Oil futures were also under some pressure from a rising dollar after the Federal Reserve rebuffed expectations for a dovish tilt and said interest rates will go higher for longer. A stronger greenback makes commodities priced in the currency less attractive.

“We are recovering back to more normal levels after last week’s sell off,” said Jens Pedersen, a senior analyst at Danske Bank.

Oil is still on track for a slight annual gain following a volatile 12 months that’s been plagued by a persistent lack of liquidity. However, investors are juggling a mixed outlook for commodity demand, including the near-term impact of China’s end to Covid Zero, which has sparked a surge in infections.

The International Energy Agency said Wednesday that oil prices could rally next year as sanctions squeeze Russian supply, although OPEC remains cautious about demand in early 2023. The US Federal Reserve also raised interest rates again and warned they still have room to climb.

Prices:

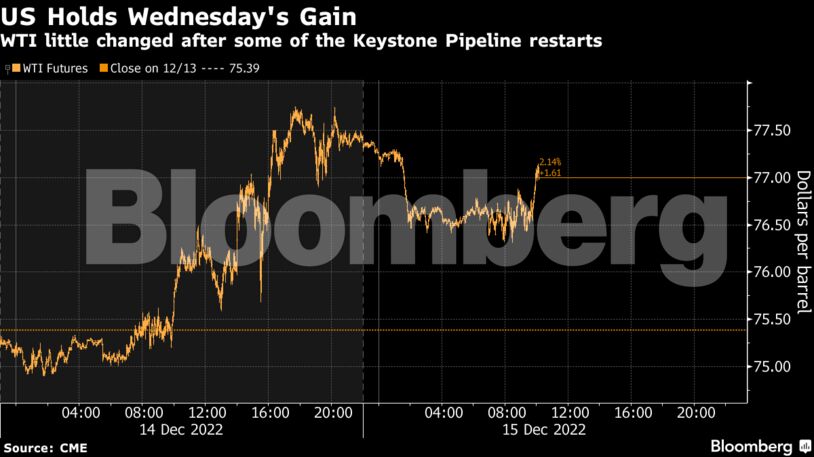

- WTI for January delivery lost 0.4% to $76.99 a barrel at 10:17 a.m. London time.

- Brent for February settlement eased 0.3% to $82.47 a barrel.

As cold weather hits large parts of Europe, diesel prices have also recovered from their recent slump. The ICE gasoil crack — a measure of the profitability of diesel over crude — climbed above $40 a barrel this week.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso