Courtesy of Shutterstock

Courtesy of ENERGYminute

See more articles and infographics from ENERGYminute HERE

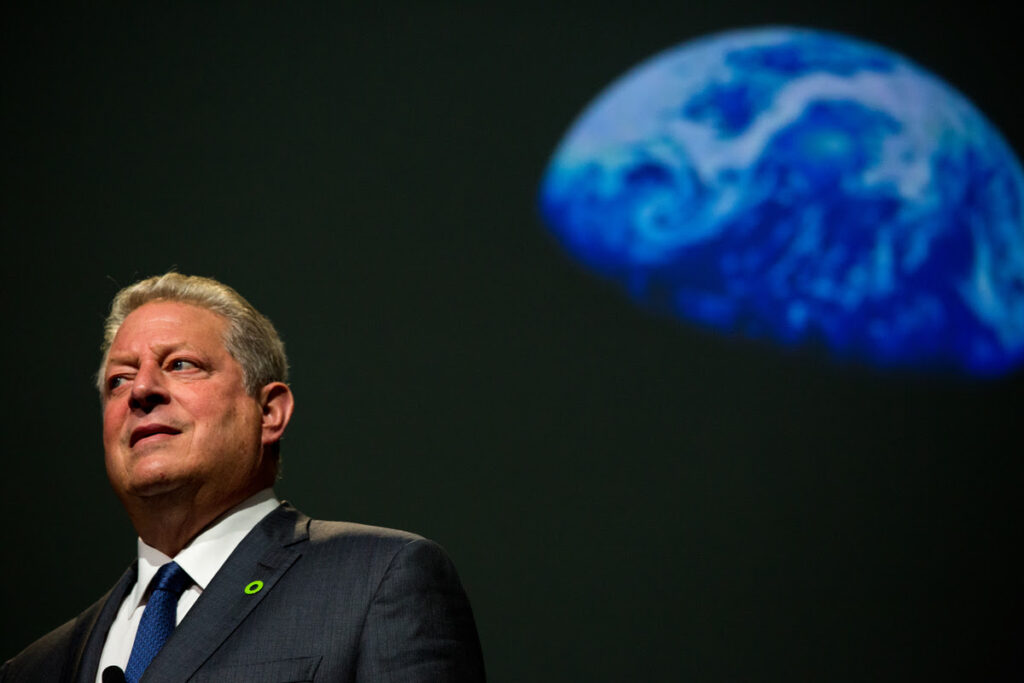

The King of Climate himself, Al Gore, has quietly grown one of the largest sustainability investment funds in the world. But for all the preaching, even the ex-Veep struggles with ESG investing.

Background: In 2004, four years after leaving public office, former Vice President Al Gore setup the Generation Investment Fund with the goal of advancing sustainable investing. Since then, it’s grown into one of the largest pure-play sustainable funds in the world and had $36 billion of assets under management as of last year.

As you might expect from the man who dramatically portrayed the increase in carbon emissions using a 30-foot scissor lift in An Inconvenient Truth, Al Gore’s Generation fund is one of the highest ranked funds for its commitment to sustainability, according to a report by Morningstar.

Yet even Al Gore struggles to make sustainable investing work

Bloomberg recently dug into the performance of Gore’s fund, and it was not pretty.

For one, the fund lost much of its value since last year’s peak – but… same. Worse was it’s emissions performance, where Bloomberg found eighteen of its 42 companies, which accounted for almost half of the fund’s emissions, increased their total emissions from 2015 to 2021. That’s the opposite direction they should be going for a sustainability fund.

Even when adjusting for growth, about a sixth of Generation’s portfolio companies have ramped up their emissions.

Share of investment portfolio assets by net change in emissions, 2015-2021

Courtesy of Bloomberg

In a study with ten other funds, no company had more of its assets increase net emissions between 2015 and 2021 than Generation’s Global Equity fund.

Big tech focus: A quick glance at its asset sheet shows the company largely holds Big Tech and financial firms. Many of these companies have been using renewable energy certificates to lower their reported emissions, not doing actual reductions.

- It’s top holding, Amazon, has only just released all its emissions data and has been accused of fueling unnecessary consumerism.

Bottom line: Even for Al Gore, sustainable investing to get sustainable results is hard.

Many similar institutions have adopted limits on Scope 1 and 2 emissions per dollar of revenue, which often reduces sustainability funds to investing only in informational technology companies and not transformational energy transition companies.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS