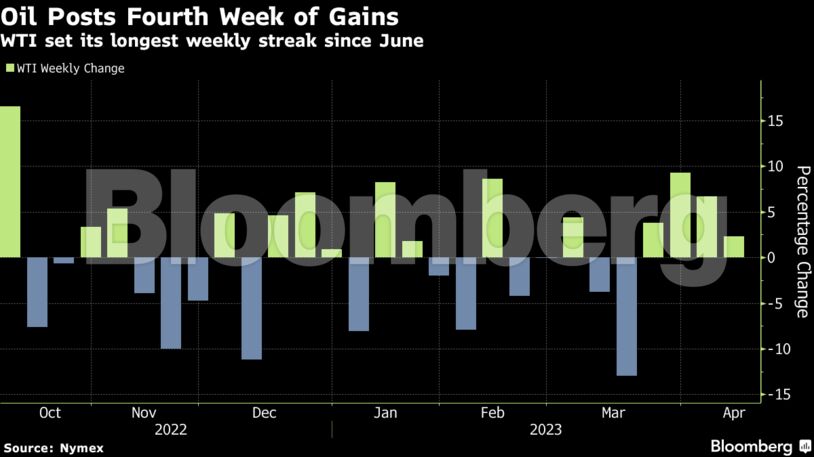

Markets are digesting a week of mixed projections for crude supply and demand. The latest OPEC+ cuts threaten to boost oil prices for consumers already facing high inflation, the IEA said in its monthly outlook on Friday. The cartel had forecast a day earlier that markets would be deeply undersupplied. In contrast, the US Energy Information Administration projected supplies surpassing demand both in 2023 and 2024.

Demand from the world’s largest crude importer is supporting prices as well. Recent data show that China imported the most oil in three years last month, underpinned by record Russian flows. On Friday, People’s Bank of China Governor Yi Gang said the nation’s economy is expected to grow about 5% this year.

Key technical measures are signaling a tighter market, too. WTI’s prompt spread — the difference between its two nearest contracts — was at 9 cents a barrel in backwardation. The bullish pattern is a stark reversal from when it was trading 16 cents in contango a month ago.

Prices:

- WTI for May delivery rose 36 cents to settle at $82.52 a barrel in New York.

- Earlier this week, the US benchmark touched $83.53 a barrel, the highest intraday price since mid-November.

- Brent for June settlement advanced 22 cents to settle at $86.31 a barrel.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS