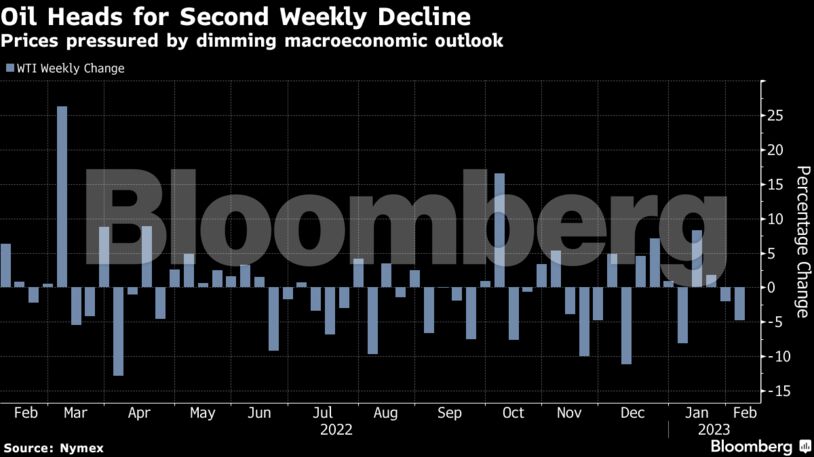

West Texas Intermediate edged higher Friday but was still down 4.4% this week. China’s reopening trade for commodities has flagged amid questions over the timing and extent of the country’s recovery. In the US, key market gauges have softened and are pointing to oversupply.

Over the weekend, European and Group of Seven countries will implement sanctions on Russian refined fuel exports. While that had been touted as another potential source of market strength, the diesel market has been generally weakening in recent days, indicating limited angst for now. Russia said Friday it has no plans to cut fuel output.

Crude has swung within a $10 range this year, with prices caught between concerns of a global slowdown and expectations of recovering oil demand in China after Beijing ditched its rigid Covid Zero policy. Central banks in the US and Europe raised interest rates this week, and warned that they weren’t yet done with monetary tightening to combat still-too-elevated inflation, while the markets for real-world barrels continue to look weak.

“The physical oil market remains sloppy,” RBC Capital Markets analysts, including Michael Tran and Helima Croft, wrote in a note. “China needs to pull harder in order for the physical messiness to clean up.”

Prices:

- WTI for March delivery gained 0.4% to $76.16 a barrel at 9:52 a.m. in London.

- Brent for April settlement gained 0.4% to $82.46 a barrel.

Crude’s retreat this week has come alongside declines in other leading industrial commodities, with copper and iron ore also lower.

Meanwhile, weekly data on market positioning published by the Commodity Futures Trading Commission will be delayed after a cyberattack on ION Trading UK meant some clearing members were unable to provide accurate data.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso