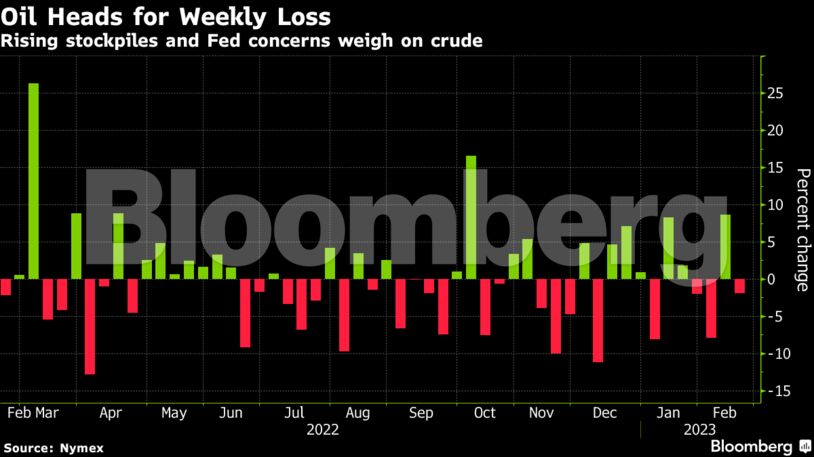

The US crude benchmark has declined by more than 3% this week, but has undulated in a relatively narrow price band since early December. While global demand may recover in the second half of the year as China recovers after Covid lockdowns, the market isn’t particularly tight in the short term.

The US this week reported a bumper increase in its crude inventories, and traders are watching whether the Federal Reserve will continue raising interest rates to fight inflation.

“Markets are concerned about a 50-basis-point rate hike at the next Fed meeting, supporting the dollar and weighing on oil,” said Giovanni Staunovo, a commodity analyst at UBS Group AG.

Prices:

WTI for March delivery declined 1.9% to $76.60 a barrel at 10:21 a.m. in London.

Brent for April settlement was 2.3% lower at $83.18.

Crude’s relatively limited price action so far this month has pushed market volatility to the lowest levels in more than a year. That move in turn has made it more attractive for producers to lock in their output by hedging, as lower volatility reduces the cost of such trades.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS