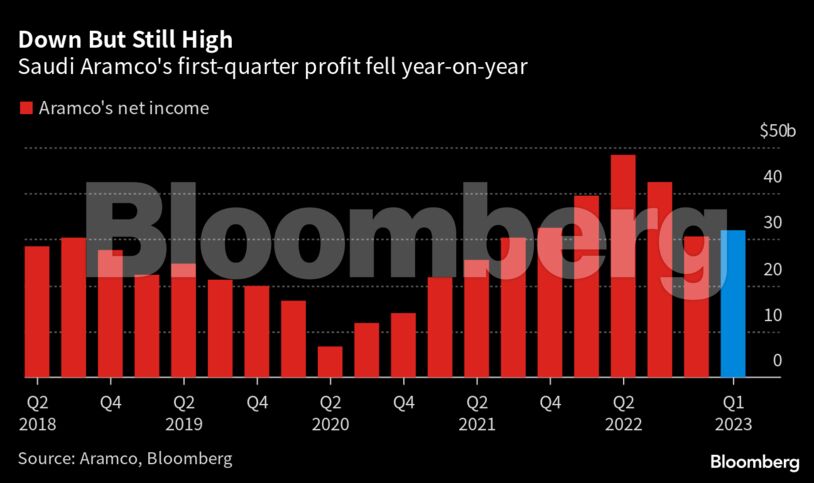

Aramco made a net profit of $31.9 billion for the first quarter, slightly below analysts’ expectations and down 19% from a year earlier. Free cash flow was $30.9 billion and the quarterly dividend was maintained at $19.5 billion.

The gearing ratio, a measure of net debt to equity, fell further into negative territory, reflecting improved finances. It dropped to -10.3% from -7.9% in December.

The firm’s free cash flow soared to almost $150 billion last year as Russia’s invasion of Ukraine roiled energy markets and pushed oil above $125 a barrel. That meant Aramco easily covered its annual dividend, a crucial source of funding for the Saudi government.

The new mechanism for shareholder payouts may increase Aramco’s dividend yield to around 4.2%, according to RBC, putting more in line with that of rivals such as BP Plc and Shell Plc.

The kingdom reported a $770 million fiscal deficit for the first quarter as spending on public sector salaries and massive projects to diversify the economy from energy increased. Growth slowed to 3.9% year-on-year, compared with 10% in the first quarter of 2022.

Oil prices have dipped sharply since the middle of last year after the global economy weakened and central banks raised interest rates to combat inflation. Brent averaged $82 a barrel between January and March. The benchmark has since fallen further to around $76.

Aramco, based in Dhahran in eastern Saudi Arabia, is targeting capital expenditure of $45 billion to $55 billion for 2023. It’s spending billions of dollars to raise its daily oil-production capacity to 13 million barrels from 12 million by 2027, and its gas output by more than 50% this decade.

Saudi Arabia, the world’s biggest oil exporter, has criticized Western companies for not investing more in fossil fuels and for trying to transition to cleaner forms of energy too quickly. While Aramco is also putting money into solar and hydrogen, it says fossil fuels will still be needed for decades to ensure the world has secure and affordable energy.

“Our long-term outlook remains unchanged as we believe oil and gas will remain critical,” said Nasser.

Still, much of Aramco’s spending is focused on petrochemicals in Asia. The company believes the use of plastics, paint and fertilizers — often made from crude-based chemicals — will rise over the coming decades. Selling more petrochemicals could protect it against any slowing of demand for gasoline and diesel as electric vehicles become more popular.

Aramco bought 10% of Rongsheng Petrochemical Co., one of China’s refining giants, for $3.6 billion in March, a move that will expand its presence in the world’s biggest energy importer. That deal and another to invest in a new $12 billion refining and petrochemical plant in the northeastern province of Liaoning could see the company eventually ship nearly 700,000 barrels of additional oil a day to China for conversion into chemicals.

“Our global downstream strategy is gaining momentum,” Nasser said.

Aramco, which produces all the oil in Saudi Arabia, pumped 10.4 million barrels a day of crude between January and March. That figure will probably drop in the second quarter because OPEC+ — an alliance led by Saudi Arabia and Russia — announced supply cuts. The Saudis are meant to lower output by 500,000 barrels a day from this month.

The company’s downstream unit, responsible for fuel distribution and trading as well as refining and chemicals, made a pretax profit of $3.4 billion in the first quarter, down 67% from the same period of 2022. That was mainly due to a fall in chemicals margins.

The unit is still dwarfed by the upstream, or production, unit, which generated earnings of $57 billion.

What Bloomberg Intelligence Says… |

| “The additional dividends Saudi Aramco is introducing could amount to more than $20 billion in 2023, potentially taking the dividend yield to above 5% — according to our calculations — closer to global peers.” |

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire