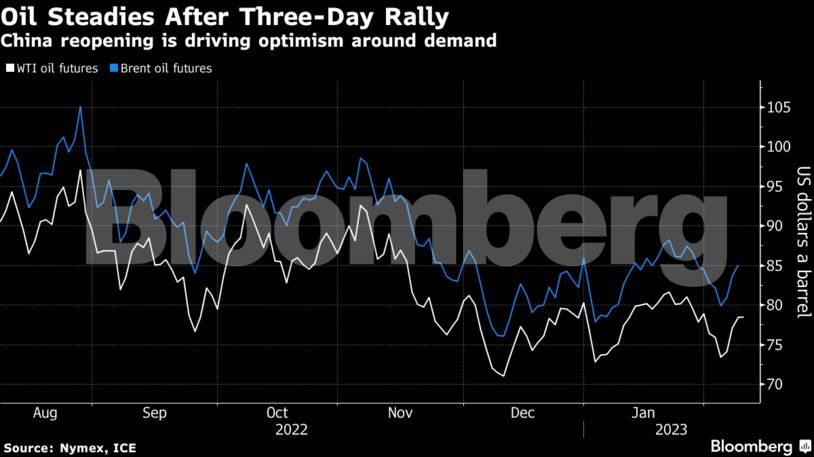

West Texas Intermediate futures traded above $78 a barrel after closing almost 2% higher on Wednesday. BP Plc said exports of Azeri oil from Turkey’s port of Ceyhan still haven’t resumed following two devastating earthquakes. Last month those flows amounted to 615,000 barrels a day.

A raft of Federal Reserve speakers reinforced the idea that interest rates will need to keep climbing to combat inflation, putting concerns about a possible drag on demand back in focus.

Crude has traded in a narrow band of just over $10 since the start of the year as investors look for signs of a sustained rebound in Chinese demand, which some predict will drive prices above $100 a barrel. Market volatility has eased as traders look for direction.

“Participants continue to wait for clearer signals on how Chinese demand and Russian supply evolve,” said Warren Patterson, head of commodities strategy at ING Groep NV. “Adding even further uncertainty to the oil market — and risk assets in general — is Fed policy in the months ahead.”

Prices and related news:

- WTI for March delivery rose 0.3% to $78.67 a barrel as of 10:23 a.m. London time

- Brent for April settlement also added 0.3% to trade at $85.31

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein