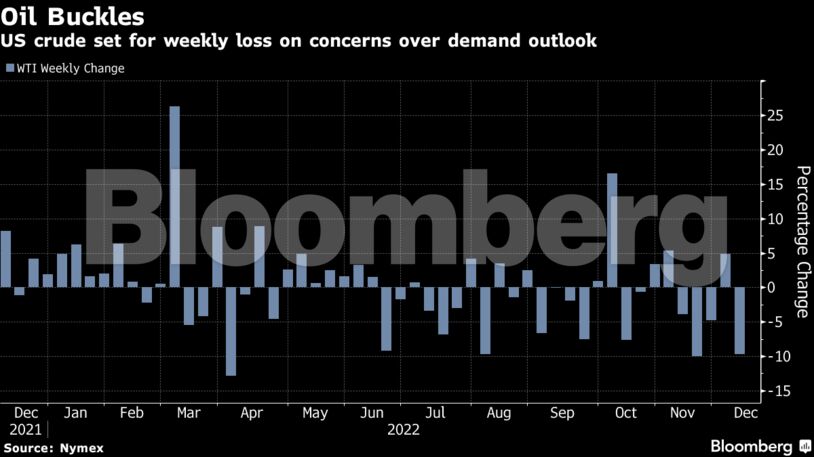

While West Texas Intermediate futures rose above $72 on Friday, the US benchmark — along with Brent crude — has recently given up all of its gains for the year. The oil market is also facing a persistent lack of liquidity that has left prices prone to large swings.

The shutdown of the Keystone pipeline after a spill has roiled the flow of crude across the US, but traders are betting that at least one segment of the conduit will restart soon.

“The oil market retracement is, in our opinion, a function of paper markets selling into low liquidity air pockets,” RBC Capital Markets analysts Michael Tran and Helima Croft wrote in a report.

Crude is on track for its first back-to-back quarterly decline since mid-2019 on a souring economic outlook as central banks tighten monetary policy, although Treasury Secretary Janet Yellen still sees the US avoiding a recession. Traders are also assessing the fallout from a price cap on Russian oil, which has led to a jam of tankers in Turkish waters due to a standoff over insurance.

There’s widespread unease among oil-reliant economies over the cap imposed by the Group of Seven nations, according to Oman’s energy minister, who said there’s concern it could extend to other countries. But for now, Russia sees the price ceiling having a limited effect on its crude production.

Prices:

- WTI for January delivery rose 1.4% to $72.44 a barrel at 10:06 a.m. London time

- Brent for February settlement gained 1.1% to $76.95 a barrel

The market continues to signal ample near-term supply, with the prompt spread — the difference between the two nearest contracts — for both WTI and Brent holding in contango. The global benchmark was 38 cents a barrel in contango, compared with $1.44 in backwardation a month earlier.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS