Energy has led the stock market for the last two years, soaring 135% in 2021 and 2022 compared with the 2.2% gain in the S&P 500 Index. Wall Street analysts expect the sector to gain another 22% in 2023, despite its 5.8% decline so far, and beat the broader market once again, according to data compiled by Bloomberg.

The ESG crowd – which is focused on environmental, social and corporate governance issues — has noticed. Rockefeller Capital Management, for example, takes great pride in its ESG investing record, which its $10.4-billion asset management division pursues. While the larger firm follows multiple investing strategies, both in and outside of ESG investing and for clients that have their own views on the market, its larger $19 billion equity portfolio now has a 6% energy weighting, even more than the S&P 500’s 4.8%.

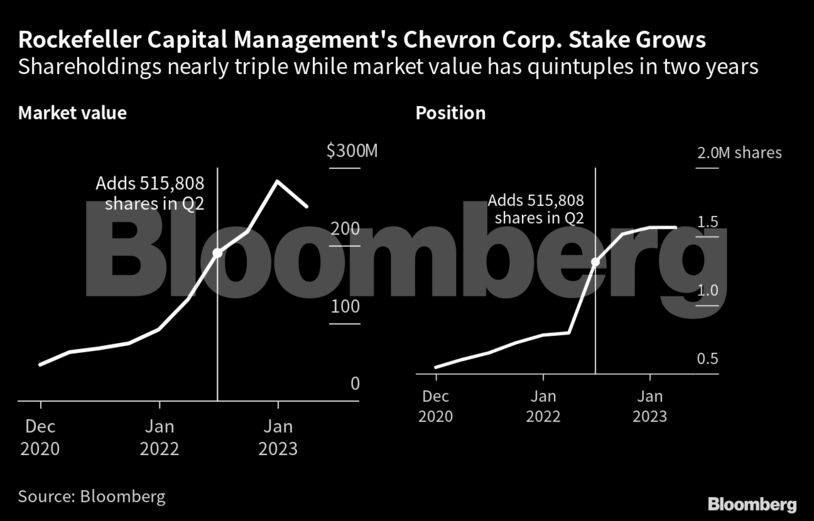

Meanwhile, the larger firm has nearly tripled its holdings in Chevron Corp., and the stake’s value has quintupled to $251 million over two years. It has been buying tens of thousands of shares in Brazilian oil producer Petroleo Brasileiro SA, better known as Petrobras, Diamond Offshore Drilling Inc. and a whole host of S&P 500 Energy Index members, from mighty Exxon Mobil Corp. to relatively tiny APA Corp. at the same time as it has been trimming its exposure to the tech sector. The firm also owns 23 million shares in the Energy Select Sector SPDR Fund, which holds large-cap oil and gas stocks.

“In regard to sustainable investing, we do not villainize industries, firms, or people. We believe firms showing the greatest improvement in their ESG footprint, including those in energy, transportation, agriculture, chemicals and steel offer great potential for generating uncorrelated alpha over the long term.” said a spokesperson for Rockefeller Capital, which manages $98 billion.

Rockefeller isn’t alone. The performance of the energy sector has pushed more investors to increase their exposure to oil and gas producers as the sector’s weighting in the S&P 500 has climbed by 71% over the last 12 months. Vanguard Group Inc., whose investment products track indexes, recently pulled out of the Net Zero Asset Managers initiative in December, citing investor confusion over the goals of the initiative.

BlackRock remains a signatory to the net zero initiative and its iShares ESG Aware MSCI USA ETF holds a host of oil and gas producers, including Exxon, which has a larger weighting than Facebook owner Meta Platforms Inc., and Chevron, which has a larger weighting than Walt Disney Co. Similarly, Exxon is the seventh-largest holding in the SPDR S&P 500 ESG ETF, which also owns Schlumberger, ConocoPhillips and EOG Resources Inc.

Performance Pressure

“There are 100 shades of net zero,” Columbia Business School professor Shivaram Rajgopal on whether the net zero, ESG or sustainability investing themes actually denote a particular strategy or sector to avoid, especially as companies pursue their own ESG-branded initiatives. “In terms of branding, you can say ‘I’m net zero,’ but what variety of net zero are we discussing here?”

Rajgopal said fund managers that were underweight energy and lagged the indexes have been under tremendous pressure in recent years to boost their exposure to energy, which has outperformed. “ESG funds pay a higher expense ratio. If you start showing a negative tracking error because you don’t hold energy, you’re going to close down the fund at some point,” he said.

Confusion over what an ESG or sustainability-focused equity portfolio should look like is spurring calls for a clearer definition.

“I think that our industry is going through a time where the consumers of these products could benefit from additional clarification,” Parnassus Investments chief marketing officer Joe Sinha said by phone about what investors expect to find in an ESG fund. For its part, the Parnassus Core Equity Fund does not own any oil and gas producers, which Sinha said is akin to owning oil reserves.

Despite Big Oil’s recent big market performance, Rockefeller Asset Management president and chief investment officer expects more funds to flow into sustainable investing over the longer-term as part of a “multi-decade, secular trend driven by increased evidence of risk and return benefits, an emerging generation of investors’ preference for sustainability, and regulation that provides clarity and minimizes greenwashing.” Rockefeller Asset Management is the division that follows ESG strategies and manages $10.4 billion.

At the same time, the firm in its own ESG report called 2020 and 2021 “breakout years” for sustainable investing, but describes 2022 as “the blip” when a “turbulent year” punctuated by an energy crisis and challenges to ESG investing led to “mixed returns” for the strategy.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS