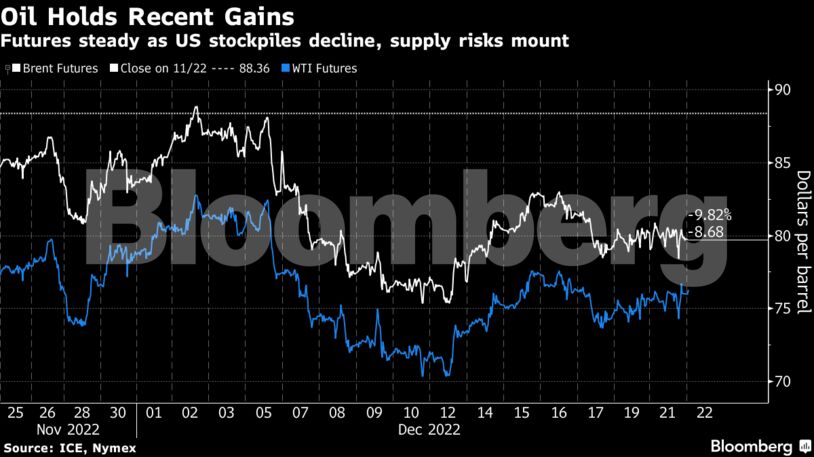

West Texas Intermediate for February delivery traded near $78 a barrel, rallying alongside equity markets. Trading volumes have generally been below average this week ahead of the holiday period. The American Petroleum Institute said US crude inventories shrank by 3.1 million barrels last week, according to people familiar with the data.

“Attention is shifting to the state of US inventories,” said Stephen Brennock, an analyst at brokerage PVM.

Crude remains on track for the first back-to-back quarterly decline since 2019 as further tightening by leading central banks risks tipping the US and European Union into recession. Traders are also tracking the impact of China’s easing of harsh virus restrictions, and a warning from Saudi Arabia that the Organization of Petroleum Exporting Countries and its allies would remain proactive and pre-emptive in managing the global oil market.

Russia’s seaborne oil shipments collapsed in the first week of Group-of-Seven sanctions targeting Moscow’s petroleum revenues, a potential source of alarm for governments around the world. In North America, meanwhile, TC Energy Corp. pushed back the full return of its Keystone pipeline by a week.

Prices:

- WTI for February delivery was 2.1% higher at $77.77 a barrel at 12:30 p.m. in London.

- Brent for February settlement gained 2% to $81.65 a barrel.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS