The alliance’s plan to curb production by as much as 1.7 million barrels a day initially triggered a buying binge in Asia and the North Sea, with importers seeking to get ahead of the cuts that start in May. That’s helped eat away at the European supply overhang caused by French refinery strikes, even lifting US grades off recent lows.

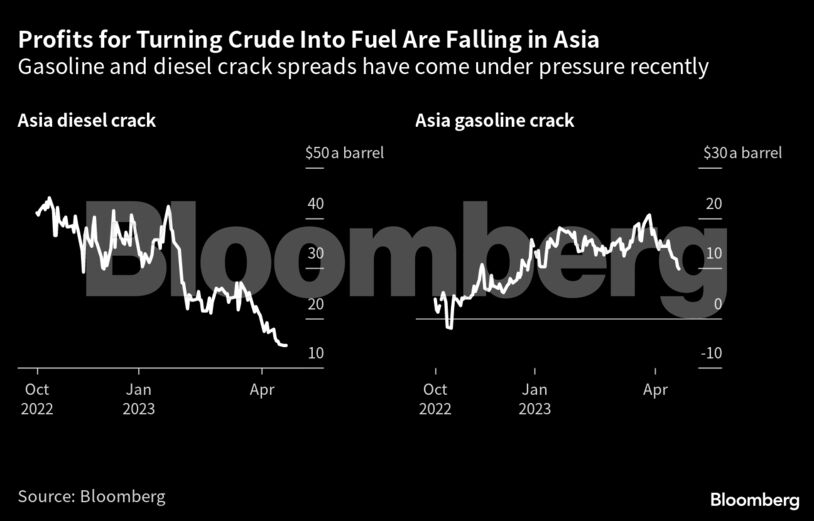

High selling prices for Middle East crude and weakness in Asia’s gasoline and diesel markets are hammering refinery profits, however, making them less likely to keep snapping up barrels. Some are even threatening to cut processing rates, though there’s no sign yet of that coming to fruition.

“After the OPEC+ cut, crude oil prices went up and margins crashed,” said Parsley Ong, head of Asia energy and chemicals research at JPMorgan Chase & Co. “Demand concerns have been rising and we expect refining margins to be lower than last year.”

The upshot is that oil traders are wrestling with a quandary that has troubled them for much of this year — will consumption rise enough in the coming months to make a dent in inventories that are more than 100 million barrels higher than a year ago? Or, will recessionary forces continue to menace demand, stopping prices from moving higher?

Nowhere is the dilemma more stark than in the Middle East crude market. Last week, traders snapped up a slew of cargoes from the UAE’s Upper Zakum to Qatar’s Al Shaheen. This week, however, buying has slowed and the value of Abu Dhabi’s Murban oil has slumped. That’s in part due to a drop in gasoline and diesel prices.

To be sure, while margins are pressured in Asia, other parts of the world are faring better. Low inventories in the US are keeping gasoline markets there and in Europe relatively robust, underscoring the optimism among bulls for a tighter summer.

Much like physical supplies, the initial rally in key spreads in the futures market has also dissipated — even with fresh bullish drivers including supply disruptions to Kurdish and Nigerian oil exports. In the US, ongoing releases from government oil reserves are poised to keep the domestic market well supplied.

The nearest US crude futures spread is in a bearish contango structure ahead of expiry later this week. Both Brent and the Middle Eastern Dubai benchmark have given up some their post-OPEC+ gains in recent days, with initial optimism cooling.

It all leaves traders looking, hopefully, for signs of an improvement in demand.

“Near-term upside is more limited until tight fundamentals start to replace macro fears as the driver of prices,” said Livia Gallarati, a senior analyst at Energy Aspects.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran