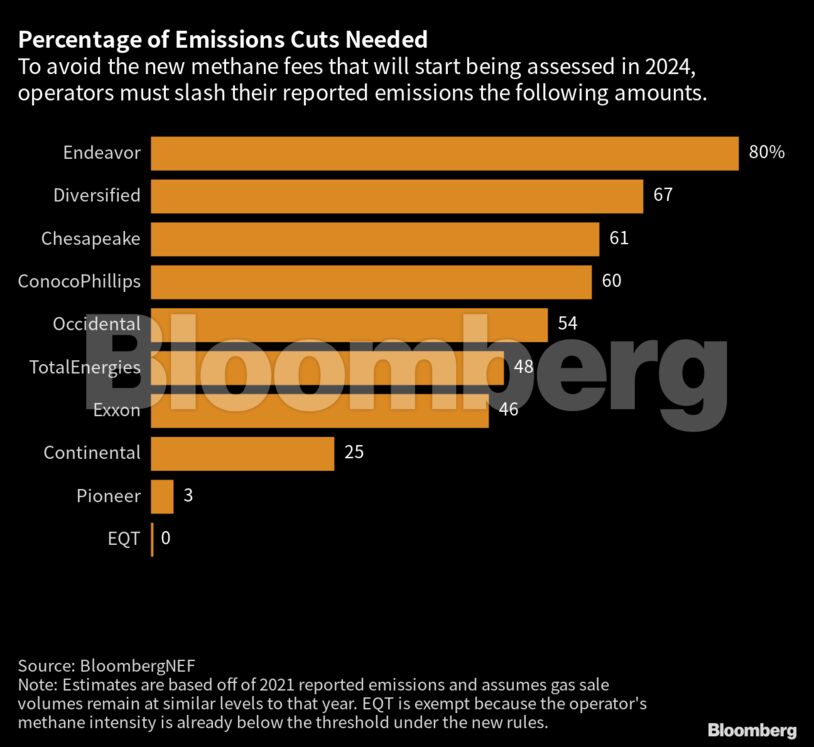

Closely held Endeavor, which is based in the heart of the Permian Basin in Midland, Texas, must reduce its onshore methane releases 80% by 2024 to avoid the fines, which are part of the Inflation Reduction Act, according to the BNEF analysis. Diversified Energy Co. and Chesapeake Energy Corp. rounded out the top three and must cut emissions 67% and 61%, respectively.

Representatives for Endeavor, Diversified and Chesapeake didn’t immediately respond to emailed requests for comment outside normal business hours in the US.

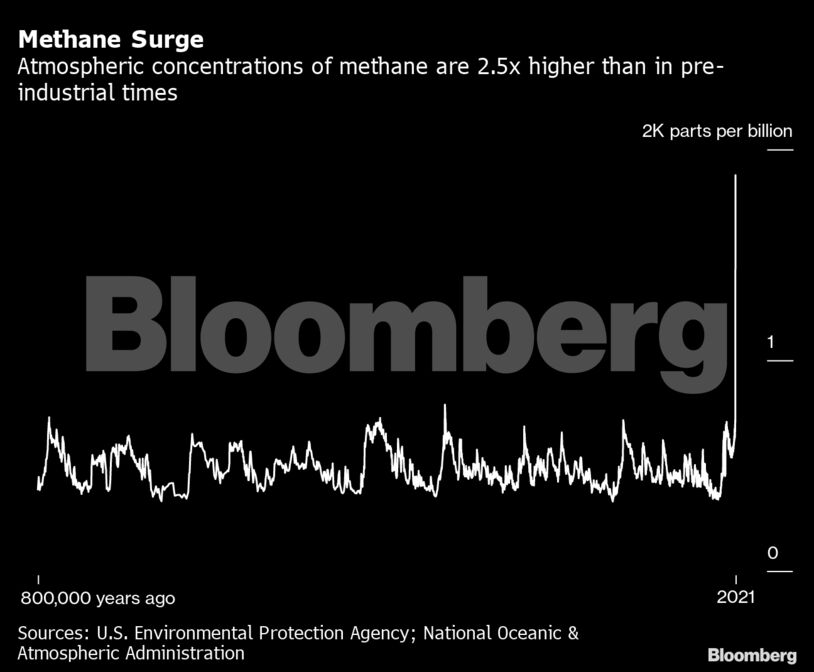

As methane emissions have exploded globally over the last few years — increasingly posing a direct threat to global climate goals — governments have stepped up efforts to curb releases of the invisible, odorless gas from the agriculture, energy and waste sectors. More than 100 countries have signed the US and European Union-led Global Methane Pledge, which aims to slash releases 30% by the end of this decade from 2020 levels.

But cuts by fossil fuel companies aren’t on pace to meet those goals. Releases from oil, gas and coal operators reached 120 million metric tons in 2022, just short of a record set in 2019, according to the International Energy Agency’s Methane Tracker report. Globally, oil and gas companies together emit nearly the equivalent of the massive Nord Stream release on average every day.

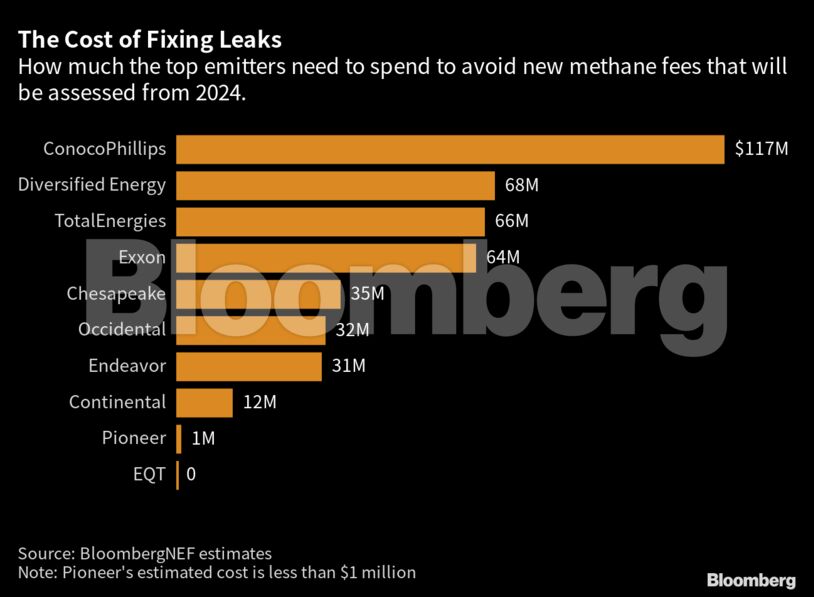

BNEF found that the cost of cleaning up methane releases at US onshore operations is small for most of the 10 largest polluters. For instance, Endeavor would need to spend just $31 million, or about 1.1% of its 2022 upstream capital expenditures, for mitigation efforts like replacing pneumatic pumps that the energy researcher said would cut its methane emissions by 18,000 tons and allow it to avoid fees. ConocoPhillips, which had the highest projected costs to curb leaks at $117 million, would need to spend the equivalent of just 1.2% of its upstream capital expenditures last year.

Representatives for Endeavor and ConocoPhillips did not immediately respond outside normal business hours in the US to questions about capital expenditures.

An exception was Diversified Energy, for whom the estimated $68 million needed to clean up its operations is equivalent to 79% of its capital expenditures last year. The company was the focus on a Bloomberg investigation in 2021 that found widespread gas leaks at its aging production installations.

The new fees start at $900 per ton in 2024 before increasing to $1,200 and $1,500 in the following two years. The payouts are collected in the year after they are assessed and only apply for methane emissions that exceed activity-specific thresholds.

In total, the top 10 US emitters, which include global energy majors Exxon Mobil Corp. and TotalEnergies SE, would need to spend a combined $426 million by 2024 on abatement technologies to reduce their methane emissions enough to be exempt from the fees, the BNEF analysis showed. Aside from the climate benefits of halting leaks, the changes could also boost profit and offer a competitive advantage.

Around 40% of the methane emissions from oil and gas between 2017 and 2019 could have been avoided at no net cost because the additional gas that is captured can be sold, boosting revenues, according to the IEA. Producing hydrocarbons with a lower emissions intensity also offers a competitive sales advantage because the fuel has a lower climate impact, said Maria-Olivia Torcea, the report’s author and an analyst at BNEF.

EQT, the largest US gas producer, is forecast to be exempt from the new fees because the company’s methane intensity is below the 0.2% emissions threshold set out under the rules. EQT started replacing gas-driven pneumatic devices 18 months ago and has spent $20 million replacing the equipment, according to the report.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso